Singapore Telecommunications Limited, commonly known as Singtel, has initiated talks with Bharti Airtel chairman Sunil Mittal to sell a small part of its holding in the Indian telco to the Mittal family, said people familiar with the matter.

Singtel and the Mittal family are shareholders in Bharti Telecom, a promoter company of Bharti Airtel. In addition, both own shares directly in Bharti Airtel. While the exact quantum and details of the transaction have not yet been worked out, people in the know said the Singapore company could sell stake worth $1-2 billion to the Indian promoter through a mix of Bharti Telecom and Bharti Airtel share sales.

As on Wednesday, the market capitalisation of Bharti Airtel is Rs 3.78 lakh crore. Selling Bharti Airtel shares worth $1 billion would reduce Singtel’s holding by close to 2% to less than 30% while divesting shares worth $2 billion would reduce Singtel’s holding by 4%.

These people said Singtel as part of its portfolio management strategy was keen to book some profit by selling Bharti shares and redeploy some of the capital in new investment opportunities. The Airtel stock has appreciated 33% in the last one year although it is down from its high of Rs 781.80 last November 24. Bharti Airtel’s stock ended Wednesday at Rs 688.35, up 1.41% from the previous day’s closing.

Emailed queries sent to Bharti Airtel, Singtel, and Mittal on Wednesday remained unanswered till press time. Singtel, in response to a separate query on whether it was looking to sell a part of its holding in the Indian telco through a block deal had earlier this week said Bharti Airtel remained a core investment in its international portfolio.

“We’ve been strategic investors in Airtel for decades and it remains a core investment in our international portfolio. We have not hired a bank to explore such a sale and we will not comment on any market speculation. We abide by market disclosure rules to report all material transactions,” said a Singtel spokesperson on Monday.

At an investor call last week, Bharti Airtel CEO Gopal Vittal had declined to comment on a question from an analyst on “fresh market rumours” around an Airtel promoter entity mulling a stake sale. “This was a shareholder matter that is best directed to them,” he said.

Singtel will announce its quarterly results on Friday.

A LONG PARTNERSHIP

Singtel has been a shareholder in Bharti Airtel since 2000. The Mittal family and Singtel own 50.56% and 49.44%, respectively, in Bharti Telecom, which in turn holds a 35.85% stake in Bharti Airtel. In addition, Singtel and the Mittal family through investment companies directly hold 14% and 6.04% in the telco. The effective shareholding of the Mittal family in Bharti Airtel is 24.13% while that of Singtel is 31.72%.

JEWEL IN THE CROWN

In February this year, Singtel Group chief executive Kuan Moon Yuen described the Indian telco as a bright spot in his company’s business.

However, as part of a ‘strategic reset’, people aware of the situation said Singtel is stepping up its investment plans in digital service companies — financial services, streaming and gaming — across Southeast Asia, as it attempts to seize opportunities in the region after the Covid-19 pandemic weighed on its traditional mobile carrier business.

It has already begun investing in new-age companies, cherry-picking a 40% stake in a digital banking joint venture with Singapore’s Grab, which has received a licence to operate in Singapore. Other focus areas announced by the company include 5G telecommunications and business-to-business services for governments and enterprises.

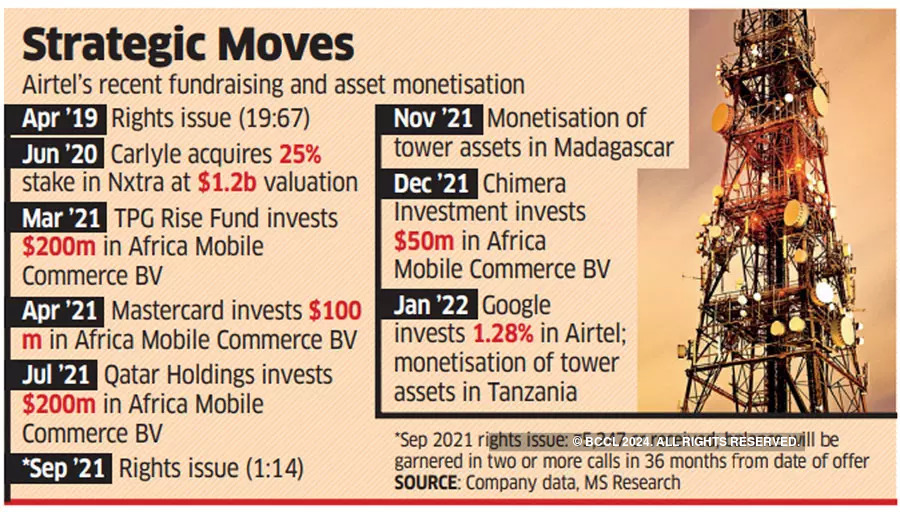

Last October, Airtel had raised around Rs 5,247 crore as the first tranche of its Rs 21,000 crore rights issue. The balance Rs 15,753 crore will be garnered once the telco decides to make the two additional calls. Analysts estimate that Airtel’s rights issue requires its promoters, Singtel and Bharti Enterprises of the Mittal family, to contribute around Rs 6,661 crore and Rs 5,067 crore, respectively.

In 2019, Singtel bought $525 million worth of shares in Airtel, which was in the midst of a fund-raising spree to boost its balance sheet amidst the need to make statutory payments and invest in its network to better take on moneyed rival Reliance Jio.

Airtel has taken strides to improve its balance sheet by raising capital and monetizing assets. It has reduced its net debt to EBITDA ratio from a peak of 4.5x in F19 to 3.0x in F22,” said Morgan Stanley analyst Gaurav Rateria. “Unlike in the previous cycle, when competition and a new capex cycle coincided, this time Airtel is well positioned to absorb the incremental investments related to 5G without compromising its balance sheet strength.”