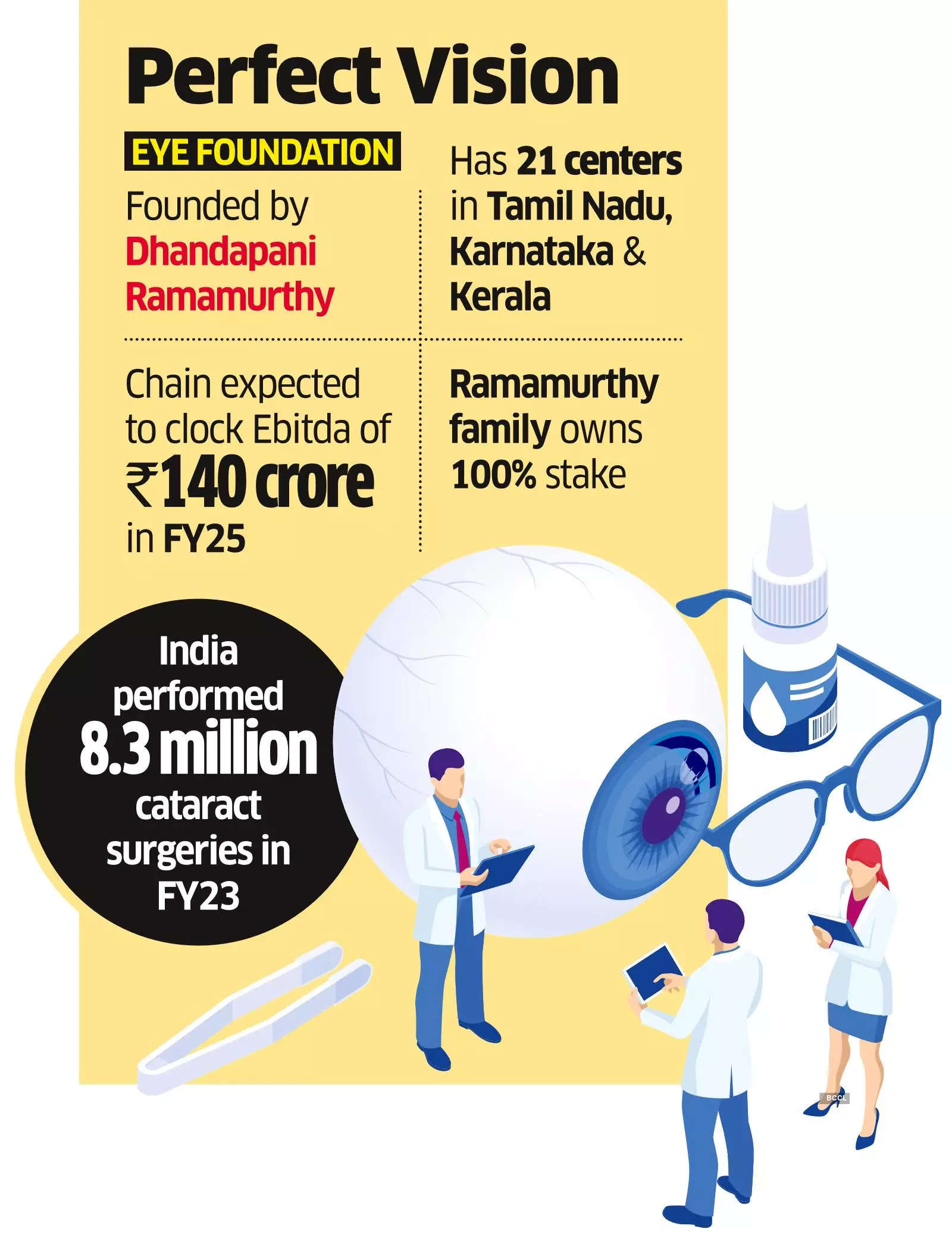

TA Associates, Multiples PE and KKR have submitted non-binding offers to pick up about 25% stake in Coimbatore-headquartered Eye Foundation at a valuation of ₹3,360 crore, according to sources. The offers are for a ₹830-crore ($100 million) investment in the eye hospital chain which has 21 centres in Tamil Nadu, Kerala and Karnataka, the people cited earlier said.

The bids value the company at twenty four times its one-year forward earnings. Eye Foundation is expected to clock earnings before interest, tax, depreciation and amortisation of ₹140 crore in FY25, according to the sources. ICICI Venture is also said to have shown interest but has not made a formal offer. The eye hospital chain is founded and 100%-owned by Dhandapani Ramamurthy and his family. Ramamurthy had a brief stint at All India Institute of Medical Sciences before setting out on his own.

Private equity players have scrambled to take positions in almost all the eye-care chains of significant scale. Their exuberance is backed by ambitious growth projections and expectations of bumper returns, as the sector gets organised and family-run eye clinics make way for branded formats.

TA Associates, Multiples PE and ICICI Venture did not respond to ET’s queries. KKR declined to comment. A query sent to Eye Foundation remained unanswered until press time on Tuesday.

Industry watchers say organised eye care players have only 10% market share. Data supports the thesis for expansion and consolidation. India performed 8.3 million cataract surgeries in FY23 trumping the US, Europe and China put together in numbers of such surgeries performed in a single year. Deal activity in the sector has been encouraged by these numbers.

“This an asset-light model. It is scalable. The capital expenditure required is low. That’s why eye care is attracting private equity investors,” said a fund manager on condition of anonymity. The fund manager was an early investor in one of the eye care chains that is now owned by PE funds.

Source: Economic Times