Qyuki Digital Media, a creator management and monetisation company, has held talks with strategic investors such as news aggregation platform Dailyhunt and music and entertainment firm Saregama, to sell a majority stake, three people with direct knowledge of the deal said.

The deal could value Qyuki at up to $100 million, the people said.

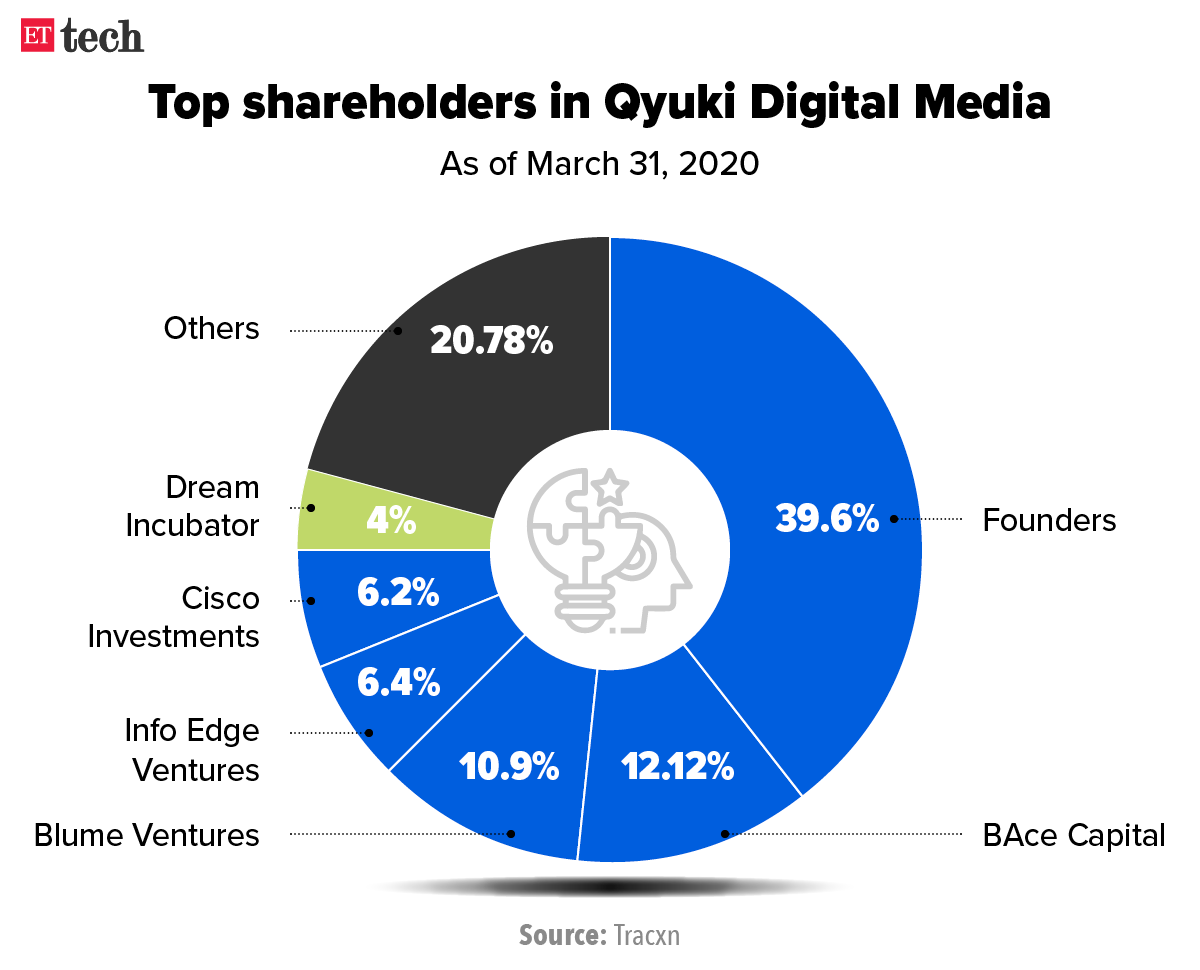

“The transaction is likely to be a mix of stock and shares and could value the company at $75-100 million… Some early existing investors like Chinese fund Bace Capital and others are looking to exit Qyuki,” one person said.

