State Bank of India (SBI) is seeking buyers for its distressed loans, and about a third of these are to the power sector. Some of these accounts include the Ruia-promoted Essar Power Gujarat, Anil Ambani’s Vidarbha Industries Power, KSK Mahanadi Power and Meenakshi Energy, three people aware of the development told ET. SBI circulated a list of 168 accounts among asset reconstruction companies and distressed-loan buyers last week.

These accounts totalled unpaid liabilities of Rs 31,363 crore, sources said. SBI did not respond to ET’s queries. Inordinate delays in debt resolution of the distressed companies in bankruptcy courts and a nudge from the government to provide additional loans to already distressed power companies have encouraged lenders to look at exit options.

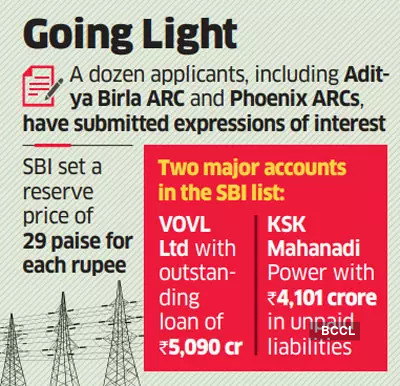

The two major accounts in the SBI list, reviewed by ET, are VOVL Ltd, an oil exploration company linked to Videocon industries with an outstanding loan of Rs 5,090 crore, and KSK Mahanadi Power, with Rs 4,101 crore in unpaid liabilities. “This is a preliminary list of large corporate accounts to gauge investors’ interest,” said a senior bank official. “In some of the accounts, the bank is in advanced talks with buyers.”

SBI has invited binding bids to sell its KSK Mahanadi Power loans on May 30, having postponed the deadline twice in the past. A dozen applicants, including Varde Capital-backed Aditya Birla ARC and Phoenix ARCs, submitted expressions of interest. The bank has set a reserve price of 29 paise for each rupee.

Other big-ticket power sector accounts are Essar Power Gujarat of Rs 1,240.5 crore, Vidarbha Industries Power of Rs 1,245 crore, Coastal Energen at Rs 1,531 crore and Meenakshi at Rs 1,312 crore.

Last month, state-run banks agreed to finance distressed power companies undergoing insolvency proceedings following a nudge from the Centre to help bridge power shortages.

Other power producers on the list include Wind World India (`992.8 crore), IL&FS Tamilnadu Power Co (`543 crore), and Bhadreshwar Vidyur Power (Rs 262 crore). It also includes several companies that lenders have identified for sale to the newly formed National Asset Reconstruction Company Ltd (NARCL) — a government promoted ARC.

These include accounts such as Jaypee Infratech, Mittal Corp and Consolidated Construction Consortium. The list also includes several road project companies.

SBI’s gross non-performing loans stood at Rs 112023 crore and restructured loan book stood at Rs 30,960 crore as on end March 2022.