Anil Ambani-promoted Reliance Power has made a revised and improved debt-settlement offer of `1,260 crore to the lenders of its Vidarbha Industries Power subsidiary, said people aware of the development. Reliance Power sweetened the offer after rival bidder CFM Asset Reconstruction Co improved its proposal.

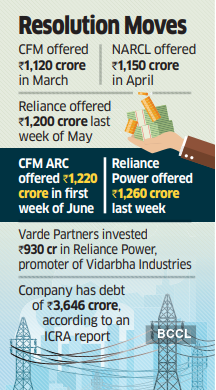

ET first reported on CFM ARC’s offer to lenders on March 30, followed by a report on an offer from government-owned National Asset Reconstruction Company (NARCL) on April 1 and a settlement offer by the promoter on May 22. CFM ARC initially offered `1,120 crore to the lenders, while NARCL offered `1,150 crore and Reliance Power made a `1,200 crore settlement proposal.

Reliance Power and CFM offered upfront cash, while NARCL’s offer is a combination of cash and security receipt. Early this month, CFM ARC improved its offer to `1,220 crore while Reliance Power made a revised offer of `1,260 crore. The offer by the promoter is backed by Varde Partners, which acquired a 15% equity stake in the company by infusing `930 crore in September last year. A Reliance Power spokesperson said: “We are committed to maximise the value for our lenders.

Our proposal, accompanied with Swiss challenge ensures maximisation of value and transparency.” CFM ARC did not respond to ET’s request for comment. The battle to gain control of Vidarbha Industries may end after the lenders auction the company’s loans. Reliance Power and CFM ARC have proposed to lenders that their offer should be considered as an anchor offer at the Swiss challenge auction, people cited above said.

The anchor bidder has a strategic advantage at a Swiss challenge auction since it has the first right to match any counter offer that lenders receive at the auction. Lenders, including State Bank of India, Axis Bank, Bank of Baroda, Punjab National Bank, Canara Bank and Bank of Maharashtra, will jointly decide next week on the proposals from the promoter and the two ARCs. Icra Ratings has assigned a ‘D’, or default category, rating on `3,646 crore debt of the company. One of the people in the know of the matter, however, said the loans have now reduced to `2,200 crore.