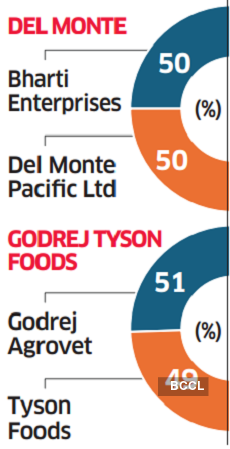

PE firm Samara Capital is in talks to acquire 50% in pasta and sauces maker Del Monte Foods from Bharti Enterprises as well as a minority stake in Yummiez frozen foods maker Godrej Tyson Foods, executives aware of the developments said.

The proposed deals reflect increasing investor interest in the ready-to-eat packaged foods categories, as convenience and accessibility drive aspirational demand of western-style foods even in tier-3 and 4 markets. On top of that, quick commerce and ecommerce are enabling impulse consumption and deeper reach. Both potential deals are expected to be housed in the new $150 million roll-up platform for packaged foods.

Samara had set up the platform along with a consortium of investors including Convergent Finance LLP, an investment management and advisory fund.

Such tuck-in platforms acquire a number of firms in the same line of business to boost product offerings and market access while gaining from synergies. Big companies or private equity firms use these platforms to acquire and merge multiple smaller businesses.

While Samara’s negotiations with Bharti Enterprises for Del Monte are at an advanced stage, talks with Godrej Agrovet for the Godrej Tyson Foods stake are preliminary, said the executives cited above.

Valuations for the proposed deals are still being discussed, they said. In FY23, Godrej Tyson Foods crossed Rs 1,000-crore sales milestone and posted Rs 13.20-crore profit before tax while Del Monte Foods reported revenues of Rs 536.36 crore and losses of Rs 15.2 crore.

Emails sent to offices of Samara Capital and Bharti Enterprises remained unanswered as of press time Thursday.

A Godrej Agrovet spokesperson said: “We do not comment on any speculative or forward-looking news or rumours… We do make and shall continue to make adequate disclosures to the stock exchanges as and when required.”

Godrej Tyson Foods is a joint venture between listed Godrej Agrovet (51%) and US-based Tyson Foods (49%).

Source: Reuters.com