Public sector banks looking to merge would have to approach the new alternative mechanism once they informed the stock exchanges about the plan. “This will ensure that all issues related to consolidation from the government, the promoter and regulator RBI are addressed from the beginning,” a senior government official told ET.

This would also expedite decision-making and address issues well in time, the official added. “Under the Bank Nationalisation Act, 1969, there are provisions allowing such mergers so there is no need to amend any laws,” the official said.

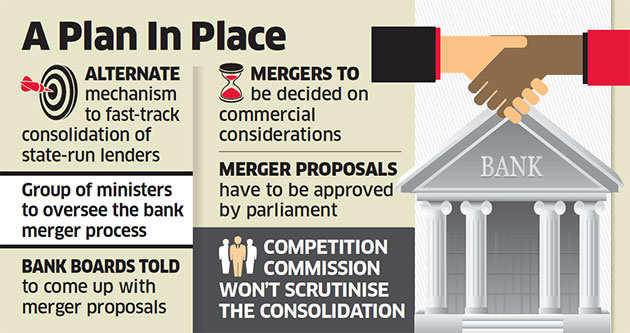

However, due to various court judgements on mergers and acquisition in state-run firms, it is imperative that the merger proposals are approved by Parliament, the official added.

“So, the alternative mechanism will help fast-track that process,” he said, adding that the decision regarding mergers would be solely based on commercial considerations.

The alternative mechanism will comprise a panel of ministers and it will give in-principle approvals to proposals for schemes of amalgamation and oversee the entire process.

The Cabinet gave its in-principle approval to the alternative mechanism late last month. The government said it will notify the final scheme in consultation with the Reserve Bank of India.

The finance ministry is already leaning on state-run banks to explore options for consolidation and identify synergies across various platforms, including business operations and geographical spread.

Four state-run lenders — Dena BankBSE 0.16 %, Syndicate BankBSE -0.69 %, Vijaya BankBSE -1.10 % and Canara BankBSE -0.50 % — have made presentations to the government along these lines.

The government last week exempted consolidation among public-sector banks from the scrutiny of the Competition Commission of India — a decision that would help reduce risks to merger plans and quicken the consolidation process.

The exemption will cover all cases of reconstitution, transfer of the whole or any part of nationalised banks and will be in force for 10 years.