Online food delivery start-up Swiggy (Bundl Technologies Pvt. Ltd) Tuesday said it has raised $80 million in a Series E funding round led by South African media company Naspers Ltd. The fresh funds could help the company gain financial edge over rival Zomato Media Pvt. Ltd.

Existing investors Accel Partners, SAIF Partners, Bessemer Venture Partners, Harmony Partners and Norwest Venture Partners also participated in the funding round.

Mint reported on 27 March that Swiggy is in talks to raise at least $50 million from Naspers and existing investors.

The company plans to make significant investments in technology, including automation, data sciences, machine learning, and personalization.

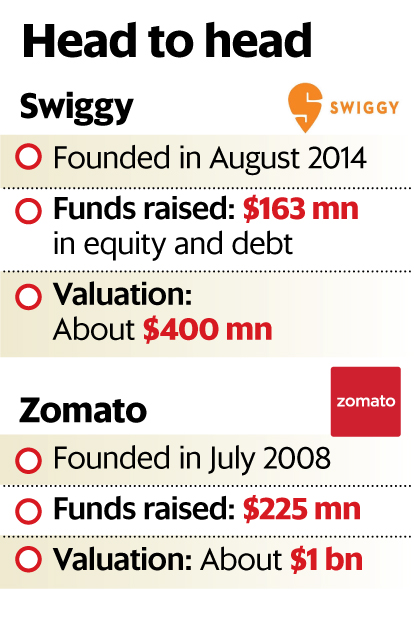

Swiggy is among the best-funded food delivery start-ups in India, having raised at about $155 million in equity from Accel Partners, Bessemer Venture Partners, Harmony Partners, RB Investments, Norwest Venture Partners, SAIF Partners and Apoletto, the personal investment firm of Russian billionaire and founder of DST Global, Yuri Milner. It has also raised about $8 million in venture debt from InnoVen Capital.

This is second only to Zomato’s $224 million among home-grown food technology start-ups.

However, while Zomato offers restaurant listings and food delivery, Swiggy is purely into food delivery business.

Swiggy, which competes with Zomato and Foodpanda India, currently operates in eight cities—Bengaluru, Delhi, Mumbai, Chennai, Pune, Gurgaon, Hyderabad, and Kolkata. The company is also piloting its own kitchens in Bengaluru.

Food start-ups are among the segments worst hit by a slowdown in funding, which have prompted companies to hold back on expansion while burning huge amounts of cash to lure customers through offers and discounts. Some investors released cash only when certain business goals were achieved.

Some food start-ups such as Dazo and Eatlo shut shop, while others were acquired. For instance, hyperlocal grocery delivery start-up Grofers bought Spoonjoy.

Swiggy posted a near 65-fold increase in losses for the fiscal year ended March 2016, indicating heavy cash burn in food start-ups, Mint reported on 18 November, citing the Registrar of Companies.

Swiggy’s revenue rose to Rs23.59 crore for the year ended 31 March from Rs11.59 lakh a year earlier. Losses bulged to Rs137.18 crore from Rs2.12 crore in fiscal 2015, the company’s filing with the Registrar of Companies shows. Total expenses stood at Rs160.77 crore, implying Swiggy burnt about Rs13 crore per month in FY16.

In April, Zomato claimed that its revenue in 2016-17 rose 80% from a year ago to touch $49 million due to growth in advertisements and the food delivery business. The company’s advertising revenue, its core business until it entered food delivery in May 2015, grew 58% year on year to $38 million in FY17, while the food delivery business clocked $9 million, an eight-fold growth over FY16.

Zomato claims to have recorded 2.1 million monthly orders in March.

Swiggy’s peers in the US such as Postmates and DoorDash charge a fee of $3-7 for each delivery. According to industry experts, the average order value in the US is around $20, significantly more than the average Rs300-400 in India. Consequently, delivery companies in India, which charge clients a commission of 10-20% of the order value, end up losing money on every delivery that costs upwards of Rs50.

Source: Mint