More small finance banks, that began operations less than a decade ago, may explore mergers either with competitors, non-bank lenders or financial technology companies as they look to achieve economies of scale faster and diversify their product bouquet.

AU Small Finance Bank’s move to acquire Fincare Small Finance Bank may encourage others to explore inorganic opportunities, industry captains believe, as bigger balance sheets would put them on a stronger platform to take on their bulge-bracket rivals, especially when it comes to mobilising public deposits.

“A good bank-good bank merger is happening in the banking industry after 10 years. It’s a rare occurrence in the industry and the first time in the small finance banking sector. This does open up thinking about more such activities. Ultimately it’s up to those players to decide what they will do but I am sure more people will evaluate such options,” Fincare managing director Rajiv Yadav said.

The small finance bank (SFB) space is turning hot with two back-to-back mergers. Fintech unicorn Slice’s acquisition of North East Small Finance Bank also reflects the regulatory comfort about such deals and opens up a new vista of mergers and acquisitions (M&As). The AU-Fincare deal is awaiting regulatory approvals.

AU’s decision to acquire Fincare would provide it with a foothold in the microfinance business, a vertical which is to date absent in its product bouquet. It would also provide the Jaipur-based lender a stronger foothold in southern India where it has merely 2% of its branches.

“The two SFBs saw merit in combining and some others may explore based on opportunities,” said Suryoday Small Finance Bank managing director R Baskar Babu.

A bigger balance sheet would help these banks seek a universal banking license which would allow them more flexibility in capital allocation and lending business.

After completion of five-to-six years of business, SFBs are eligible for a universal bank licence. But this is a minimum qualifying condition. “This does not necessarily mean that they have reached the size, scale and quality of services needed for the licence,” said Yadav.

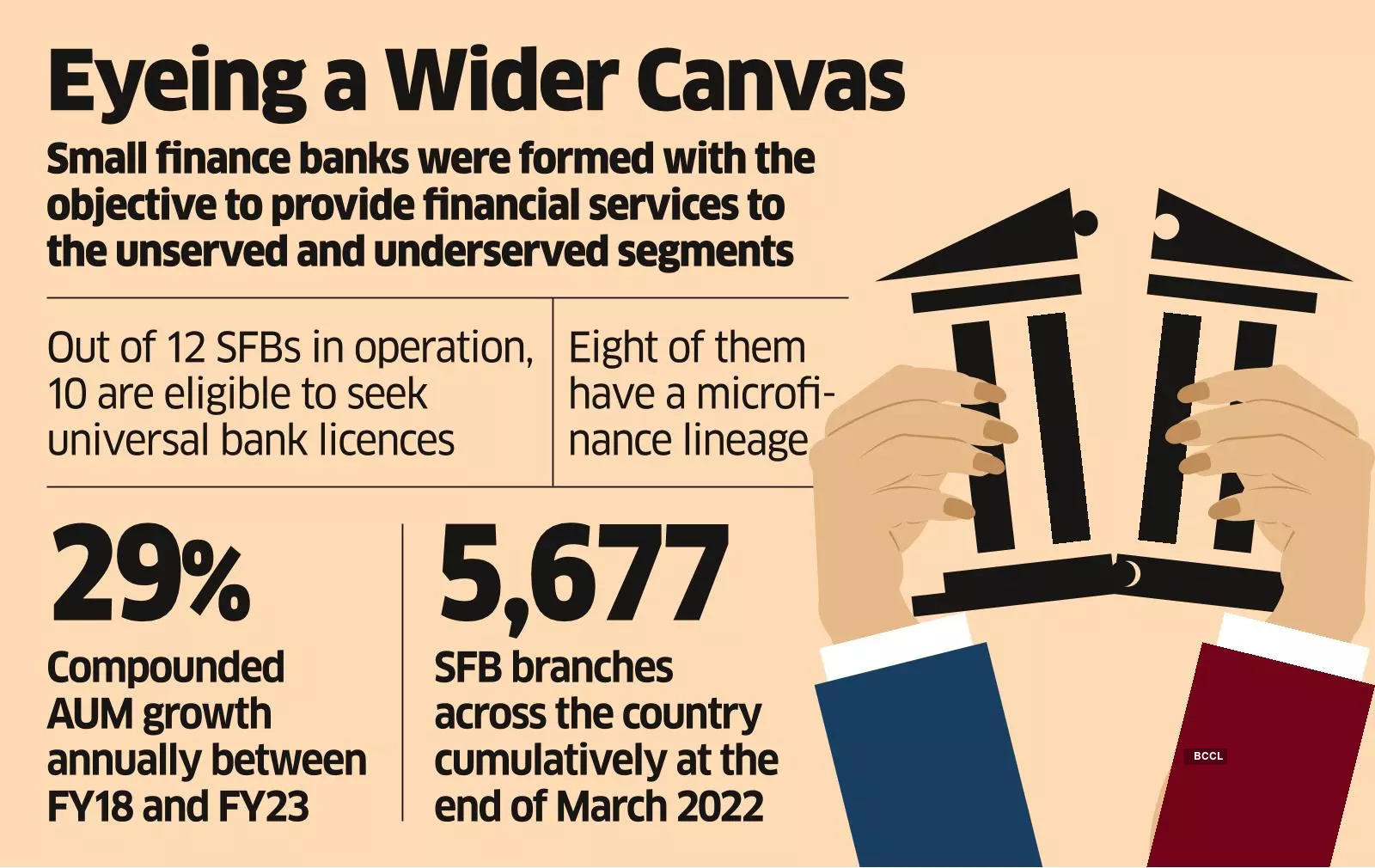

Small finance banks’ assets under management clocked a 29% compounded annual growth rate between FY18 and FY23, data from Crisil showed.

Two years ago, it was believed that non-bank lender Clix Capital was exploring the possibility of a merger with Suryoday. The management of Suryoday had denied but had said that it “continues to explore and evaluate various opportunities or associations in the interest of the bank”.

The objective of such differentiated banking was to provide savings instruments to the unserved and underserved segment of the population. Out of the 10 small finance bank licences, eight were awarded to microfinance lenders.

Currently, there are 12 SFBs in India and eight of these lenders have a microfinance lineage.

“I am a strong believer that in the unbanked and underbanked space, a far greater number of SFBs can survive and thrive. This is not a numbers game. The merger will be all about strategic options, strategic thinking and about getting various benefits that may be derived,” Yadav said.