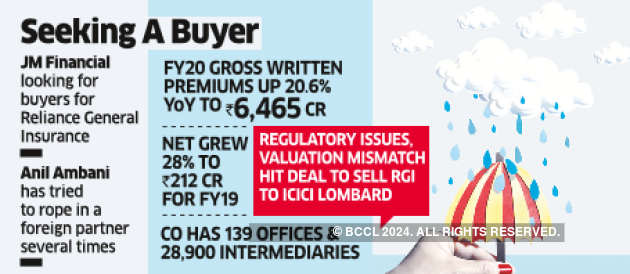

Lenders of Reliance General Insurance are in talks with global funds and strategic investors to sell 100% in the insurance company owned by the debt-ridden Anil Ambani group. Investment bank JM Financial has been appointed to look for buyers for the company, valued at about Rs 4,000 crore, said four people with direct knowledge of the matter.

An information memorandum went out to prospective buyers last week with an asking valuation of Rs 4,000-4,500 crore, said one person.

Currently, non-residents are not allowed to own more than 49% in an insurer. Also, the proposed owner will have to be certified as fit and proper by the Insurance Regulatory and Development Authority of India, which will carry out due diligence and ascertain the prospective buyer’s financial soundness.

On February 27, the Securities Appellate Tribunal allowed lenders Nippon India Mutual Fund and Credit Suisse to invoke shares of Reliance General Insurance pledged by Anil Ambani group firms. Lenders including Credit Suisse, Nippon Life, Life Insurance Corporation of India. Other banks and institutions own non-convertible debentures of Reliance General Insurance.

In March 2018, Reliance Home Finance had issued bonds worth Rs 400 crore to Nippon India and Rs 1,200 crore to Credit Suisse by pledging Reliance General shares and later was unable to pay.

The regulator declared the pledge enforcement as invalid in December 2019 because its approval had not been sought and the transfer violated foreign investment norms.

Emailed queries sent to the spokespersons of Reliance Capital, SBI Caps, JM Financial and Credit Suisse did not elicit any response.

Anil Ambani had tried to rope in a foreign partner several times, but did not succeed. In October 2017, Reliance Capital also filed draft papers with market regulator Securities and Exchange Board of India for an initial public offer. Approval for the IPO expired in November 2018.

Reliance General Insurance had 10.5% market share in terms of gross premiums among private general insurance companies for April.

Source: Economic Times