Tata Consumer Products Ltd (TCPL) has emerged as the frontrunner to acquire Capital Foods Pvt Ltd, the maker of condiments, food products and ingredients under the Ching’s Secret and Smith & Jones brands, ending weeks of protracted negotiations, said people with knowledge of the matter.

TCPL is to first buy 65-70% of the company from its three investors, with a pathway to acquire the rest over a period of time, valuing the company at Rs 5,500 crore. The other contenders in fray include Nestle SA, the world’s largest foods company, and The Kraft Heinz Co.

Over the years, Capital Foods has launched a series of products with ‘desi’ flavours. These include Ching’s Secret instant noodles, soups, condiments, curry pastes and frozen entrees along with the Smith & Jones range of ginger-garlic paste, niche sauces and baked beans.

The legal documentation and final rounds of negotiation are ongoing to determine the stake the existing shareholders will rollover or whether they will exit entirely.

Kotak Mahindra is advising TCPL.

Capital Foods’ three main shareholders decided to put the company up for sale late last year. The three are Invus Group, a European family office and investment arm, with a 40% stake; US private equity group General Atlantic (35%); and Ajay Gupta (25%), founder chairman of Capital Foods and a former advertising boss turned food entrepreneur. ET was the first to report on the sale plan on November 14 last year after Goldman Sachs was appointed to initiate a formal auction process. ET reported May 9 on the three final bidders–Nestle, TCPL and Kraft.

The potential buyout will pit TCPL against Nestle’s Maggi, which leads the Rs 5,000 crore branded instant noodles market with a 60% share. The Maggi franchise is part of Nestle’s prepared dishes and cooking aids business. Other players in the category include Top Ramen, Wai Wai and Patanjali.

“Tata Consumer Products does not comment on market speculation,” the company said in an email. Gupta, GA and Invus remained unavailable for comment.

Gupta is likely to continue with the company for the time being, though it is unclear in what capacity, said the people cited above.

The sale process had drawn interest from several multinationals and homegrown consumer companies including ITC, Hindustan Unilever, Orkla, Nissin Foods and McCormick. The original ask had been much higher at close to $1.5 billion (Rs 12.45 crore).

Capital Foods is yet to file its FY23 numbers with the Registrar of Companies (RoC) but sources close to the company expect sales to touch Rs 900 crore with a 25% ebitda margin. The core business has been growing at a compounded annual growth rate (CAGR) of 30% while peers are expanding in single digits, said executives close to the company.

“A potential deal such as this and other recent acquisitions show a rebound of valuations in the FMCG market,” said Rajat Wahi, partner at Deloitte India. “While sales for most brands have now exceeded the pre-Covid values and volumes, the weaker rural sales over the last six quarters have impacted overall growth.”

It’s expected the start of the festive season, improving supply chain and sourcing, declining raw material prices, a likely reduction in interest rates in the coming months, improved liquidity and the build-up to the elections will significantly boost rural and urban sales of fast-moving consumer goods (FMCG) products, he said.

However, the growth that a company like Capital Foods saw during the pandemic, when people stocked up on packaged foods, is difficult to sustain unless a national player with significant distribution and advertising and marketing strength takes it over, said a senior executive of a rival food major who had evaluated the prospect but lost out. Even during Covid, noodles, sauces and condiments that Capital Foods sold in the key hotels, restaurants and caterers (HoReCa) channel were impacted due to reduced mobility and work from home (WFH).

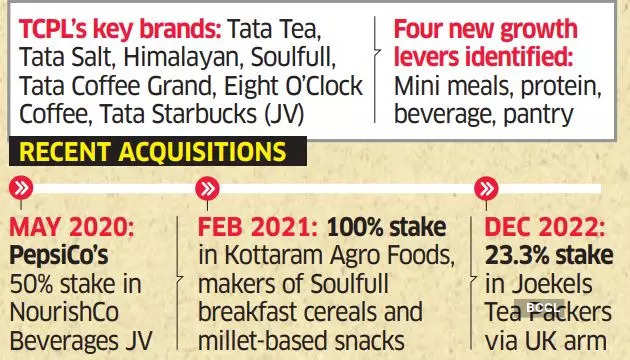

According to analysts who track TCPL, it’s been on a multi-year transformation journey, expanding from being a tea-and-salt company to a broader food and beverage franchise after the Tata Group rationalised and consolidated its portfolio, which includes a merger with Tata Coffee expected by end FY24. The company’s stock has appreciated 24% in the past six months. With the initial building blocks in distribution and portfolio expansion in place, the stock market expects TCPL to deliver strong growth over the medium term. Even though tea and salt account for about 85% of revenue, newer growth categories in beverages and food (NourishCo, Sampann, Soulfull etc.) are growing at over 40% CAGR.

The company has been acquisitive—buying Soulfull, which makes breakfast cereals and millet-based snacks, in 2021. It clocked a 50% jump in revenue through brand extensions and new launches at low incremental costs. In May 2020, it bought out PepsiCo’s 50% stake in NourishCo Beverages Ltd, an equal JV between the two companies that houses brands such as Himalaya packaged water and GlucoPlus. However, it’s much-talked-about takeover bid for Bisleri didn’t succeed after close to two years of dialogue. The deal for

India’s largest bottled water brand had been pegged at Rs 7,000 crore.

“M&A remains high on agenda but strategic fit and right price are a must,” said Vivek Maheshwari, analyst with Jefferies.

The company has been especially focussing on ramping up its distribution based on three pillars — expanding total reach to 4 million outlets by September of this calendar year and has already reached the figure of 3.9 million by June end. It has also initiated split routes for salesmen in 1million plus population towns while simultaneously investing in direct distribution in smaller towns. Most analysts believe the benefits of these initiatives to drive revenue growth rates and market share upwards in FY24-25.

“Scale-up of the India growth businesses would support the growth trajectory. Strong FCF, improving return ratios, attractive long-term potential for Starbucks and the opportunity to leverage Tata Group assets (e.g., BigBasket) are other potential positive drivers,” said Latika Chopra, analyst with JP Morgan.