The government is speeding up plans to auction 4G spectrum worth more than ₹4 lakh crore, said a senior government official. An inter-ministerial note being drafted is likely to be presented to the Cabinet as early as next month, the person said.

Bharti Airtel and Reliance Jio Infocomm, India’s top two telcos, have been pushing for an early 4G spectrum sale given the surge in demand for data and voice services, and to buy back airwaves in circles where their permits are expiring next year. The government, in turn, requires the auction proceeds to meet spiralling expenditure needs amid the Covid-19 crisis that has hit revenue.

“The draft will most likely head for inter-ministerial consultations and then the Cabinet next month. The dates for the auctions will be fixed after those approvals come in,” said the official.

Another official said both Airtel and Jio have “unofficially intimated” to Department of Telecommunications that they need the airwaves as soon as possible. The telcos did not respond to queries.

Govt may Not Meet Targeted Mopup from Sector

DoT has already taken a call to split spectrum auctions — 4G airwaves later this year and 5G bandwidth in asubsequent sale, probably in 2021.

The 4G airwaves in the 700 Mhz, 800 Mhz, 900 Mhz, 1800 Mhz, 2100 Mhz, 2300 Mhz and 2500 Mhz bands will go on the block first. DoT has earmarked the 3300-3600 Mhz band for 5G. The 4G bands on offer, especially 700 Mhz and 800 Mhz, can also be used for next-generation 5G technology at a later stage once that ecosystem develops, experts said.

Rating firm ICRA said that even without the 5G band, the government will offer 2,475 Mhz of spectrum, valued at Rs 4.35 lakh crore at base price.

STIFF FIGHT UNLIKELY

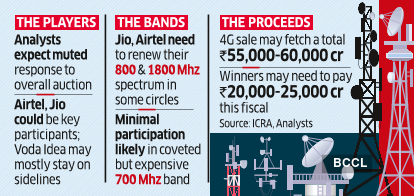

Analysts don’t expect the next sale to see stiff competition given the overall financial stress in the industry compounded by high debt levels of over Rs 7 lakh crore. Cashstrapped Vodafone Idea is unlikely to take a significant part given its financial troubles.

The government may generate around Rs 55,000-60,000 crore, of which the telcos would need to pay around Rs 20,000-25,000 crore upfront while the balance will be paid over 16 years, said Ankit Jain, assistant vice president, corporate ratings, ICRA.

“The top two telcos (Airtel and Jio) will be interested in 4G spectrum as it will help them ease capacity constraints in some pockets,” said Rajiv Sharma, head of research at SBICap Securities. “We do not see Voda Idea adding more spectrum given balance sheet constraints.” Jain said the telcos will focus mainly on renewing spectrum in the 800 Mhz and 1,800 Mhz bands, with “minimal participation” expected in the 700 Mhz band.

TELCOS’ PLAY

Jio needs to buy back Reliance Communications’ 800 Mhz spectrum permits that are expiring in 18 circles in July-August 2021. Jio currently uses these premium 4G airwaves via a sharing pact with RCom.

Airtel is expected to bid for the 1,800 Mhz spectrum band that it will lose rights over in some markets by 2021 and also selectively load up on some 4G airwaves in urban circles, said analysts. Speaking at its recent fourth-quarter earnings call, Airtel CEO for India and South Asia Gopal Vittal said the carrier needs to improve its 4G airwave holdings by adding pan-India sub-GHz spectrum, or those in the 700 Mhz, 800 Mhz and 900 Mhz bands. He pointed to gaps in key challenger markets such as Kerala, UP-West and Haryana.

Permits of Vodafone Idea in eight circles are also set to expire in 2021, but it has adequate back-up airwaves following the merger of Vodafone India and Idea Cellular, analysts added.

ICRA said that with only Rs 20,000-25,000 crore expected in upfront payments from spectrum this financial year, and another Rs 20,000 crore from regular receipts — licence fees and spectrum usage charges — the government is likely to fall short of its budgeted estimate of Rs 1.33 lakh crore as non-tax receipts from the sector.

Source: Economic Times