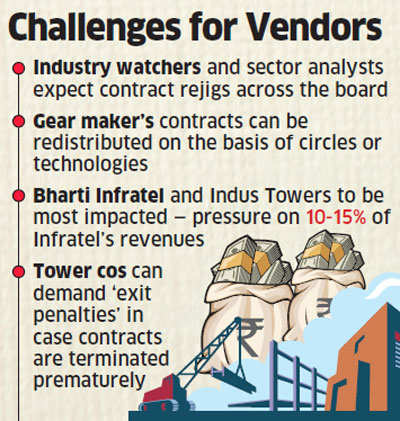

A potential Vodafone and Idea CellularBSE -2.68 % merger is likely to lower rentals for tower providers and lead to revaluation of contracts with network gear makers in the near term, as carriers would look at combining synergies and removing redundancies.

Consolidation will also shrink the revenue pie for IT vendors to both companies — major one being IBM — who would have to brace for a sharp hit to revenues coming from long-term contracts.

“In case of 15% site rationalisation by the Idea-Vodafone combine, it will lead to 5.9% revenue contraction for Infratel, while 20% revenue rationalisation will lead to 7.9% revenue contraction for Infratel,” analysts at Edelweiss said in a note to clients. JM FinancialBSE 7.38 % estimated an overlap of about 100,000 sites.

“A 10% redundancy of existing sites for Idea could wipe out the entire tenancy addition for Bharti Infratel for a year,” said Jefferies in a separate note to clients. Shares in Bharti Infratel, the country’s only listed telecom tower company, fell more than 14% to Rs 292.55 during the day’s trade, to reach its 52-week low, on the BSEon Tuesday. The scrip closed 11% down at Rs 293.65.

Vodafone India and Idea Cellular have common vendors across towers, network equipment, managed services and IT, which includes more than half a dozen companies. Indus Towers, Bharti Infratel, American Tower Corporation, GTL Infra provide towers and Huawei, Ericsson and Nokia, which provide telecom gear, some also do managed services. IT vendors include primarily IBM, among others like Tech Mahindra and Accenture.

The merger would “induce the need to make lots of tough choices around technology vendors/IT partners, customer relation management partners (like third-party contact centres), and should naturally lead to realignments of existing agreements and contracts with their respective partners,” said former Bharti Airtel CEO Sanjay Kapoor. “Since the objective would be to build synergy and avoid duplication of network/systems/people-resources/partners on a circle-by-circle basis, the consolidation at ecosystem partners’ level is inevitable,” he added.

The No 2 and No 3 carriers in India by subscribers may have to renegotiate some vendor contracts to optimize network and bring in operational efficiency on a circle-to-circle basis. Idea and Vodafone bought spectrum in the 2016 auctions, and some network rollout contracts have been given out. Vodafone gave a 4G LTE deployment and expansion deal worth $450-500 million to Nokia covering 10 circles in January, which followed a multi-year managed services contract worth $200 million.

Last year, a three-year managed services and network operations contract worth $180-220 million was given to Huawei in some circles.

The carriers would have to choose between vendors running parallel service and supply contracts, so as to keep one network. They may even redistribute geographies between suppliers.