Schneider Electric SE, the French industrial multinational and Eaton Corp have emerged as the top contenders to acquire Larsen & Toubro’ electric and automation division for Rs 15,000-Rs 17,000 crore as India’s largest engineering group looks to prune its portfolio and exit non-core areas, said three officials aware of the ongoing developments.

Schneider Electric has teamed up with Temasek, the Singapore’s state investment company for the buyout, while Eaton has re-engaged after their 2011 bilateral discussions with L&T, fell through. It is not clear yet if it will also form a consortium with a financial sponsor. Binding offers are expected by next month.

The two are believed to be far more serious than other potential suitors that included Siemens AG, Swedish- Swiss multinational ABB, Hitachi, Honeywell and few global buyout funds. According to one of the sources, Schneider is the more aggressive of the two and have given an indicative offer of Rs 17,000 crore but clarity on that will emerge once the binding bids are on table.

Spokespersons of Schneider, Temasek, Eaton Corporation and Larsen & Toubro all declined to comment on speculation and rumor.

However, L&T’s high valuation expectation may turn out to a deal breaker, even this time around, warned an official directly in the know. But company watchers feel prospects of a successful transaction are brighter this time around because the division’s plants have been segregated from the parent and real estate has been clearly demarcated at all the locations, thereby making it easy to value the assets.

Portfolio management

In case the discussions fail yet again, L&T may resort to an alternative strategy of shifting the division in a wholly owned subsidiary – it already has an enabling provision to do so — and will list it on Indian bourses, an official added.

“In FY17, L&T monetised its stake in its two key IT subs. This, together with the divestment of General Insurance business, helped the company to completely fund its investments in Nabha Power/ Hyderabad Metro in FY17. Even going forward, we anticipate investments to be limited to development businesses and consol capex to moderate to Rs30bn annually vs Rs 80bn over FY12-16,” said analysts Aditya Bhatia, Pratik Rangnekar and Veenit Prasad from Investec in their August report on the company.

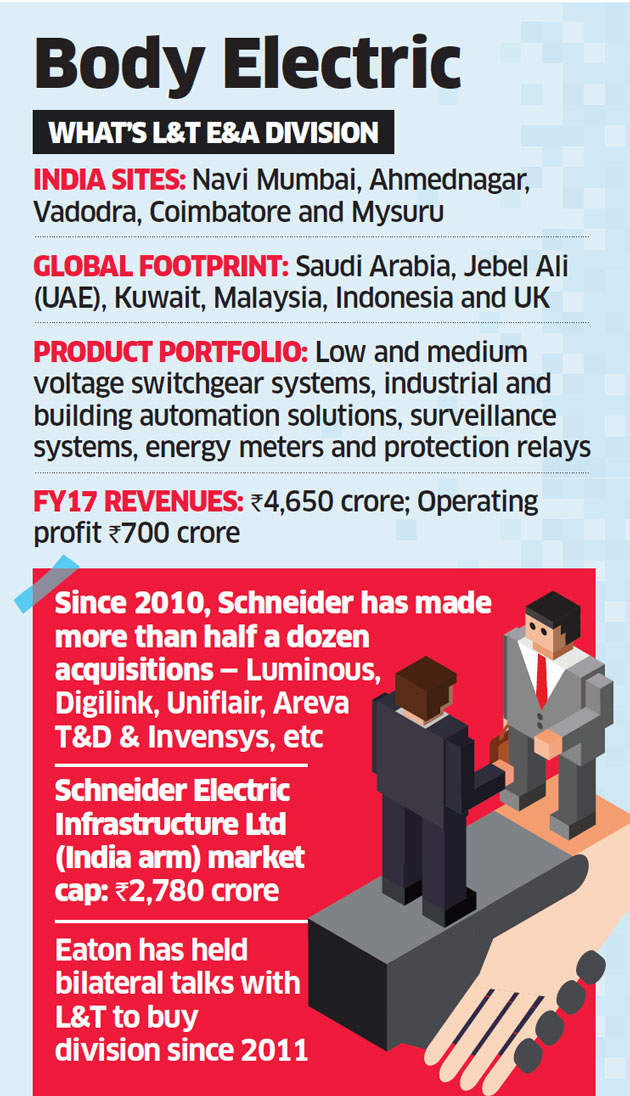

L&T’s electrical and automation business offers a wide range of products and solutions for electricity distribution and control in industries, utilities, infrastructure building and agriculture sectors. Its product portfolios include includes low and medium voltage switchgear systems, industrial and building automation solutions, surveillance systems, energy meters and protection relays and has manufacturing facilities at Navi Mumbai, Ahmednagar, Vadodara, Coimbatore and Mysuru in India as well as in Saudi Arabia, Jebel Ali (UAE), Kuwait, Malaysia, Indonesia and the UK.

The business runs six switchgear training centres across the country educating engineers, consultants, contractors, technicians and electricians about good electrical practices. Larsen & Toubro’s division generated revenues of Rs 4,650 crore and operating profit of a little over Rs 700 crore in 2016-17.

Eye on India

Compared to Schneider that has a listed Indian arm, Dublin headquartered Eaton has a small presence in India and have been looking at a bigger play, especially via L&T.

Interestingly, both ABB and Schneider are also believed to be competing with PE heavyweights KKR, Warburg Pincus and to acquire General Electric’s Industrial Solutions business for $3 billion. That global M&A is expected to be a key reason why ABB opted out from bidding aggressively for the L&T business.

Schneider Corporation that specialises in energy management and automation solutions, spanning hardware, software, and services Global industrial conglomerates has been aggressively expanding its footprint in Indian market. Since 2010 it has made more than half a dozen acquisition that include Luminous, Digilink, Uniflair, Areva T&D, and Invensys among others. Some of them are standalone acquisition some are parts of global deal.

But even for Schneider, which has a relatively small operation in India comparing to Siemens AG and ABB, the acquisition will help in making a strong player in one of the fastest growing markets that is far from saturation. Its Indian subsidiary Schneider Electric Infrastructure Limited in which it owns 75 per cent stake, has reported operating profit of Rs 67 crore on a turnover of Rs 1,288 crore, last fiscal. Its market cap is Rs 2,780 crore.

Most of the European conglomerates are facing headwinds in their home markets and a slowdown in China, once pegged as the single most important outpost for many. Indian economy that has been on a gradual rebound offers them a sweet spot, feel analysts.

More importantly, with a wide footprint, spanning across India, UAE and Saudi Arabia, a potential takeover will further consolidate their presence in several emerging geographies.

“L&T Ltd has 3 main companies housed in it – construction, heavy engineering which includes defence and the electric and automation division. Hydrocarbons is already a separate company with a separate P&L. Consolidation of portfolio is the stated goal so that Naik’s successor inherits a less sprawling and management portfolio. Since 2015, it is trying to also sell its valves business, said a company official on condition of anonymity.”

Source: Economic Times