The Shapoorji Pallonji (SP) Group, the single largest shareholder of Tata Sons, is in talks to raise $1.75 billion by pledging the remaining half of its stake in the unlisted holding company of the Tata Group, said people with knowledge of the matter. The SP Group is looking to repay part of its debt obligations and infuse cash into its operating companies, they said.

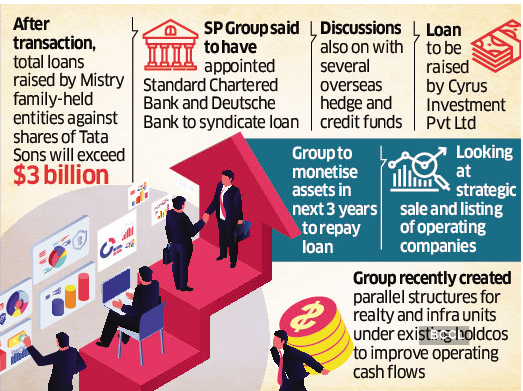

The group has already pledged close to 9% of its 18.37% stake in Tata Sons. After this latest transaction, the entire stake, currently valued at close to ₹94,000 crore, will be pledged to lenders including two foreign banks and several overseas hedge and credit funds. The zero-coupon payment-in-kind (PIK) loan will be raised by Cyrus Investment Pvt Ltd (CIPL), a Mistry family entity, and will be repaid at a pre-agreed value at the end of the maturity, which is expected to be around three years.

“The group has appointed Standard Chartered Bank (SCB) and Deutsche Bank (DB), both of which are its long-term relationship banks, to syndicate the loan,” said one of the persons. “Apart from SCB and DB, other lenders are in discussions to participate in the transaction.” They include foreign hedge funds Cerberus Capital Management, Ares SSG, Oaktree Capital, Davidson Kempner Capital Management and Ontario Municipal Employees Retirement System, (OMERS), a Canadian public pension fund, the person said. The SP Group, Cerberus Capital and Davidson Kempner didn’t respond to queries. SCB, DB, OMERS, Oaktree and Ares SSG declined to comment.

“With this, the total value of the loans raised by Mistry family-held entities against shares of Tata Sons will exceed $3 billion,” said a second person. “The group has already raised around $1.6 billion from various lenders from 2021 onwards and it has repayments maturing to the tune of $750 million by end of current year.”

According to bankers privy to the ongoing talks, the SP Group, which is largely privately held by the Mistry family, will use part of the funds to infuse cash in its operating companies.

Stake Sales on Cards

These will be monetised via stake sales to financial and strategic investors as well as public market listings, they said.

Founded by Pallonji Mistry in 1865, the SP Group is one of India’s oldest diversified industrial conglomerates and has presence across sectors such as real estate, construction, infrastructure, solar power generation and allied services for the oil and gas sector among others.

The group has recently created parallel structures for its real estate and infrastructure units under its existing holding companies to improve operating cash flows. The group has had close ties with the Tata Group in the past but relations soured after the late Cyrus Mistry was ousted as chairman of Tata Sons in 2016. The two sides fought a bitter courtroom battle, which went in favour of the Tata Group.

Source: Economic Times