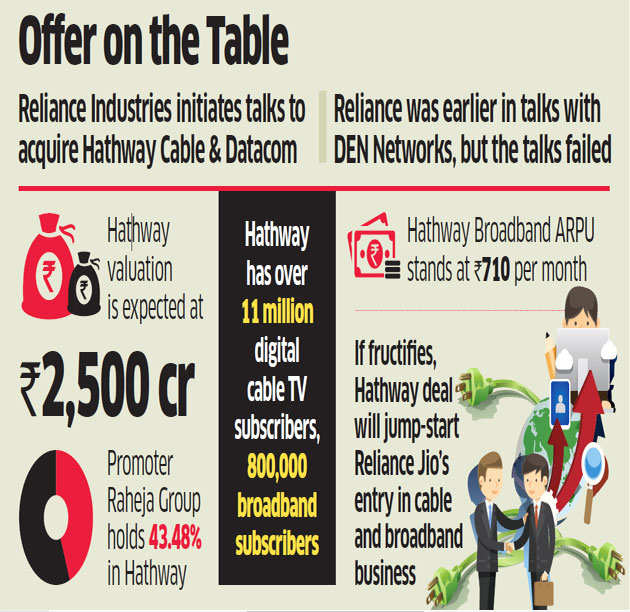

Three people with direct knowledge of the talks confirmed the development to ET, while maintaining that the talks were at “an initial” stage and a deal was still at an “exploratory stage”. “It’s too early to say if the deal will go through or not, but RIL is aggressively pursuing it,” one of the people said. The valuation figure being discussed is around Rs 2,500 crore, this person said.

RIL and Hathway didn’t respond to ET’s request for comment until press time Tuesday.

Hathway is a multi-system operator, the industry term for a cable company that signs content and carriage deals with broadcasters, and offers the services to local cable operators.

This is not for the first time that RIL is eyeing acquisition in the cable TV industry.

ET reported in September last year that the company was in advanced talks with Sameer Manchanda-promoted DEN Networks for a possible acquisition. Those talks didn’t fructify and the RIL management decided to go solo on the launch of GigaFiber under its Reliance Jio Infocomm unit, one of the people said.

“At any given point of time various business plans are being discussed at Jio. Earlier, the idea was to acquire a big MSO and a few smaller ones. We have plans ready on how to use existing infrastructure of MSOs to give both video and broadband services,” the person said.

Another person said as Reliance Jio Infocomm was facing resistance from local cable operators (LCOs) in extending crucial lastmile connectivity in key markets, the GigaFiber rollout was slower than anticipated. “This has resulted in revisiting of prior plan of acquisition,” the person said. Hathway, which had a net debt of Rs 1,617 crore at the end of March, is looking to deleverage its balance sheet by Rs 500 crore in the next two years.

ET reported on July 31 that the promoters of Hathway were infusing Rs 350 crore in the business over the next 18 months in the form of equity as well as long-term unsecured loans.

Managing director Rajan Gupta had told ET in an interaction that the company got `100 crore from the promoters in July, while another tranche of `100 crore was to be received by August end. The rest of the funds, Rs 150 crore, would come by March 2020, while another Rs 150 crore would be generated from operations over the next few months, Gupta said in the interview.

Industry experts said acquisition of Hathway would give a jumpstart to Jio’s broadband plans as it would bring in more than 11 million digital cable TV subscribers and 800,000 broadband users, out of which 90% users have high-speed (over 40 Mbps) plans.

Hathway’s average revenue per user for broadband business was around Rs 710 per month, in the June quarter.

“While I am not aware of the talks between RIL and Hathway, it does not surprise me either. RIL already has a MSO licence and they have fibre laid out. All they need is LCOs support to get the last mile, which is missing. Acquisition of an MSO will solve that problem,” a media analyst with a top brokerage firm said.