Four state-owned financial entities – Punjab National Bank, Life Insurance Corporation of India, State Bank of India, and Bank of Baroda – that together own just over 45% of UTI Asset Management Company (AMC) are understood to be working on inviting formal bids for selling their stakes, top officials close to the development told ET.

Industry sources said these entities have recently appointed merchant bankers to initiate the sale process.

Earlier, the Tata Group was understood to be in advanced talks to buy a majority stake in UTI AMC from the four public sector entities, but the discussions fell through after a large investor in the AMC insisted that the other investors follow a formal bidding process to sell their stakes instead of using the nomination route, said one of the officials cited above. There were also some issues that had to be sorted around the stakes held, it is learnt. The Tata Group will now put in a fresh bid for the AMC, officials close to the development said.

In September last year, the Department of Investment and Public Asset Management (Dipam) issued detailed guidelines for public sector companies on dealing with their downstream investments. While giving state entities greater autonomy, the government has asked the respective boards to follow thorough due diligence on qualified bidders, including assessment of security risks and political clearance of qualified bidders if the latter is necessary from a national security standpoint.

Not Classified as Promoters

ET’s mailed queries to UTI AMC, Punjab National Bank, Life Insurance Corporation of India, State Bank of India, Bank of Baroda and the Tata Group remained unanswered.

Although UTI AMC had earlier denied talks of a stake sale by the four public-sector sponsors, the Tata Group is keen on buying the 45% stake from the four state-owned financial entities as its current asset management business is very small.

To be a significant player in the segment, the Tata Group must scale up, and the merger & acquisition route seems to be the only way to do so quickly, one of the officials cited above said.

Purse & Purpose

“It is mostly the Tata Group, which has a serious intent to scale up its asset management business and (has) the deep pockets to fund such an acquisition,” said a highly placed official at a leading mutual fund.

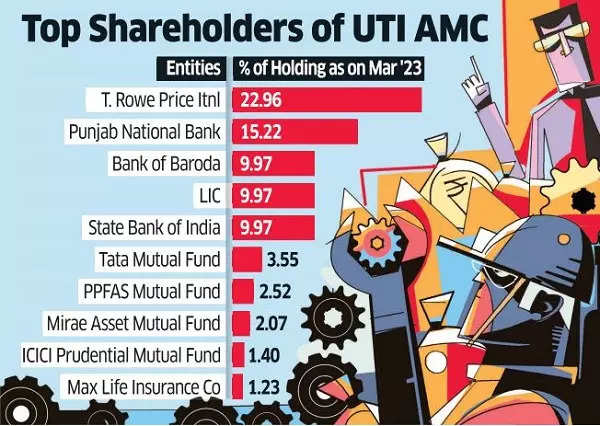

UTI AMC, which was carved out of the erstwhile Unit Trust of India (UTI) in 2003, has no promoters but sponsors, such as the four entities interested in selling their stakes. The other large investor in the AMC is T Rowe Price Group Inc which, through its wholly-owned subsidiary T Rowe Price International, held a 22.96% stake in UTI AMC as on March 31, 2023.

The public-sector entities, which together own 45%, are not classified as promoters of the AMC because they also have their own asset management businesses, and Securities and Exchange Board of India (Sebi) rules bar companies from being promoters of more than one asset manager.

Furthermore, India’s takeover rules mandate the acquirer of 25% stake in a publicly listed company to mandatorily make an open offer to other shareholders for buying an additional 26% equity. Hence, a single buyer of the entire 45% stake will be ordinarily required to make an open offer for an additional 26%.

UTI AMC, which was listed in October 2020, commands a market capitalisation of ₹8,800 crore as of Wednesday. Assets under management (AUM) of UTI AMC, as of March 31, 2023, were ₹2.39 lakh crore, or about 6% of the total industry AUM.

Shares of UTI AMC declined 11% in the past six months, compared with gains of half a percent in the benchmark Nifty.

For the year ended March 31, 2023, UTI AMC posted an 18% year-on-year decline in its net profit at Rs 440 crore on revenue of Rs 1,267 crore.

Last year, Punjab National Bank said it wanted to monetise its non-core assets, including selling its stake in UTI AMC. In October 2020, the lender sold a 3% stake in UTI AMC for around ₹180 crore, bringing down ownership to 15.22%.

In December 2019, Sebi directed LIC, SBI, and BoB to reduce their stakes in UTI AMC by December 2020. These three public sector financial institutions held 18.24% each back then, while Sebi’s cross-holding norms for mutual funds do not allow the sponsor of one AMC to hold more than 10% in another. Subsequently, these three firms reduced their stakes below 10% during the IPO in October 2020.

Source: Economic Times