After months of running due diligence, PhonePe, one of India’s leading fintechs and the biggest player in the UPI market, has turned on its heels and walked away from a potential deal with cash-strapped buy-now-pay-later (BNPL) player ZestMoney. Read on for all the details, a story which we broke this morning.

It’s official. Deal talks between payments major PhonePe and credit startup ZestMoney have been called off after months of deliberation, dealing a huge blow to the BNPL player’s hopes of a big funding infusion.

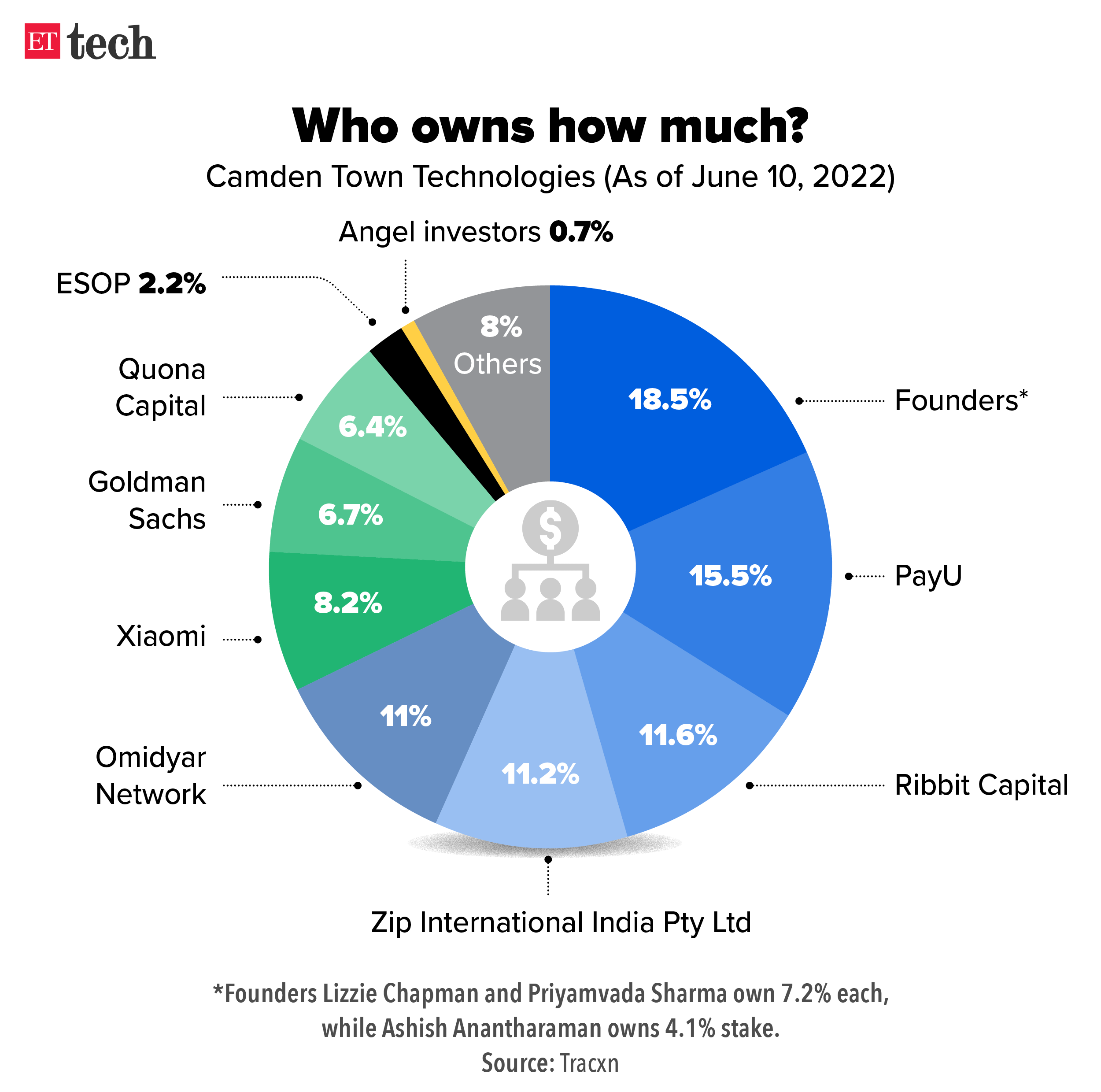

What led to the breakdown? Multiple sources told us that transaction fell through mainly because of due diligence concerns after more than five months of the term sheet being signed in November last year. ZestMoney’s shareholding structure was also a point of concern during the due diligence process.

