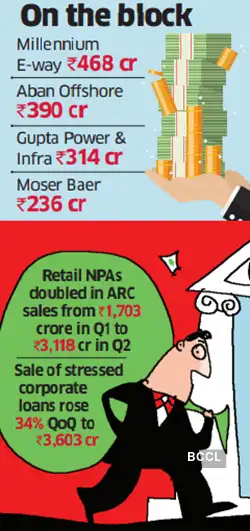

State-run Punjab National Bank (PNB) has invited offers from asset reconstruction companies (ARCs) to sell bad loans worth Rs 2,560 crore, including exposures of Rs 468 crore to Millennium Expressway, Rs 390 crore to Aban Offshore, Rs 314 crore to Gupta Power and Infrastructure and Rs 236 crore to Moser Baer, along with about 20 other loan accounts.

PNB has sought expressions of interest (EoIs) by January 3, to be followed by a Swiss auction. This marks a rare instance in recent times of a bank offering corporate loan accounts for sale, as lenders have largely been focusing on the disposal of retail and microfinance (MFI) portfolios.

“The move reflects a more proactive approach to balance-sheet clean-up in the corporate segment, as banks look to free up capital, sharpen their risk focus and address stressed exposures through market-based resolutions rather than prolonged recoveries,” said an official in the know.

In an interview in August, PNB MD & CEO Ashok Chandra had said the lender had identified more than 100 NPA accounts with an aggregate value of Rs 4,000 crore to Rs 5,000 crore for sale to ARCs. “We expect to recover something in the range of 40-50% minimum,” Chandra had told PTI.

According to the bid document seen by ET, the sale will be conducted on a 100% cash basis, with due diligence on the accounts to be completed between January 21 and January 31. Binding bids for certain accounts are to be submitted by January 31, while others will close on February 9.

Reflecting a sharper focus on balance-sheet hygiene, banks and non-bank lenders accelerated the offloading of stressed assets during the September quarter. The sale of retail bad loans to ARCs nearly doubled in three months, rising to Rs 3,118 crore at the end of the September quarter from Rs 1,703 crore in June, industry data indicate.

The sale of non-performing corporate loans also rose by about 34% to Rs 3,603 crore in the September quarter from Rs 2,685 crore in the previous quarter. In total, bad loan sales stood at Rs 6,721 crore at the end of September, up from Rs 4,388 crore in June, while the total dues involved increased to Rs 37,381 crore from Rs 16,876 crore over the same period.

The sale of corporate bad loans has been on a steady decline over the years, in line with the gradual shift in the composition of bank credit over the past decade-from industrial and corporate lending towards retail loans. The rising share of retail loans in stressed assets mirrors this broader shift in credit dynamics.

Source: Economic Times