Anil Ambani-promoted Reliance ARC has submitted a writ petition against the Reserve Bank of India in the Bombay High Court opposing the Swiss challenge method during the debt sale of Vidarbha Industries Power, which has drawn interest from funds like Varde Partners-backed Aditya Birla ARC and Avenue Capital-backed Asset Reconstruction Company of India (Arcil).

Vidarbha Industries Power, currently in bankruptcy and promoted by Anil Ambani, has a total debt of Rs 2,569 crore.

Reliance ARC has challenged the central bank’s circular of September 24, 2021, calling it arbitrary as it confers “unwarranted and unreasonable benefit” in favour of a Prospective Transferee.

The deadline for bidders to submit firm offers was August 8, but the hearing for that petition will take precedence, a bank source said. The matter could be taken up for hearing by the end of this week, another source said.

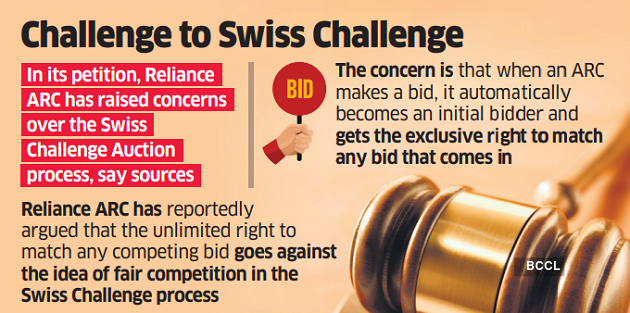

In its petition, Reliance ARC has raised concerns over the Swiss Challenge Auction process, according to a lawyer source. The concern is that when an ARC makes a bid to buy a troubled asset or a non-performing asset (NPA), it automatically becomes an initial bidder and this gives the ARC the exclusive right to match any bid that comes in during the Swiss Challenge Process, the lawyer explained.

This means even if another bidder submits a competing offer, the initial bidder has the right, as per the RBI circular, to match that offer without needing to improve or raise the bid amount and this way, the initial bidder can secure the asset without having to exceed the highest bid amount, Reliance ARC has said.

Reliance ARC has argued that this unlimited right of the initial bidder to simply match any competing bid goes against the idea of fair competition in the Swiss Challenge process. When other potential bidders know that their bids can be matched easily by the initial bidder, it reduces the incentive for them to put forward their best offers.

The initial bidder only needs to match the rival bid, not surpass it, which practically makes it very difficult for ARCs to have a real chance of winning the acquisition process. Spokespersons of RBI and Reliance ARC did not immediately respond to requests for comment.

Axis Bank, the lead lender, had called for bids for the assignment of debt. Lenders appointed SBI Capital Markets as the process advisor for coordinating this bid process. On July 7, 2023, lenders considered the base bid by CFM ARC and approved the bid to be treated as the base offer for the purpose of launching the Swiss Challenge process. On July 12, Reliance ARC submitted an expression of interest along with three others — Aditya Birla ARC, Avenue Capital backed Arcil to acquire debt under the Swiss Challenge method.

On July 21, Reliance ARC was selected as one of the three bidders eligible to bid for the debt and later that week it sent a letter to lenders highlighting the onerous clauses of the EOI.

Lenders have chosen to sell the debt to an asset reconstruction company to speed up the recovery process. In a previous insolvency application by Axis Bank, the court had that admitting applications under Section 7 of the Insolvency and Bankruptcy Code, 2016 is discretionary.

The Supreme Court urged prioritisation of company revival and consider feasibility and circumstances when deciding on admission. This influenced lenders to opt for debt sale rather than pursuing lengthy in-court resolutions.

Vidarbha runs a coal-based power project in Nagpur. Its electricity rates are regulated by the Maharashtra Electricity Regulatory Commission (MERC. It won an award of Rs 1,730 crore order from the Appellate Tribunal for Electricity (APTEL). MERC has contested it in the Supreme Court.

Source: Economic Times