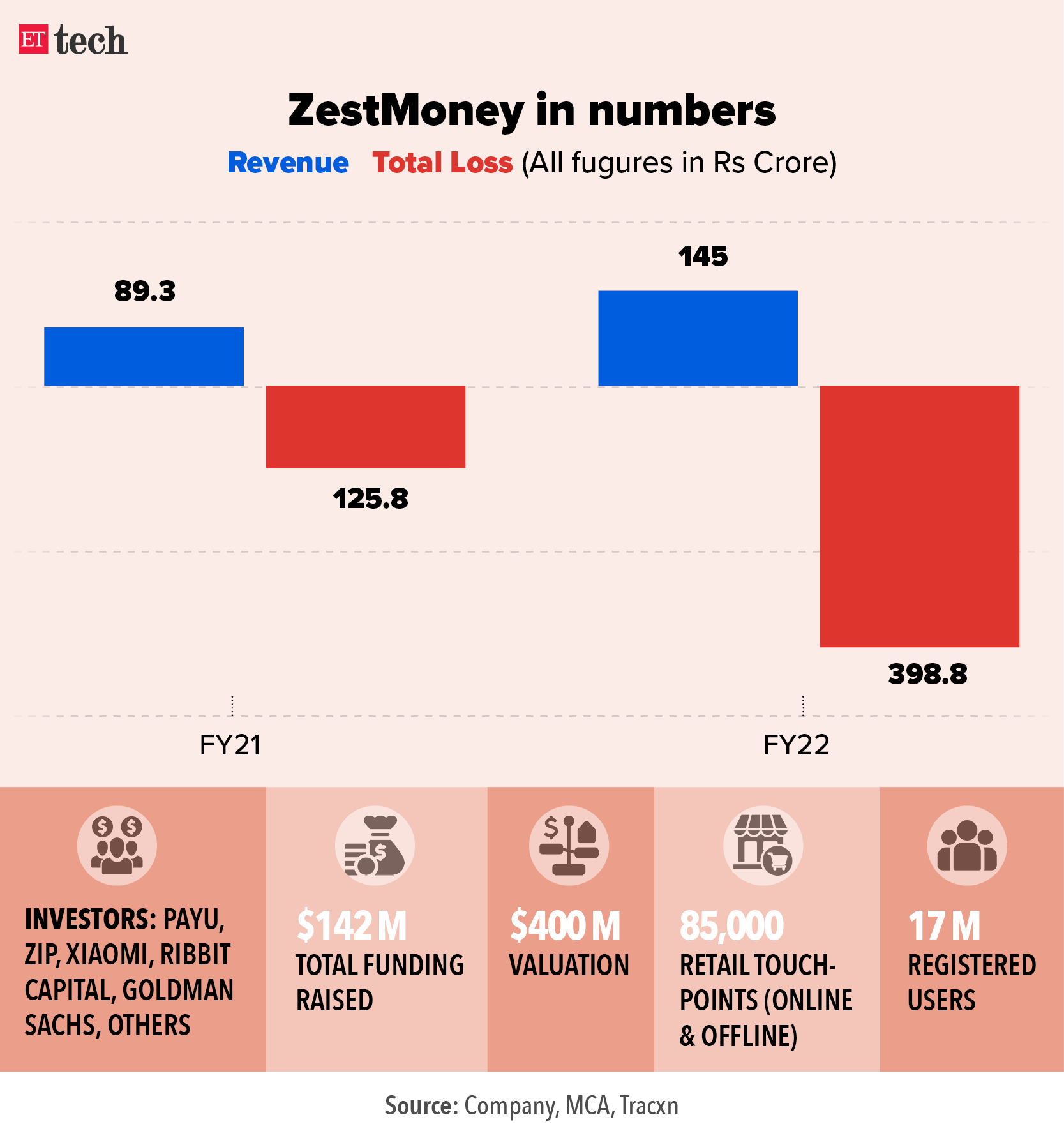

What led to the breakup? ET had reported in November that the high delinquency rates of loans provided by ZestMoney had come under the scanner earlier as well which became a roadblock for the company’s attempts to raise capital. This issue is likely to have come up during the due diligence which took over five months.

During the negotiations, questions were raised around the complex structure of the company. Primrose Hill Ventures, the Singapore-based parent of India-registered Camden Town Technologies, is the entity which owns and operates the ZestMoney platform.

Primrose Hill Ventures owns Nahar Credits, which is the non-banking finance arm (NBFC) partner of ZestMoney, as well as Euston Insurance Advisors, the insurance broker arm of the group.

ZestMoney claims to have 17 million registered users and sports a network of 85,000 online and offline touchpoints. Unlike its counterparts, such as Simpl and PayU’s LazyPay, it focuses on big-ticket items and sits at the checkout counters of various ecommerce websites and points of sale of various offline retail partners. It competes with the likes of Axio (formerly CapitalFloat).

Source: Economic Times