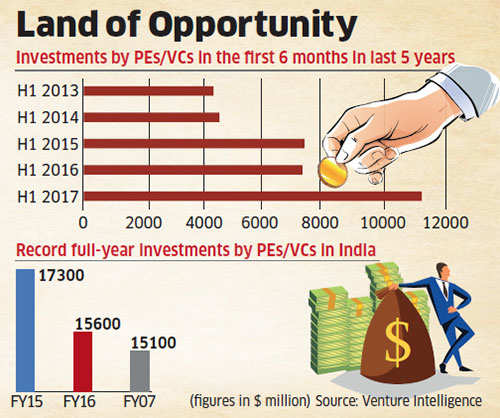

A PE deluge continues to drive up the deal street as well as India’s foreign direct investment ranking. Breaking all previous records, private equity firms invested a record $11.3 billion in the country in the half year ended June 30, 2017, with $5.9 billion getting deployed during the quarter through March across 124 deals, as foreign capital backed compelling themes in sectors as diverse as healthcare, manufacturing, insurance and business process outsourcing.

This is in stark contrast to early-stage venture investments that have dropped to $275 million across 78 deals during April-June, making it the weakest quarter for VC fund investments in the past years, data from Venture Intelligence showed.

“While the challenges in the consumer Internet and mobile sector had become quite apparent last year, they are beginning to reflect quite starkly in terms of VC investment figures during 2017,” said Arun Natarajan, founder of Venture Intelligence, an M&A and PE data provider.

“Given the plentiful availability of capital in the system, once the dust settles on the consumer Internet front, newer themes like health tech and deep tech should also emerge stronger on the radars of investors,” he added.

“Given the plentiful availability of capital in the system, once the dust settles on the consumer Internet front, newer themes like health tech and deep tech should also emerge stronger on the radars of investors,” he added.

In the first half of 2016, global and domestic PE funds invested $7.4 billion in 335 companies. The previous record was the $10 billion of investments that flowed in during the second half of vintage 2007 when the equity markets world over were at their peak, the data showed. For the quarter ended June 30, 2017, the investment of $5.4 billion was 62% higher than the year-earlier period but 9% lower than the immediate previous quarter.

“Private investors are more willing to put their money to work. Distressed assets continue to be an opportunity,” said Sanjay Nayar, the India CEO at KKR. “Broadly, the approach for PE players should now move towards strategic solutions. This will involve partnering with promoters to help them find ways that can help them grow, de-consolidate and go global where there is scope.

This can be done by shifting the focus towards operational value add, larger deals and breaking away from the thematic play and expensive sectors,” he added. The latest quarter witnessed 10 PE investments worth $100 million — twice that during the same period last year. Canadian pension fund CPPIB, as well as PE firm Warburg Pincus, were especially active, joining Soft-Bank on the list of investors committing to invest over $1 billion in the first six months of 2017.