Bharti Airtel is in talks to buy UK-based Vodafone Group’s 21.05% stake in Indus Towers, which could potentially give India’s second ranked telco a controlling interest, said two people aware of the matter. If Vodafone Plc sells its Indus stake to Airtel, it could infuse some of the proceeds into Vodafone Idea (Vi), its cash-strapped, local telecom venture with the Aditya Birla Group, industry experts said.

However, talks are stuck over valuation, with the Sunil Mittal-led Airtel unwilling to acquire Vodafone’s stake at the current Indus share price, which has jumped over 77% since January. Airtel, instead, wants a valuation of ₹210-212 a share, or the level at which US private equity fund KKR and Canadian pension fund CPPIB had sold stock in Indus in February 2024.

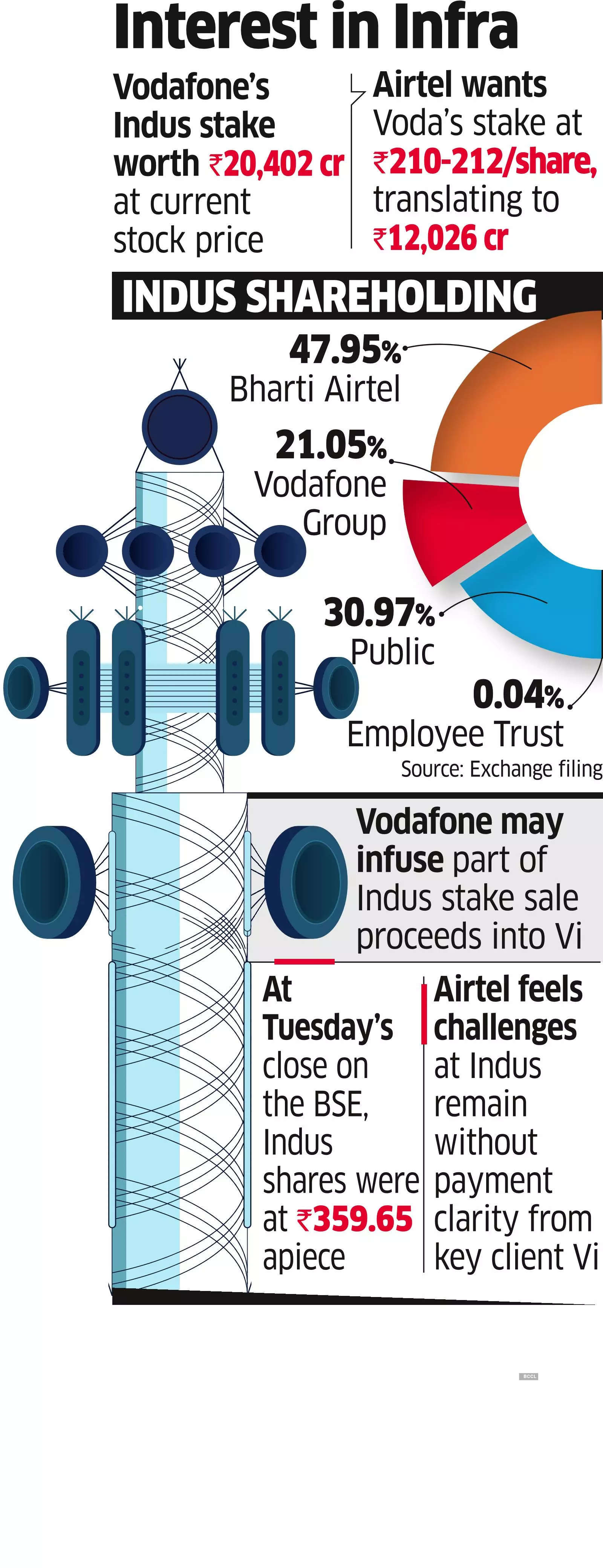

Airtel is the biggest shareholder in Indus, with 47.95%; Vodafone Group has 21.05% and 30.97% is with the public, according to the tower company’s latest filing with the BSE. A buyout of the Vodafone stake will boost Airtel’s shareholding to 69%.

