Sequoia Capital is weighing an exit from Ahmedabad-based La Renon Healthcare at a valuation of $1 billion, according to sources in the know.

Plans are still on the drawing board and the storied Silicon Valley venture capitalist (VC) may not necessarily follow through with them, the sources cautioned.

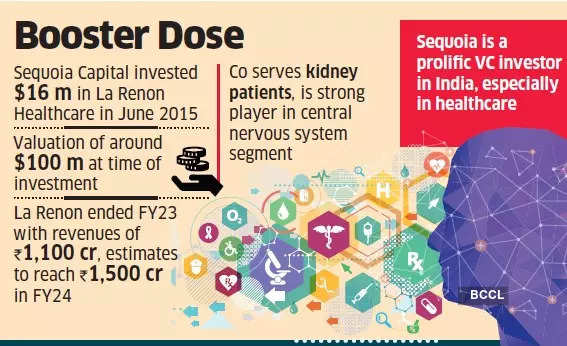

Menlo Park-headquartered Sequoia Capital had invested a sum of $16 million in Pankaj Singh-founded La Renon Healthcare in June 2015 at a valuation of around $100 million.

At $1-billion valuation, the VC firm, an early backer of tech giants such as Google and Apple, could clock a six- to eight-fold return on its investment after accounting for changes in its shareholding which possibly reduced over time, according to the sources.

In January 2021, A91 Partners, floated by former Sequoia Capital managing directors Abhay Pandey, VT Bharadwaj and Gautam Mago, pumped in $30 million into La Renon Healthcare at a valuation of $500 million.

It is learnt that Sequoia Capital and A91 Partners collectively own 20% stake in the company.

Sequoia Capital refused to comment when contacted. A91 Partners did not respond to requests for comment.

“The hugely successful listing of Mankind Pharma has demonstrated that healthcare continues to remain an attractive sector and that remains a trigger for investment activity,” an industry expert said.

La Renon ended FY23 with revenues of ‘1,100 crore and estimates to reach ‘1,500 crore in FY24.

Founded in 2007, La Renon serves kidney patients and is also a strong player in the central nervous system segment.

The company, which originally relied on contract manufacturers, has strategically moved towards backward integration through acquisition of 51% stake in active pharmaceutical ingredient maker EnaltecLabs last year. It has also entered the manufacturing of injectables and parenteral drugs through a controlling stake in RusomaHealthcare in the same year.

Sequoia Capital is a prolific venture capital investor in India, especially in healthcare. The company’s investments include Akumentis Healthcare, Cloudnine, Curatio Healthcare, HealthKart, Innovcare Lifesciences, Koye Pharma, Medgenome, Oncostem, Pristyn Care, Vasan Health Care, among others.

It had exited skincare company Curatio Healthcare by selling it to Torrent Pharma.

As per latest available Securities and Exchange Commission (SEC) filings in the US, Sequoia Capital has $53 billion in assets under management.

Source: Economic Times