Private equity firm SeaLink Capital Partners and the promoter of Surya Children’s Medicare are looking to sell a majority stake in western India’s largest children’s hospital chain, said people aware of the matter.

A deal is expected to value the company at ₹1,000-1,200 crore, the people said, adding investment bank JM Financial is running the sale process. Feelers have already been sent to global PE firms and leading hospital chains in India, the people said.

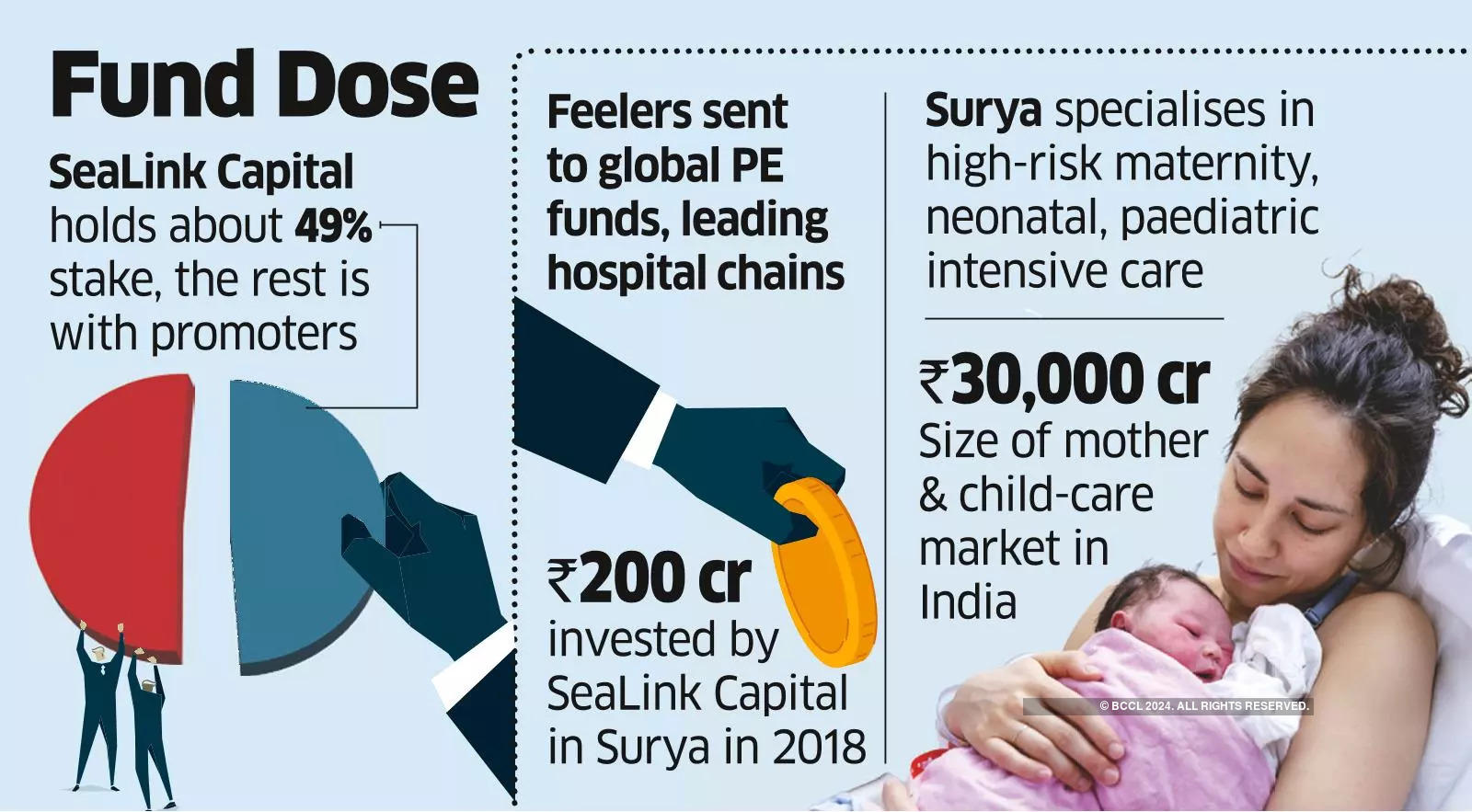

SeaLink Capital currently holds about 49% of Surya while the rest is with the promoter.

The people cited above said along with SeaLink Capital, Surya promoter Dr Bhupendra Avasthi plans to pare his holding in the company.

SeaLink Capital, a fund launched by former KKR & Co. executives Heramb Hajarnavis and Karthik Narayanswamy, invested ₹200 crore in Surya in 2018. Besides purchasing a stake held by OrbiMed, SeaLink had deployed primary capital in Surya.

SeaLink Capital, which runs a $315-million fund, is also an investor in NephroPlus, JM Financial, THB, and Ki Mobility.

Founded in 1983 by Dr Avasthi, Surya has a presence in Santacruz, and Chembur in Mumbai, Pune and Jaipur. It plans to open one more hospital in Pune. Surya specialises in high-risk maternity and neonatal and paediatric intensive care. It has India’s largest level 3 neonatal intensive care unit, and western India’s only national teaching institute for paediatric intensive care, according to the company’s website.

A SeaLink Capital spokesperson declined to comment, while Surya Children’s Medicare did not respond to ET’s queries.

The mother & childcare market in India is estimated at about ₹30,000 crore and is expected to grow 15% compounded annually over the next few years. The market is currently dominated by a handful of private hospitals such as Apollo Cradle, Hyderabad-based Rainbow Children’s Medicare, Bengaluru-based chains Motherhood, Cloudnine Hospitals and Kangaroo Care.

British International Investment Plc-backed Rainbow got listed in 2022 and has a market cap of ₹14,712 crore as of Wednesday. Motherhood is backed by TPG Growth and Singapore’s GIC, while Cloudnine is backed by True North, TPG Newquest, Temasek and Peak XV.

Large hospital chains and PE funds have been actively looking to tap healthcare opportunities in western India.

Recently, India’s second largest chain Manipal Hospitals entered Mumbai’s healthcare market with the acquisition of Khubchandani Hospital in Andheri for ₹415 crore. Manipal Hospitals entered Pune in 2022 through its acquisition of Columbia Asia Hospitals. It has two hospitals in Pune. Earlier in 2022, Canadian pension fund Ontario Teachers’ Pension Plan acquired Maharashtra’s largest hospital chain Sahyadri from PE fund Everstone.

Source: Economic Times