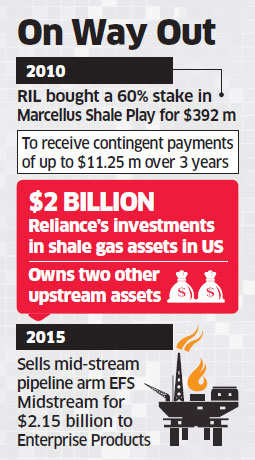

Energy major Reliance IndustriesBSE 1.53 % on Friday said it has entered into an agreement for the sale of its assets in the “Marcellus Shale Play” of northern and central Pennsylvania.

According to a BSE filing, Reliance Marcellus II, LLC, a subsidiary of Reliance Holding USA, Inc., and Reliance Industries has signed “agreements to divest all of its interests in certain upstream assets in north-eastern and central Pennsylvania”.

The filing said that assets, which are currently operated by Carrizo Oil and Gas, were sold to BKV Chelsea, an affiliate of Kalnin Ventures for a consideration of $126 million, subject to customary closing terms and conditions.

The filing said that assets, which are currently operated by Carrizo Oil and Gas, were sold to BKV Chelsea, an affiliate of Kalnin Ventures for a consideration of $126 million, subject to customary closing terms and conditions.

“Additionally, Reliance could receive contingent payments of up to $11.25 million in aggregate based on natural gas prices exceeding certain thresholds over the next three years,” the company said in a regulatory filing to the BSE.

“The assets produce mainly gas and are located in Susquehanna, Wyoming and Clearfield Counties of Pennsylvania.”

The company said the sale of assets will be consummated in accordance with the terms of a purchase and sale agreement, dated October 5, 2017, by and between Reliance and the buyer.

The transaction is anticipated to close by the end of the third quarter of FY2018.

Source: Economic Times