Private equity funds Bain Capital and CVC Capital Partners are among those evaluating buying the promoter stake of in Max Financial Services Ltd (MFS) — the flagship listed company of serial entrepreneur Analjit Singh, said people in the know.

Max Financial Services, the country’s largest non-bank private life insurance company, is the parent entity of Max Life Insurance in which Axis Bank is a co-promoter with 12.99 per cent stake. Mitsubishi Sumitomo Insurance owns 21.86 per cent in Max Financial Services. The Japanese group in 2012 bought out New York Life by buying their entire 26% stake in then Max New York Life JV for Rs2,731 crore cash, a deal that was then dubbed as the second largest in the insurance sector.

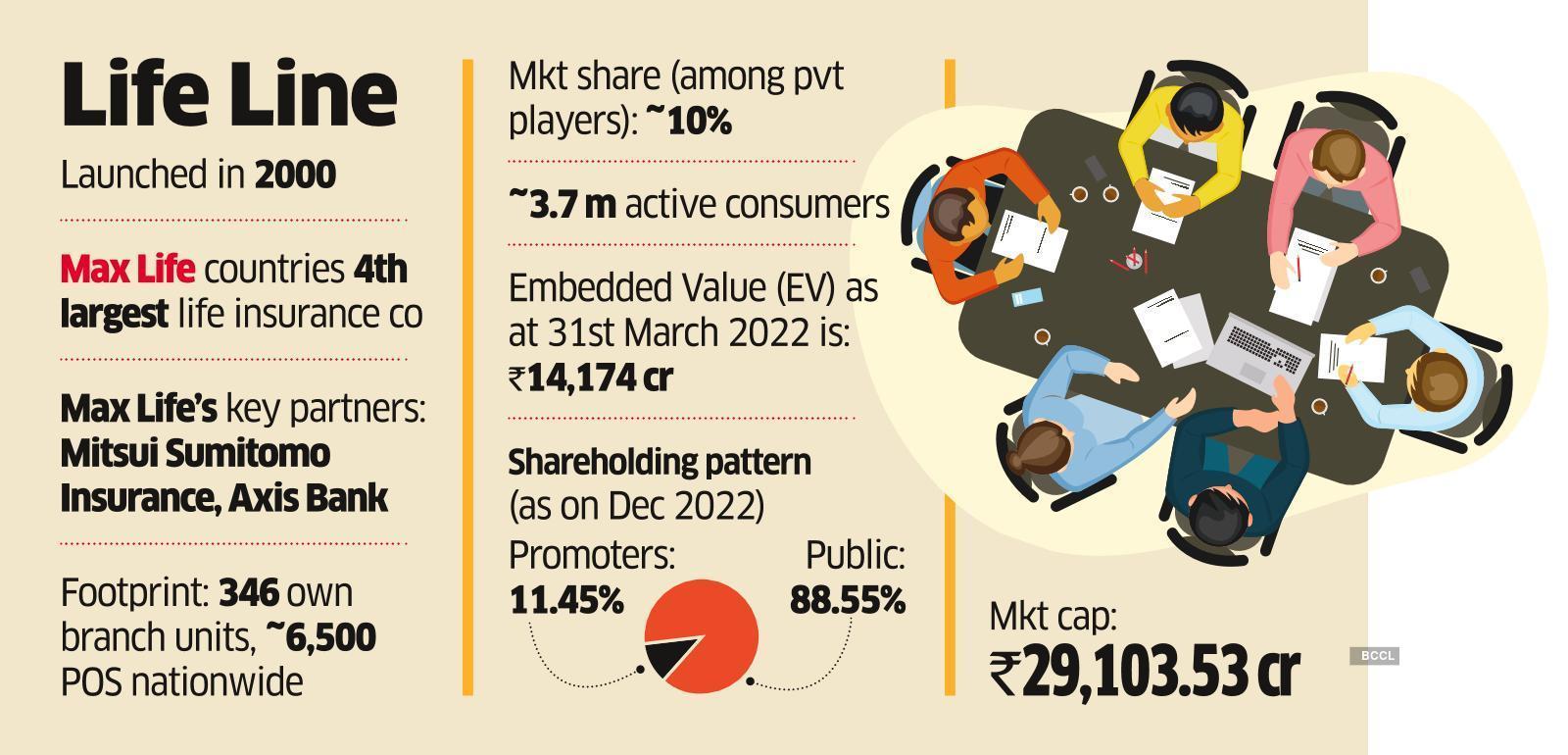

The Singh family, classified as promoters of the company including Analjit, his wife and children and Max Ventures Investment Holdings Pvt Ltd owns 11.45 per cent of Max Financial. The public shareholders, including the Japanese financial group, own the remaining 88.55 per cent.

The Singh family is working with advisors to help them in the stake sale which is likely to trigger an open offer for an additional 26% since the transaction is expected to lead to a change of control.

“We remain engaged and invested in the company and are looking forward to its growth,” the company’s promoters issued a statement following ET’s queries.

Bain declined to comment. CVC Capital Partners did not respond to ET’ queries.

At current market capitalisation of Rs 29,103.53 crore, the Singhs family’s stake is worth Rs 3332.25 crore. If the open offer is successful, then the buyer may end up spending Rs 10,899.27 cr.

But the Singh family is seeking a significant control premium.

The discussions however are at an early stage.

For the full fiscal 2021-22, MFS posted a consolidated profit of Rs 318 crore, 43 per cent lower compared to the previous year. Its sole operating subsidiary Max Life Insurance recorded 27.4 per cent rise in total new business premium (individual and group) to Rs 1,528 crore in FY22. Its assets under management (AUM) were at Rs 1,07,510 crore as on March 31, 2022, a rise of 19 per cent over the previous year.

“Max Life is a high-quality life insurance company with strong agency channel, diversified product mix, stable and quality management team etc. As investor concerns get addressed one by one – Axis Bank deal, corporate structure simplification – we believe there is no reason for the stock to trade at ~40%-50% discount to its listed peers HDFC Life and SBI Life,” said Nidhesh Jain of Investec.

