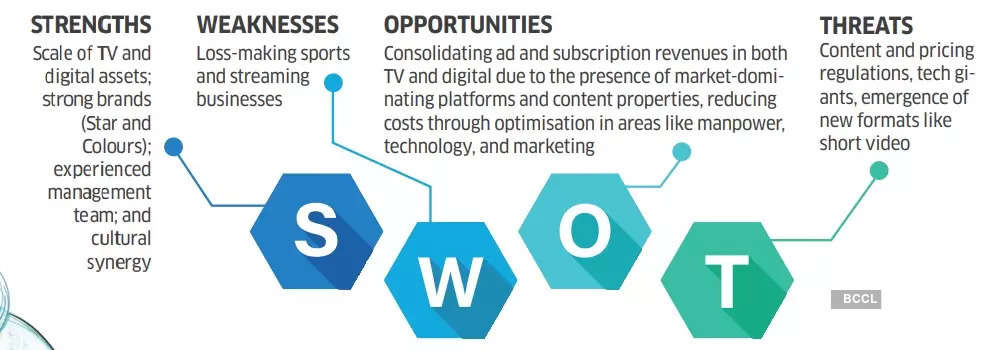

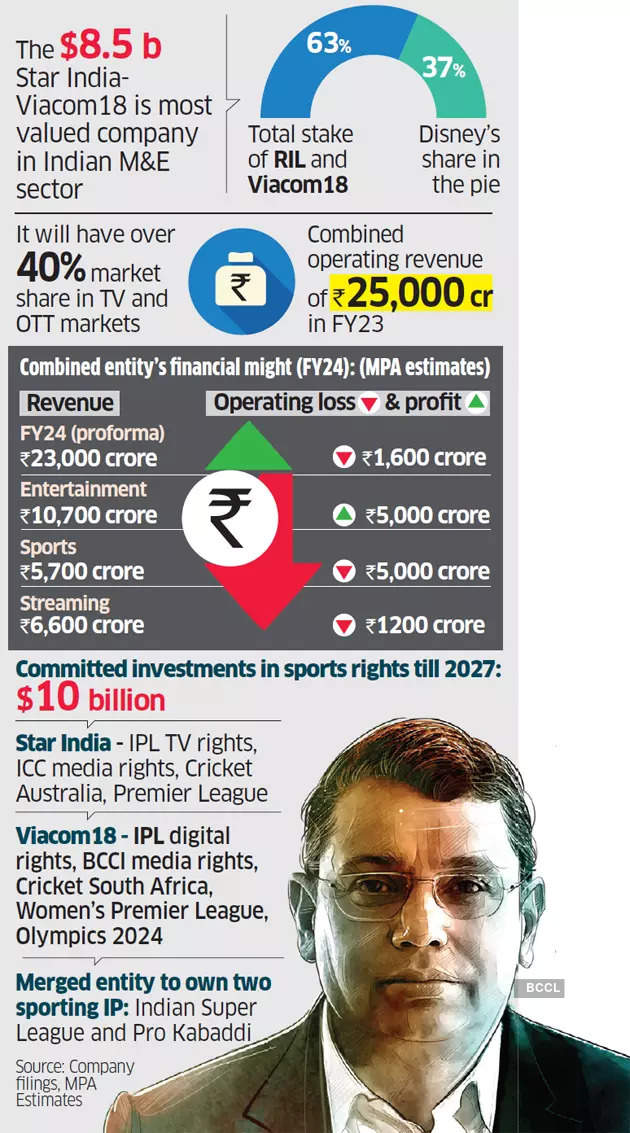

The $8.5 billion behemoth birthed by the merger of RIL’s Viacom18 and Walt Disney’s Star India is set to redefine media, entertainment and sports in India. With over 750 million viewers, 200,000-plus hours of content and all the key cricket properties under its belt, the new entity could very well change the rules of the game even globally. Javed Farooqui & Vinod Mahanta take a look at the reasons behind the merger, the opportunity at hand and the key players who could make it all happen.

In a video played at Anant Ambani and Radhika Merchant’s pre-wedding bash in Jamnagar last week, Reliance head honcho Mukesh Ambani, portraying Amitabh Bachchan’s iconic character in the 1978 hit Don, delivers a popular dialogue in a filmi way—“Hamari zindagi mein asli don ek hi thi, ek hi hain aur ek hi rahegi” — and walks away from the throne. Nita Ambani coolly takes over the throne, dons the black shades and effortlessly embodies the look of a boss. Well, the boss is now going to take over a new throne — at Star India-Viacom merged entity. Months after relinquishing her position on the board of Reliance Industries (RIL), Nita Ambani has taken on her first business role as the chairperson of the proposed Star IndiaViacom18 merged entity.

This transition not only marks her direct plunge into a sector close to the heart of her husband, but also underscores the Ambani dynasty’s continued focus on the media domain, exemplified by an investment of Rs 22,000 crore in Viacom18 and the imminent creation of the Star-Viacom18 behemoth in record time.

While Nita Ambani has been associated with sports, steering the ship for ventures like the IPL franchise Mumbai Indians and spearheading grassroots sports development through the Reliance Foundation (RF), her coronation as chairperson of the StarViacom18 juggernaut marks her grand debut into the glitzy world of media. She enters the arena as a formidable contender, poised to clash swords with Sony, Netflix and Amazon’s Prime Video.

Her ascension signals a significant change as she takes the reins of what promises to be India’s biggest media empire.

This comes after her appointment as the first Indian woman on the board of the International Olympic Committee. She has also been on the East India Hotels board for over a decade. In August 2023, she stepped down from RIL’s board to focus on RF.

