MUMBAI: City-based mid-market focused investment bank Singhi Advisors has picked up minority stakes in four companies across sectors by converting potential fee income into sweat equity, partnering with growth risk and thus carving out a niche model in investment advisory in the country.

The 25-year-old investment bank has picked up stake in big bull Rakesh Jhunjhunwala-backed John Energy for providing strategic, financial and M&A advisory services. It is in advanced discussions to acquire 5-15% in close to 10-12 companies including an E&P service provider company, security surveillance company, a specialty chemical company and an early stage FMCG company, managing director Mahesh Singhi told ET.

The company has set up a board, consisting of MD of petrochemical major Borouge India -PR Singhvi, erstwhile owners of Ambuja Cement’s family office head – Sanjay Kothari, senior executive at Godrej, Bajaj & FMCG expert Jimmy Anklesaria, former Unilever senior executive Michael Parkinson, country head of Rockwood Lithium & ex Clariant – Siddhan Subramanian, and former head of diversified Jumbo group -Prakash Nene, to help it effectively build the strategy.

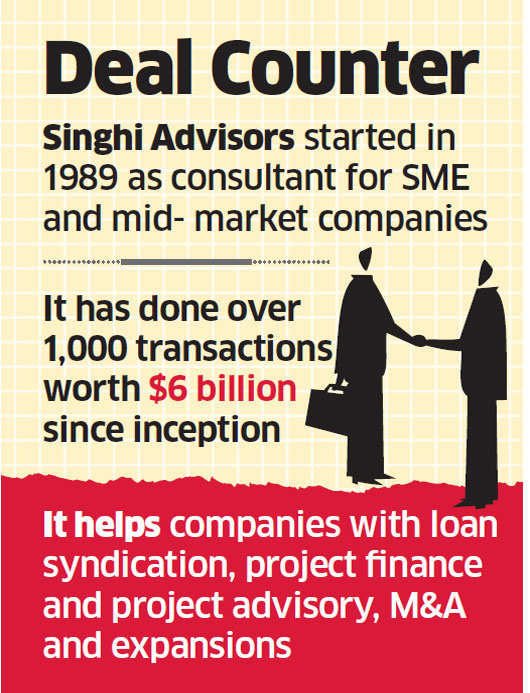

Mahesh Singhi, an engineer by education, started operations in 1989 from a “one-table one-bedroom” workplace in Mumbai, Bhandup, as a project consultant for small-time businessmen and first-time entrepreneurs setting up factories.

According to analysts, acquiring shares instead of taking fee shows the confidence of the business model and is an increasing trend. “It’s re-investing capital in the company itself. Experienced bankers, advising midsized firms can easily identify the growth potential and instead of taking a negligible fee, the equity structure would give them larger upside,” said Satish Modh, director of VES Institute of Management, Mumbai.