Indus shares ended 2.9% higher at ₹359.65 on the BSE on Tuesday, giving it ₹96,923.41 crore market capitalisation.

Burden of dues

At this level, the 21.05% stake will cost Airtel Rs 20,402.37 crore, while at Rs 210-212 per share, the deal will be worth around Rs 12,026 crore. Bharti Airtel shares jumped 3.4% to close at Rs1,342.30 on the BSE on Tuesday.

“Airtel is likely to push Vodafone Plc for a sharp discount (to Indus’ current share price) as it believes the business challenges for Indus very much remain, as key client Vodafone Idea is yet to close its full fundraise and has also not shared any concrete plans around clearing its massive backlog of old dues (to Indus),” said one of the people cited above.

Vi chief executive Akshaya Moondra recently told ET that the telco would not be using the proceeds of its just-concluded Rs 18,000 crore follow-on public offer (FPO) to clear dues of any promoter or promoter group entity, alluding to Indus. It expects to pay vendor dues out of the cash flows generated from operations, he said. He also didn’t give any timeline for clearing the Indus dues.

Vi accounts for 35-40% of the tower company’s revenue. Ambit Capital estimates Vi still owes Indus around Rs 10,000 crore. Lately though, Vi has begun clearing its substantial dues to Indus, boosting the tower company’s net profit in the fiscal third quarter.

Indus operated 211,775 towers at December-end, with Bharti Airtel and Vi as its main customers.

Bharti Airtel, Vodafone Plc and Indus Towers did not respond to ET’s queries.

The Indus Issue

Airtel managing director Gopal Vittal had said on an earnings call in May 2023 that the tower infrastructure business — a reference to Indus — is key to telecommunications and must be kept stable. In order to prevent volatility, Airtel may even take control, he had said.

On the other hand, the telco has also said Indus is better off independent and that it will pare its stake over time.

Moondra had also told ET that Vodafone Group remains committed to Vi and can invest in the telco by monetising its stake in Indus. He said Vodafone’s own shareholders have asked the UK company to ringfence local operations with Indian assets. “So, their (Vodafone Group) source of funding is limited, and generally, if one has to look at monetisation of Indus, then they would want Indus to get to its fair value. It has actually re-rated quite a lot,” said the CEO.

Industry Views

Industry executives and analysts estimate that Vodafone can, at best, inject a little over Rs 9,000 crore. The reason: Vodafone’s 21.05% Indus stake is now valued at around Rs 20,402 crore but the British telco had pledged its Indus stake with lenders to the tune of Rs 11,000 crore to fund its contribution to Vi’s rights issue in 2019, people aware of the matter said.

IIFL Securities said Vodafone Plc may sell its 21.05% Indus stake and infuse Rs 6,000-7000 crore into Vi after it pays the lenders to which it has pledged Indus shares.

In total, VI is planning to raise around Rs45,000 crore, including the FPO proceeds and debt of Rs25,000 crore. Vi’s board has already approved a preferential share issue to raise Rs 2,075 crore from Aditya Birla Group.

Analysts expect Indus’s growth outlook to improve if Vi quickly closes its targeted Rs 45,000-crore fundraise via equity and debt, and uses the cash to bolster its 4G network and roll out 5G services. They said that if Vi adds around 75,000 sites to cover network gaps in its 17 priority markets, it could lead to 40,000-45,000 tenancy additions for Indus.

In February, KKR entity Silverview Portfolio Investments Pte Ltd sold 130.8 million Indus shares, or 4.85%, at Rs 210.21 apiece, aggregating Rs 2,749.61 crore. CPPIB had sold 57.6 million shares or 2.14% in India’s largest telecom tower company at Rs 212.15 apiece, aggregating Rs 1,223.46 crore.