CNBC TV 18 in November was the first to report about the sale being planned. The company denied any plans to sell then.

Shareholder roulette

Earlier this month, Axis Bank informed that it has entered into revised agreement after IRDAI guidance and it will acquire the remaining stake in Max Life Insurance at fair market value using discounted cash flows instead of valuation. The lender in 2021 had announced the acquisition of equity shares of Max Life Insurance Company Limited by the bank itself along with its subsidiaries – Axis Securities Limited and Axis Capital Limited under definitive agreements. As per the agreement, Axis Entities had collectively acquired 12.99% of the equity share capital of Max Life. In addition, Axis Entities also had a right to acquire an additional stake of up to 7.00% of the equity share capital of the life insurer in one or more tranches at a valuation as per Rule 11UA of the Income Tax Rules, 1962. Mitsubishi Sumitomo too had rejigged their holdings in Max Life Insurance and MFSL to simplify the holdings through a put and call option that was approved by the Max board in 2020. The regulatory approvals for the last tranche of the transaction came through last November.

The Singh family too – which itself has seen Analjit Singh caught in a legal dispute with wife Neelu over the management the family holding company Max Ventures – offloaded 58.85 lakh shares translating to a 1.7% stake to pare down their holdings in the company and raised Rs 400 crore through an open market transaction. ET in its Aug 30 2022 edition had reported a 2 judge bench of the National Company Law Tribunal (NCLT) urged the warring couple to resolve the dispute through a settlement. Neelu Singh owns 24.1% stake in Max Ventures.

“The transaction has the blessings of all factions,” said an official in the know on condition of anonymity. “The cash from the liquidity event will help in the family settlement,” Over the years, Singh had sold his investments in telecom, hospitals and other businesses.

The life insurance penetration in India is about 3.2 %. With India ranking 10th in the global life insurance market, ahead of China and UK. So there is an enormous market opportunity to grow the segment, feel industry observers. With clarity of rules allowing PE players to become promoters of insurance companies, funds have naturally attracted to the space. From Carlyle to Kedaara, Advent and True North, foreign as well as domestic funds have direct or indirect exposure to these firms.