The race to buy the debt-laden SKS Power Generation has narrowed down to just four bidders – Reliance Industries, public-sector utility NTPC, Gujarat-based Torrent Power and Singapore-based Vantage Point Asset Management.

These companies have indicated their willingness to increase bids to what the company owes creditors.

Indicative bids from Nagpur-based Sarda Energy & Minerals, Delhi-based Jindal Power and the Adani Group are much lower and these bidders are no longer considered strong contenders to take over the plant, people familiar with the matter said.

“Although no one has pulled out officially, some bidders have informally expressed their inability to increase their initial bids, while NTPC, Torrent, Vantage and Reliance are still open to increasing their bids,” said a person familiar with the process. “Banks want to avoid a prolonged bidding war through a challenger process and hence are pushing bidders to settle all dues on a full cash basis, which will be a good outcome and is a high probability.”

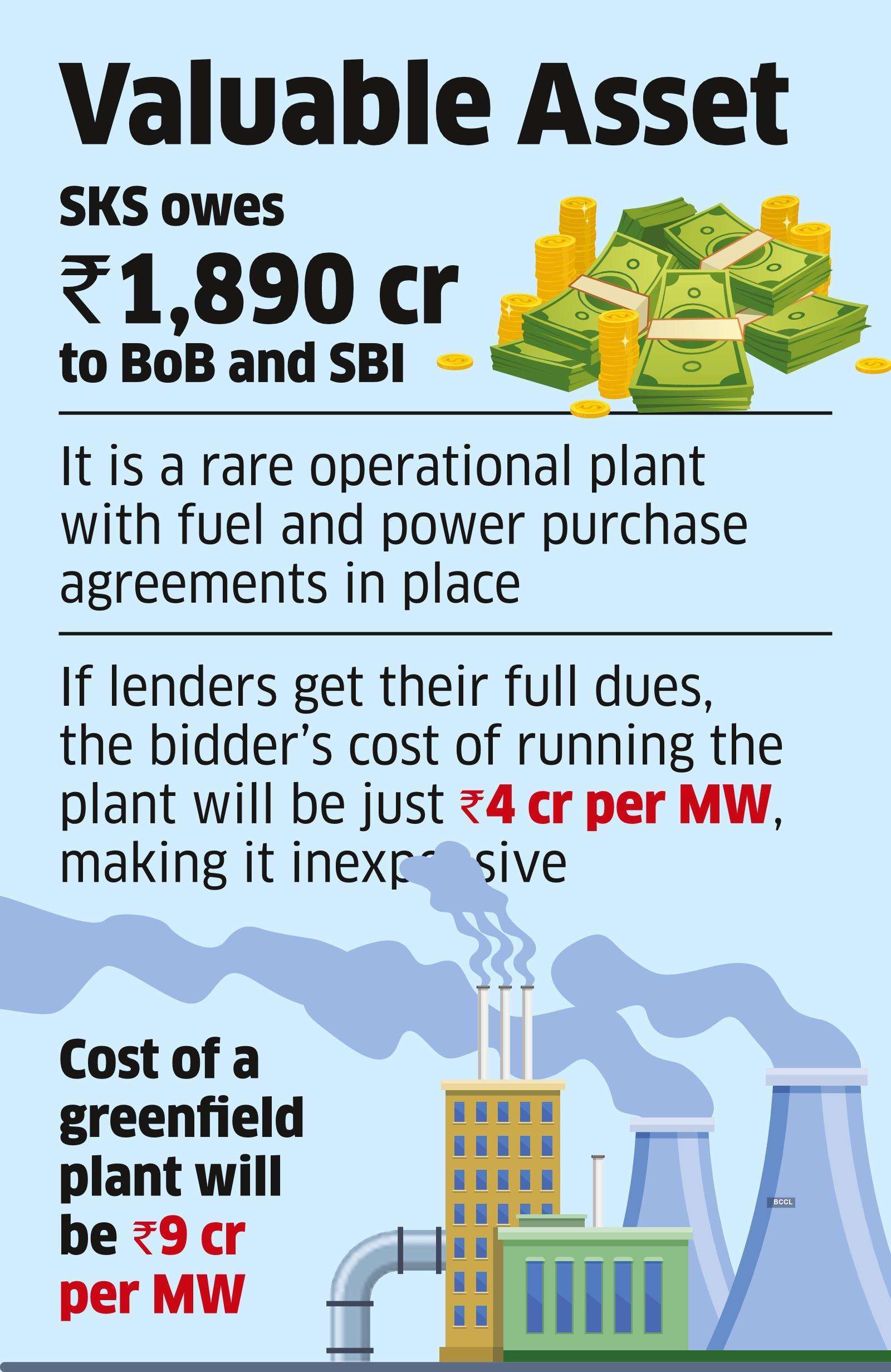

The corporate insolvency process for SKS was initiated in April 2022. The company owes ₹1,890 crore to two banks – Bank of Baroda and State Bank of India (SBI).

Bankers are confident of recovering all their dues because of the high demand for the plant.

It is a rare operational plant available for sale with a fuel agreement and power purchase agreements. More importantly, the asset is inexpensive because total costs, assuming lenders receive their full money, come to less than ₹4 crore per MW. That compares with ₹9 crore per MW required to build a similar plant today.

The plant has 25 years of fuel agreement with South Eastern Coalfields, a Coal India unit, with a railway line directly transporting coal to the plant – a rare facility.

“The bids are now in the final stages. Our estimation is that banks are getting close to receiving a full recovery. Jindal and Sarda had some facilities close to the plant and were considered strong contenders but both have indicated that they do not want to pay top dollars. The problems of Adani Group are well known, which means only four bidders remain in the race,” said a second person aware of the developments.

Process advisor BoB Capital Markets and resolution professional Ashish Rathi did not reply to an email seeking comment.

Rules say that any amount recovered above the dues of financial creditors has to go to operational creditors after adjusting for the costs. In this case, operational creditors have dues of more than ₹500 crore.

The plant is currently being run by NTPC following a government directive aimed at overcoming power shortages.

Lenders are confident that there will be some amount left for operational creditors even after taking care of their dues.

The 600-MW Chhattisgarh-based plant had stopped production after Hong Kong-listed owner Agritrade Resources failed to keep it running due to financial difficulties of its own.

Agritrade Resources bought the plant in 2019 in a one-time settlement with a group of lenders led by SBI.