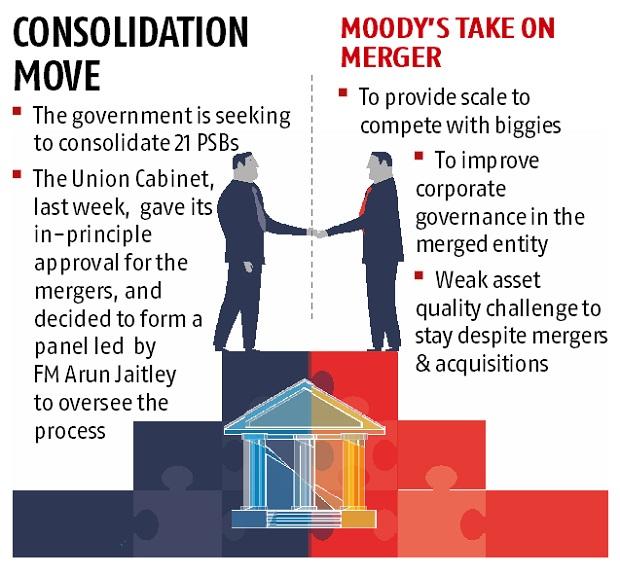

Poor corporate governance has been a structural credit weakness at PSBs, and managing all 21 has proven to be unwieldy for the government. The government has largely failed to pay sufficient attention to key issues, such as long-term strategies and human resources. Consolidation would address some of these issues.