Given the vast footprint of her media empire and her competitive nature, Nita Ambani’s mantra will surely be, “Don ko pakadna mushkil hi nahi, namumkin hai.”

Into the future: Disney’s case for merger with Viacom 18

When Disney completed the buyout of Star India in 2019, the asset held a lot of promise for the global media conglomerate thanks to strong television and digital assets.

Cut to 2022, a series of miscalculations happened starting with the $3 billion acquisition of IPL TV rights and the loss of IPL digital rights to competitor Viacom18 plus the ill-fated acquisition of the ICC media rights for $3 billion. It all contributed to the decline in valuation of India’s once most valuable media asset.

Star India, which once commanded over $15 billion in valuation, has seen its valuation plummet to over $3 billion due to the decline in subscriber base of Disney+ Hotstar due to IPL digital rights losses and the mounting losses from sports due to costly sports rights renewals.

The issues in India and the challenges in the US had led Disney, under Bob Iger, to reconsider the future of Star. The company opted for a joint venture with Reliance to mitigate losses in the Indian market, even at the cost of a decline in valuation.

Growing investor activism in the US after the share prices hit a nine-year low in August last year due to losses from the streaming business and declining profits from the TV business also forced Disney to hand over the reins of its India business to the country’s richest man.

It’s all about scale: Why Reliance found the perfect match in Disney

Mukesh Ambani’s love for scale and size is no secret. The chairman of retail-to-telecom conglomerate Reliance Industries had always aspired to build India’s largest media empire after taking control of Network18 from its erstwhile promoter, Raghav Bahl, in 2014.

Viacom18 became part of the Reliance empire after the Network18 acquisition. Reliance took a controlling stake in Viacom18 after buying out an additional 1% stake from Paramount Global (earlier Viacom) in 2018.

Reliance has always been concerned about Viacom18’s smaller size compared to Star, Zee, and Sony. Its quest for inorganic expansion first took it to Sony Pictures Entertainment’s India unit. However, the proposed merger was called off by Reliance due to differences over shareholding and valuation in 2020.

Following the collapse of the deal with Sony, Reliance toyed with the idea of merging Viacom18 with Zee. The deal had the blessings of Zee’s then-largest shareholder, Invesco, which was looking to recast the Zee board and oust Punit Goenka as CEO. Zee promoters rejected Reliance’s offer and instead opted for a deal with Sony, which also eventually failed after two years in January 2024.

After failing to conclude a deal with the second and third largest players, the Mukesh Ambanibacked company struck gold in its third attempt with the acquisition of market leader Star India, a treasured asset in India’s media industry. The Star-Viacom18 merger deal signed on February 28 will create an $8.5 billion media goliath with a dominating presence in both TV and digital segments.

The sweetener in the deal for Reliance is the $3 billion valuation at which Disney decided to merge Star India with Viacom18.

Months before Disney mega deal with Reliance Uday Shankar sat down for a chat with ET, and he had this to say about himself: “Meri story ki headline har din alag honi chahiye (Everyday there should be a new headline for my story).”

Providence has granted his wish many, many times over. The latest headline has him as vice-chairperson of India’s largest entertainment behemoth.

Ever since he left Disney-Star India in 2020, Shankar had shifted focus to his new obsession — digital. So much so that he even took out the TV in his room.

While digital will continue to be at the forefront of the merged entity’s agenda, he might have to get the TV back soon considering that the new entity runs over 100-plus TV channels.

As he provides strategic guidance to the Star-Viacom18 combine, Shankar’s biggest challenge will be to turn around the streaming and sports businesses considering the pay-TV business is in a chronic decline.

But that tells something about the journalist-turned-CEO-turned-investor-turned-vice chairperson. “My default mode is challenger,” Shankar told ET. “I get bored when there is no big challenge.”

Shankar grabbed global attention in 2017 with a stratospheric bet of Rs 16,348 crore for the IPL media rights for five years. And in another déjà vu moment, Shankar, this time for Mukesh Ambani’s Viacom18, bagged the digital rights of IPL for the Indian subcontinent for a very substantial Rs 23,758 crore. That was in 2022.

What has helped Shankar take bold bets has been his knack for cultivating successful partnerships with powerful promoters. Just like his current partnership with RIL chairman and managing director Mukesh Ambani. Before that, Shankar was firmly backed by Rupert Murdoch and his sons James and Lachlan while he built Star India into a media leader.

He started his career as a political reporter at The Times of India in the 1990s and went on to helm the newsroom at AajTak before captaining one of India’s most influential media enterprises Star India. In his decades in the media, Shankar has also been at the forefront of industry-related issues whether it was the implementation of cable TV digitisation, the creation of the Broadcast Audience Research Council or even teaming up with rivals to fight subscriber under-reporting by cable TV operators.

“I closely interacted with him when I was secretary of information and broadcasting during 2015-16,” said former bureaucrat and ex-chief election commissioner Sunil Arora. “In his capacity as president of FICCI’s Media and Entertainment Committee, he played a crucial role between the media and the establishment by offering constructive, frank, and useful inputs that had a broad bandwidth.” Key to Shankar’s success has been the ability to forge high-quality teams. At Star, this involved professionals from diverse backgrounds who have gone on to solid careers: Sanjay Gupta, who is now the India head of Google; Ajit Mohan, who heads Snap’s APAC operations; Nitin Kukreja, who is the CEO of Allen Career Institute; and Amit Chopra, currently with Samara Capital, among others.

“I don’t look at CVs; I like people with one breakout achievement,” he told ET.

After exiting Disney, Shankar wanted to dabble in healthcare and education. Looks like those sectors will have to wait.

Source: Economic Times