Global investment management firm T Rowe Price has entered an agreement to get majority stake in the trustee of UTI Asset Management Company.

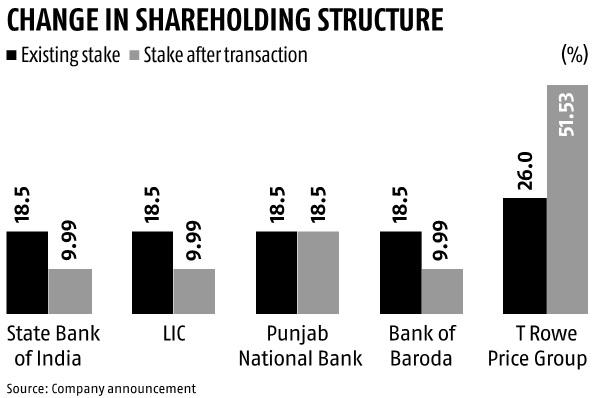

The deal will give it over 51 per cent stake in UTI Trustee Company even as the stake of three public sector shareholders drops to under 10 per cent.

“…three sponsors – State Bank of India, Bank of Baroda (and) Life Insurance Corporation of India – and T Rowe Price International… and UTI Trustee Company…have entered into a share purchase agreement dated November 11 for further divestment of 8.51 (per cent) equity stake by each of the three sponsors,” said an announcement.

The asset manager and its shareholders did not immediately respond to an email seeking comment. Mutual fund trustees hold assets of the fund on behalf of investors in its schemes. Trustees also monitor performance and compliance with regulations. The public sector shareholders had come together to take a stake in UTI after a crisis in the early 2000s.

T Rowe Price had bought 26 per cent stake in the company in 2010. Since then, it had faced issues, including those related to appointment of top management, with the public sector shareholders arrayed against it.

The Securities and Exchange Board of India (Sebi) recently passed an order asking sponsors who had their own mutual funds to reduce stake in UTI. Each has its own asset manager, with the exception of Punjab National Bank, which exited the business. It continues to maintain an 18.5 per cent stake in UTI Trustee Company.

Sebi also passed an order in August against three shareholders, imposing a penalty of Rs 10 lakh each. “…a sponsor of a mutual fund, its associate or group company including the asset management company of the fund, cannot have 10 (per cent) or more shareholding or voting rights in the asset management company or the trustee company of any other mutual fund,” it said in its August 14 order.

The asset manager listed itself on the stock exchanges in October. A number of the public sector shareholders reduced their stake in the share sale.

Each of the three sponsors offered 8.25 per cent stake in UTI Asset Management Company during the initial public offer. PNB and T Rowe price offered to unload around three per cent each. The stock was down 0.95 per cent on Wednesday, compared to a 0.52 per cent gain on the benchmark S&P BSE Sensex.

Source: Business-Standard