A company of Anil Ambani’s Reliance Group has submitted a resolution plan for another group firm, Reliance Naval & Engineering Ltd (RNEL), at a time when lenders have begun voting on two other proposals, two people aware about the development said.

Reliance Infrastructure made the offer on Friday under Section 12(A) of the Insolvency and Bankruptcy Code (IBC), which gives tribunals the power to permit withdrawal of an application from insolvency proceedings provided 90% of the lenders by value of debt agreed to it.

Lenders are voting on plans offered by Hazel Mercantile in partnership with Swan Energy, and Naveen Jindal’s Jindal Steel & Power Ltd.

As per the Reliance Infrastructure proposal, lenders would receive Rs 25 crore as an upfront payment, Rs 25 crore at the end of the first year, Rs 50 crore each at the end of the second and third years, Rs 75 crore after the fourth year and Rs 2,300 crore a year later, one of the people said.

RNEL’s resolution professional (RP), Sudip Bhattacharya, and Anil Ambani’s Reliance Group did not respond to ET’s queries.

Hazel Mercantile, a part of Groupe Veritas, is offering Rs 2,040 crore to lenders of which Rs 1,640 crore would be paid over the next five years and the remaining after the recoveries of certain dues. JSPL has offered Rs 2,210 crore. Of this, Rs 850 crore would be paid over the next five years, while the payment of the balance would be conditional upon certain recoveries, as reported earlier.

“This is a last-ditch attempt made by the promoter to retain control over its shipbuilding company,” said one of the lenders. RP Bhattacharya, backed by Duff & Phelps, will soon hold a meeting of the committee of creditors (CoC) to discuss the plan and push back the March 15 deadline for voting, the people cited above said.

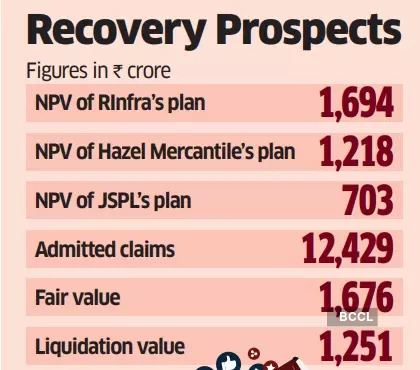

The RP has admitted Rs 12,429 crore of secured financial creditors’ claims. The net present value of the plan from Reliance Infrastructure is the highest at Rs 1,694 crore, compared with Rs 1,218 crore for the Hazel Mercantile proposal and Rs 703 crore of JSPL, a third person said. The fair value of RNEL is pegged at Rs 1,676 crore, while the liquidation value is Rs 1,251 crore, the person said.

The voting on the two offers started after the Gujarat bench of the National Company Law Tribunal on February 22 vacated a stay on the process, while rejecting Citi Securities & Financial Services’ appeal to admit its Rs 2,538 crore claim, and thereby making it a part of the CoC.

The tribunal said the Citi Securities plea appeared to be an effort to make a “back door entry” into the CoC, “to have a control over the process of the insolvency resolution process.” Citi Securities is an affiliate of listed VB Desai Financial Services.

The RP had informed the tribunal that Citi Securities’ claim emanated from a Rs 2,538 crore loan that Reliance Infra assigned to the finance company in March 2019, soon after IDBI Bank referred RNEL to the bankruptcy court but before it was admitted by the tribunal.

The RP has also received Rs 31,371 crore of claims from unsecured financial creditors including disputed claims from Citi Securities. Among the unsecured claims, he has admitted a Rs 111 crore claim from Reliance Capital. Since Reliance Capital too is undergoing bankruptcy proceedings, its administrator will vote on the RNEL plan.