Realisation by financial creditors through the Insolvency and Bankruptcy Code (IBC) has fallen drastically in the fiscal third quarter, resurfacing industry concerns over slowing recoveries that are increasingly prompting lenders seek out-of-court settlements.

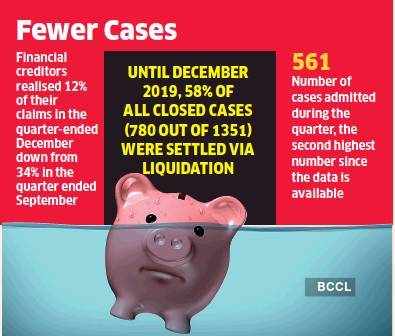

Data from the Insolvency and Bankruptcy Board of India (IBBI) showed that financial creditors realised just 12% of their claims in the quarter ended December, down from 34% in the quarter ended September. The statistics are published each quarter.

During the quarter ended December, a total of 30 cases were resolved with realisation ranging from just 5% on Rs 218 crore of claims for Ambey Iron to 90% on Rs 13 crore of claims.

Two large cases, namely EMC where Rs 6,150 crore of claims were admitted and Ushdev International where Rs 3,293 crore of claims were admitted, yielded just 9% and 6%, respectively, pulling down the total for the quarter.

Bankers say realisations through the IBC are falling as the companies under review are mostly service linked, with lower chances of recovery.

“Some of these companies don’t have the potential because they are service companies or EPC type companies. Manufacturing companies which are continuing as a going concern have a higher recovery potential but many of them have already completed the process,” said Pallav Mohapatra, CEO at Central Bank of India.

Bankers said falling recoveries from the IBC and delays in resolution have pushed them to seek solutions out of the courts.

“It has been noted that if a promoter is involved in the company which is a going concern and has some intellectual property (IP) to offer and is ready to put some skin in the game then we are better off in doing some one time settlement or restructuring. Realisation in these cases is lower through the NCLT route and banks will increasingly look to settle them out of court,” Mohapatra said.

The high number of cases going into liquidation is also a concern. Until December, 58% of all closed cases (780 out of 1,351) were settled via liquidation. However, the data show that there is now finally some urgency in admitting cases.

A total of 561 cases were admitted during the quarter, the second highest number since data are available and following the 565 admitted in the quarter ended September.

“In the last two quarters, there has been a sense of urgency in courts taking up cases, particularly with regards to financial creditors. Additional benches put up across the country have helped. This has resulted in a lot of backlog of admissions being cleared in the last two quarters,” said KP Sreejith, managing partner, India Law LLP.

However, the slow pace of resolution continues to be a deterrent. Out of 1,961 ongoing admitted cases, 635 cases have passed 270 days since admission, while another 247 cases have crossed 180 days since admission.

Source: Economic Times