The Mumbai-based company has also held talks with beauty and personal care conglomerate Good Glamm Group said a person in the know. Preliminary discussions have also been held with ecommerce firms including Meesho and Flipkart as online retailers look to bolster their content play through influencer tie-ups, the person added.

While stake sale talks are on, another person said the company is also open to picking up capital from financial investors if the sale doesn’t go through.

The discussions come amid consolidation in the burgeoning creator led-content sector, fuelled by well-funded startups.

Content-to-commerce has emerged as a big theme for transaction-led internet firms, which are banking on online creators and influencers to push their brands to shoppers.

Qyuki counts Info Edge Ventures, Blume Ventures and Bace Capital as investors and had raised $22 million so far. When it last raised around two years ago, the firm was valued at $50 million.

“Dailyhunt is a good fit as its offer of a cash-and-equity deal is the most attractive for Qyuki… while Dailyhunt is a front-runner, no definite agreements have been signed with anyone beyond several non-binding term sheets,” another person privy to the deal details said.

Verse Innovation, which runs local language news aggregator Dailyhunt, also operates short video app Josh, with which Qyuki has an ongoing exclusive partnership for its creators.

ETtech

ETtechJosh contributed about 20% of Qyuki’s overall revenue in FY21, according to a person cited earlier.

“As part of this transaction, a few existing investors will swap equity and get shares in Dailyhunt,” the person added.

Since August last year, Dailyhunt’s parent has raised close to $475 million from investors, valuing the firm at more than $3 billion.

Josh competes with ShareChat’s Moj and MX TakaTak, both of which merged recently.

MX TakaTak was owned by Times Internet, part of the Times group, which also publishes this paper.

Spokespersons for Qyuki, Meesho and Flipkart did not respond to ET’s queries.

A spokesperson for Good Glamm said in an email that the company was not in talks to acquire Qyuki.

Saregama spokesperson declined to comment.

Founded in 2010 by musician AR Rahman and filmmaker Shekhar Kapur, Qyuki’s first investor, US-technology conglomerate Cisco, brought on board Samir Bangara, the former chief operating officer of Indiagames to steer the operations of the media startup as its CEO.

ETtech

ETtechBangara passed away in 2020 in an accident. Since then a new management team has been put in place, led by one of the company’s angel investors Abhimanyu Radhakrishnan, who took over as managing director, and cofounder Sagar Gokhale.

Qyuki primarily focuses on helping creators monetise their content by providing different avenues and takes a predefined cut as talent management fee.

According to Qyuki’s regulatory filings, sourced from business intelligence platform Tofler, the company’s consolidated revenue in FY21 stood at Rs 70.5 crore compared to Rs 76.23 crore in the previous financial year. Its losses narrowed to Rs 12.38 crore for the same period compared to Rs 14.25 crore in the previous financial year.

Revenue took a hit as live events, which was one of its top revenue contributors, came to a standstill last year. The company is expected to close FY22 at Rs 150 crore in revenue, marking a 50% jump from the previous year.

Consolidation in creator ecosystem

Influencer and creator economy startups have seen a spate of acquisitions in recent months led by the Good Glamm group which has created its influencer business as a separate entity to house under the Good Creator Group, and other new age brands like MamaEarth which acquired influencer-engagement platform, Momspresso MyMoney.

According to multiple executives, e-commerce players are exploring investments and acquisition opportunities to reduce the cost of acquiring new customers and build a social commerce play.

“This is bound to happen as brands, ecommerce, and social platforms all achieve scale because all three sectors are going to be heavily dependent on the creator economy and would want operational expertise in that area,” said an executive at a creator management company.

The co-founder of a startup that represents top creators said direct-to-consumer brands are still unclear about their long-term vision for acquiring these startups.

“A lot of these folks genuinely don’t know what they’re going to do with it. They’re going to absorb these teams and try to make a sales team out of it. Even if they start an influencer marketing or a talent management firm for other brands to work with, it is like a direct conflict towards a brand,” said the executive. “…why would other brands want to work with an agency that’s associated with one brand? So, that’s the sort of a disassociation I see in this whole equation.”

Source: Economic Times