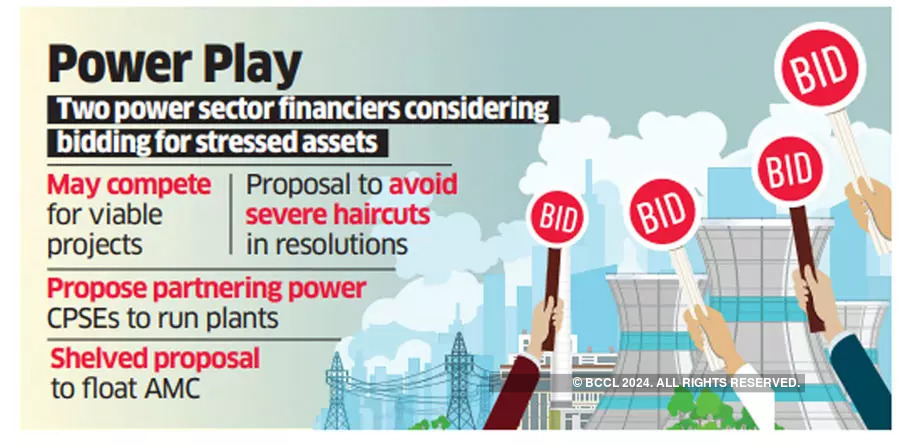

The two dedicated power sector financiers Power Finance Corp (PFC) and REC Ltd are considering bidding for stressed power assets to prevent large haircuts on their loans during resolutions. The state-run companies propose to float a consortium of lenders and state-run power developers to acquire and operate such stressed assets, sources in the government said.

“The lenders have incurred large haircuts in the past resolution processes for even good projects, which are nearly commissioned, have power purchase agreements and assured coal supplies. The two companies are looking at bidding for the stressed projects during resolution,” a senior official said.

Another official said the companies are considering partnering with other central power sector entities for technical know-how to run the acquired projects.

“We are looking to participate in a consortium with other CPSEs in stressed asset resolution,” he said.

The two financiers PFC and REC have so far have stayed away from taking over power projects or assets. “However, as there are only a few bidders each time for power plants and as the interest in coal-based generation diminishes, there could be further deterioration in their valuations. Hence, both lenders are mulling these opportunities to prevent losses,” the official quoted first said.

While most of the 34 identified stressed assets in the power sector have been resolved, the two lenders propose to save key projects including Lanco Amarknatak and KSK Mahanadi from severe undervaluation.

NTPC’s bid for Avantha Group’s 600-Mw Jhabua plant is by far the highest on a per-megawatt basis under stressed asset resolutions in the power sector. Lenders could recover 40% of their loans at ₹3.2 crore per MW NTPC offered against the construction cost of ₹6 crore for new projects. Adani Power had valued it at about ₹750 crore, or ₹1.25 crore per MW.

Adani Power had won GMR Infrastructure’s 1,370 MW coal-based power plant in Chhattisgarh, offering to take over its debt at ₹3,530 crore, or ₹2.58 crore per MW. It paid a nominal ₹1 for the equity component.

Tata Power-backed Resurgent Power paid about ₹6,000 crore, or a little over ₹3 crore per MW, for the 1,980 mw Prayagraj Power plant in Uttar Pradesh. Hong Kong-based Agritrade Resources bought SKS Power’s 1,200 MW Binjkote power plant for ₹2,170 crore, valuing it at ₹1.8 crore per MW.

PFC and REC have also discussed the possibility of setting up an assets management company to takeover viable projects through bidding or change of management route. However, that plan has been dropped now.

REC Ltd had in 2018, in the middle of the large stressed assets crisis, proposed Power Asset Revival through Warehousing and Rehabilitation, or ‘Pariwartan’ scheme, to warehouse around 20,000 MW stressed projects under an asset management company to protect their value and prevent distress sale. The scheme did not take off.