Shriram Group has revived plans to restructure its various financial services businesses that includes lending and insurance by collapsing its two listed units into one and reverse merging the holding company into it, while spinning out insurance into a separate entity, said multiple people aware of the developments. The group however denied any such development, calling it speculation.

Morgan Stanley and ICICI Securities are advising Shriram Capital, the unlisted holding company of the group. The proposed reorganisation, if approved by a majority of minority shareholders and regulators, will lead to a simplified corporate structure and allow its investors— billionaire Ajay Piramal and TPG Capital —an exit from the privately held entity.

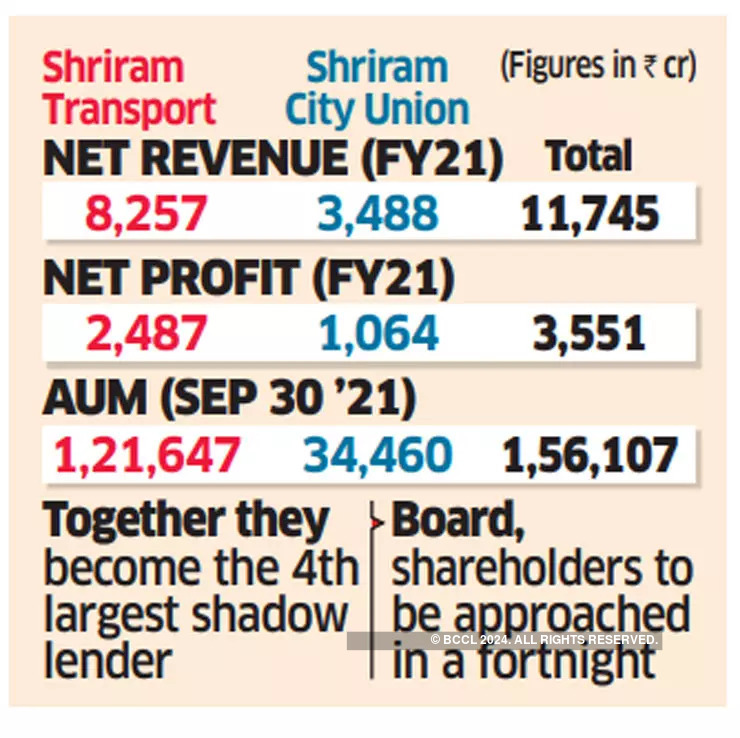

Piramal Enterprises Ltd., which bought TPG’s stake in Shriram’s transport finance unit in 2013, tried and failed to combine the Chennai-based group with IDFC Ltd. more than two years ago. The merged lending entity will also have Rs1.5 lakh crore of assets under management, making it among the top five shadow lenders in the country.

The group, headed by patriarch R Thyagarajan, is expected to approach the respective boards and shareholders in the next fortnight.

MERGER CONTOURS

Under the composite scheme that is being considered, two listed companies, Shriram Transport Finance Co.(STFC) and Shriram City Union Finance Ltd (SCUF) are to get merged. Shiram Capital owns a quarter of STFC, which has a market capitalisation of Rs 44,726.94 crore, while it owns 34.6% of SCUF, whose current market capitalisation is Rs 14,314.15 crore.

Shriram Transport is a leading financier of new and pre-owned trucks. Shriram City Union, is a non-bank finance company that gives loans for consumer goods, gold and motorcycles, where it is a market leader.

Once the merger between the two listed companies takes place, Shriram Capital is likely to get reverse merged into the new combined listed entity. Shriram Capital is being valued at Rs 25,000 -28,000 crore, said sources within the group on condition of anonymity as the talks are in private domain. Shriram Ownership Trust and Shriwell Trusts together own 42.9% of the unlisted Shriram Capital; Sanlam Group has a 26% stake, while the Piramal Group has 20%. TPG Capital owns 9.4% and individuals own the residual 1.7% as on March 2021, according to Crisil.

Shriram Capital also houses its life and general insurance businesses, a 77:23 JV with South Africa’s Sanlam Group. As part of the overall group amalgamation process, the insurance venture is expected to be spun out or demerged into a separate unlisted company. The reason, explain sources, is RBI’s discomfort about listed shadow banks owning stakes of over 50% in insurance businesses and was one of the reasons why the Shriram merger plan was called off last year. For example, in the past, the regulator had given a conditional nod for the merger between Apollo Munich Health Insurance and HDFC Ergo, subject to parent HDFC Ltd’s stake in the merged company not exceeding 50%.

“The Shriram Group denies all such speculations. These are nothing but speculations based on old discussions, now resurfacing. We will formally communicate to all stakeholders if, at any stage, the group decides to restructure its holding/operations,” Shriram Group’s spokesperson Ravi Subramanian told ET when inquired about the merger plans.

The sources cited warned that the contours of the merger is yet to be voted upon and no final decision has yet been reached. Bloomberg was the first to report about the impending merger on Monday evening.

CHALLENGES AHEAD

Analysts feel, subject to the final valuation of the unlisted Shriram Capital, Shriram Group’s shareholding in the merged entity may fall to as low as 17-18% while some others believe it will be in the 24-26% range. This will be crucial as it will impact credit rating and its cost of borrowing, a key component for any financial services player. Who will lead the merged entity is another issue that needs clarity. The group linkages are several. For example, general insurance is heavily reliant on the group’s two lending businesses.

“A lot of factors will depend on the holding company discount. There are only around 7% shareholders in the two listed companies STFC and SCUF that are common. Minority investors may not bless this merger which also might end up having high tax incidence,” said the head of research of a leading brokerage company.

“Merger overhang clearly remains a constraint for any meaningful expansion in multiples and further re-rating will be contingent on clarity around merger,” believes Amit Nanavati of Nomura even as the companies have navigated the Covid disruptions well.

The asset quality of Shriram’s lending arms took a heavy toll during the pandemic but has been recovering in recent quarters. STFC’s net profit rose by 13% on year for the second quarter of FY22 as provisions were almost back to normal levels after rising sharply in the first quarter of the current financial year. The growth in assets under management in the pre-owned vehicle segment was 13% on year, similar to that achieved for the first quarter of FY22. The company has so far restructured loans worth Rs 11, 600 crore, or 1% of total AUM under the Covid-19 resolution plan.

“Investors seem to be concerned about the slowdown in economic activity, which could impact the asset quality outlook for SHTF. However, we believe its current valuation is still reasonable and the stock has the potential to rerate as we expect its ROE to improve over FY22-23,” said Punit Srivastava of Daiwa Securities.

Shriram City Union Finance also reported a 10% year-on-year (y-o-y) increase in second-quarter standalone net profit at Rs 282 crore, against Rs 257 crore in the year-ago quarter.

“Events over the past two years have tested SCUF’s resilience, particularly given its reliance on the self-employed segment. The company responded by going slow on growth and recalibrating collection strategies to navigate the tough environment,” argued Prakhar Agarwal of Edelweiss. “SCUF surpassed estimates on sharper recovery trends. Asset stress, despite uncertainties, was managed well, with gross stage-3 now at 6.9%. This coupled with limited restructuring and low ECLGS disbursement lends comfort. Business momentum has also picked up significantly.”

Source: Economic Times