The stock of Gujarat Gas gained 11.12% on NSE Monday following the state’s plan to simplify the shareholding structure through a reverse merger of Gujarat State Petroleum Corp (GSPC) and Gujarat State Petronet Ltd (GSPL) into the company.

After the restructuring, the EPS is projected to increase by 5-7%, adjusted for equity dilution from the issuance of new shares. The entire transaction will be completed by August 2025.

Prior to the merger, the Government of Gujarat held a 55% stake in GSPC, which in turn held a 37% stake in GSPL. GSPL held a 54% stake in Gujarat Gas.

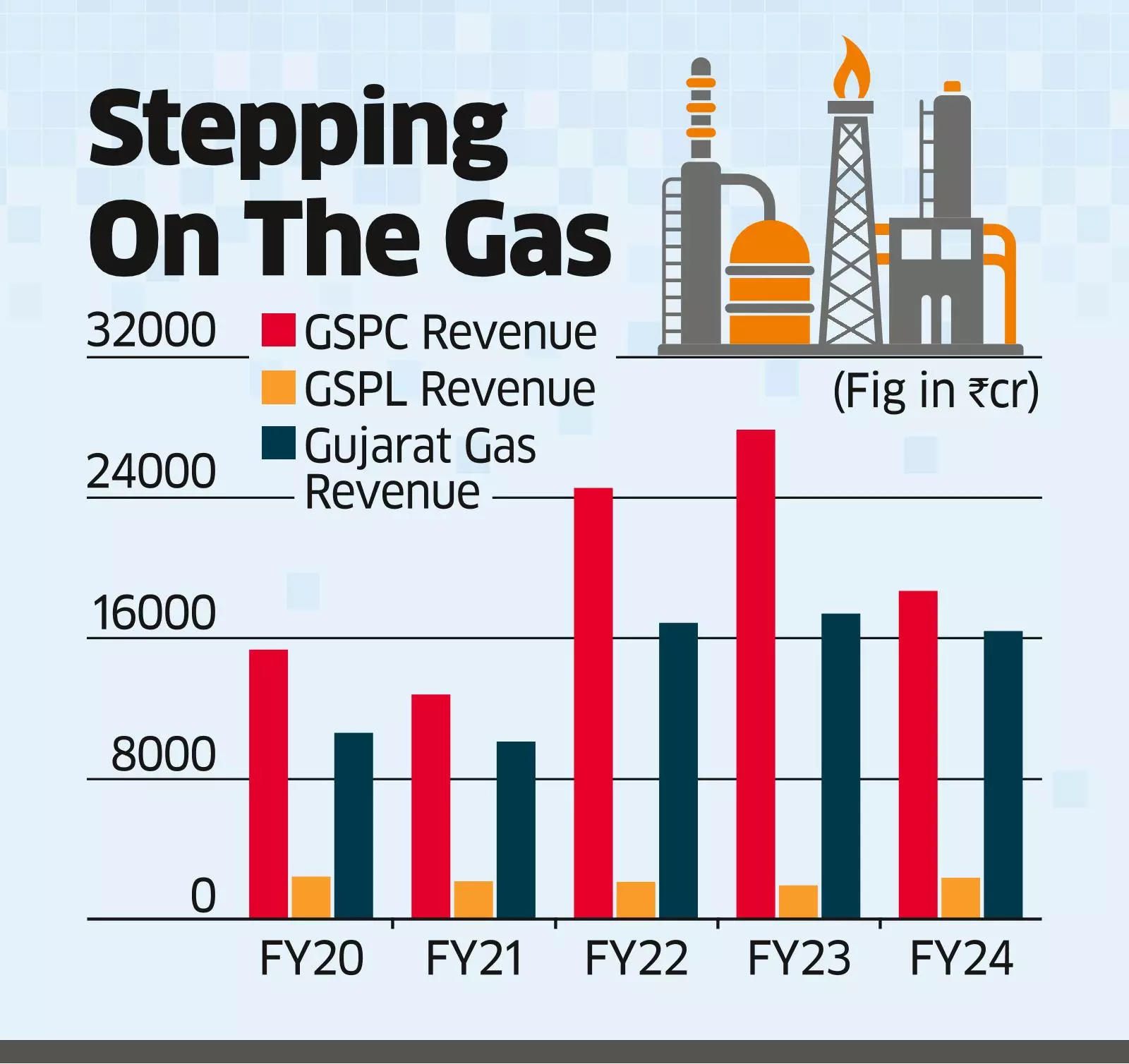

GSPC is involved in gas trading and exploration, with a significant portion of its operating profit derived from gas trading. In FY24, GSPC’s gas trading volume was 11 mmscmd.

Under the scheme of arrangement, investors will receive 10 shares of Gujarat Gas with a face value of ₹2 for every 13 shares held in GSPL with face value of ₹10. They will also get 10 shares of Gujarat Gas for every 305 shares held in GSPC with face value of ₹1. The arrangement will increase Gujarat Gas’s total outstanding shares to 938 million from the current 688 million, resulting in a 36% equity dilution.

Currently, the promoter’s stake in Gujarat Gas is 60.9%, which will decrease to 25.9% after the reverse merger, while the effective stake of the Gujarat government is approximately 18%. Other Gujarat government entities will hold 29% while the remainder will be with minority shareholders.

Following the proposed deal, GSPL’s transmission segment will be spun off into a separate listed entity. This move will eliminate layered structures and remove the Holdco discount associated with GSPL and Gujarat Gas. It will also eliminate related-party transactions, potentially improving Gujarat Gas’s operating profit, 18-20% of which currently is through the volume transferred from GSPC.

After the reverse merger, if Gujarat Gas shows capital trading profit in the city gas distribution (CGD) segment, it may result in a higher earnings before interest, tax, depreciation, and a mortisation (EBITDA) of around ₹6.5-7 per scm. Financially, Gujarat Gas will benefit from a lower tax rate due to accumulated losses of ₹7,200 crore over the next eight years. The pro forma valuation of all entities is estimated to be around ₹56,000-60,000 crore, translating to a per-share value of approximately ₹600-650 for Gujarat Gas.

Source: Economic Times