Lenders of Asian Hotels (West) received seven expressions of interest, including from K Raheja Group entity, Devvrat Developers and Panchshil Corporate Park, said two people aware of the development.

The listed Asian Hotels (West), which operates Hotel Hyatt Regency near Mumbai airport, was admitted for corporate insolvency proceeding last September.

K Raheja Group’s entity Unique Estate Development submitted an EoI, while the other applicants include GVPR Engineers, Jindal Power, and two consortiums.

One consortium comprises Basab Bijara Paul, Savannah Lifestyle and Prema Investment Services. The other consortium is led by Mayank Welfare Society, Amaltas Hotel, Suresh Singh Bhadauria and Amaltas Resorts.

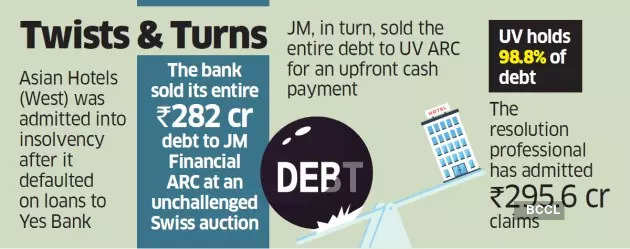

The resolution professional Sapan Mohan Garg, who admitted ₹295.6 crore financial creditors’ claim, did not respond to ET’s request for comment. UV Asset Reconstruction Company (ARC) holds 98.8% of the debt. Garg has extended the last date for submitting a resolution plan to April 7 from March 10.

“The resolution of Asian Hotels (West) has an element of mystery since Yes Bank first sold the loan to an ARC. The loan itself was traded twice, and now the terms of sale of the hotel are restrictive,” said an expert advising one of the Big Four consulting firms on the resolutions of distressed loans.

The offer document inviting EoIs stated that the prospective resolution applicant should be willing to provide about ₹200 crore as interim finance to restart the company’s operations at a rate not exceeding State Bank of India’s 12-month MCLR (marginal cost of fund-based lending rate). SBI’s MCLR stands at 8.4%.

“Interest rate charged on interim finance to a defaulting company is pegged at high teens worldwide since it is high-risk exposure. Thus, fixing it at the prime lending rate of a bank will dissuade bidders,” the person cited above said.

Not only should the applicant be committed to providing the interim finance at any stage of the resolution process, but it should also provide proof of funds ‘evidencing availability of liquid funds’ along with their EoIs, the offer document stated.

Interestingly, Asian Hotels (West) debt has seen a series of transactions in the last few months. Yes Bank, the sole banker, sold its entire ₹282 crore debt for upfront cash at an unchallenged Swiss auction to JM Financial ARC in June 2022. Most ARCs told ET that they were not aware that Yes Bank had proposed a Swiss auction to sell the loans.

The NCLT admitted the hotel to corporate insolvency in September 2022. Within three months, JM Financial ARC sold the entire debt to UV ARC for an upfront cash payment. Unlike banks, which mandatorily hold an auction to sell distressed loans, ARCs can undertake bilateral transactions while selling loans to another ARC.

Asian Hotels (West) has a subsidiary, Aria Hotels and Consultancy Services which runs JW Marriott Hotel at Aerocity in New Delhi.

In June 2021, Asian Hotels (West) stated that it shut down the Hyatt Regency Hotel in Mumbai because Yes Bank, which maintains an account, had blocked it and held back all funds. The bank had blocked the account after the company defaulted on payments and took possession of Hyatt Regency building in September 2021.

Source: Economic Times