Tata Motors is planning to hive off its vehicle financing subsidiaries under Tata Motors Finance Ltd by way of a merger with Tata Capital, to streamline its operations and deleverage its balance sheet, said people in the know.

The process will involve a share-swap agreement. Group holding company Tata Sons will offer shares of Tata Capital to Tata Motors. This will give India’s third-largest carmaker by volume a minority stake in Tata Capital.

Tata Capital is a 95% subsidiary of Tata Sons and the flagship financial services company of the conglomerate. Its products include commercial finance as well as consumer, home, education, personal and car loans. It also offers loans against property, wealth services, private equity and the distribution and marketing of Tata Cards.

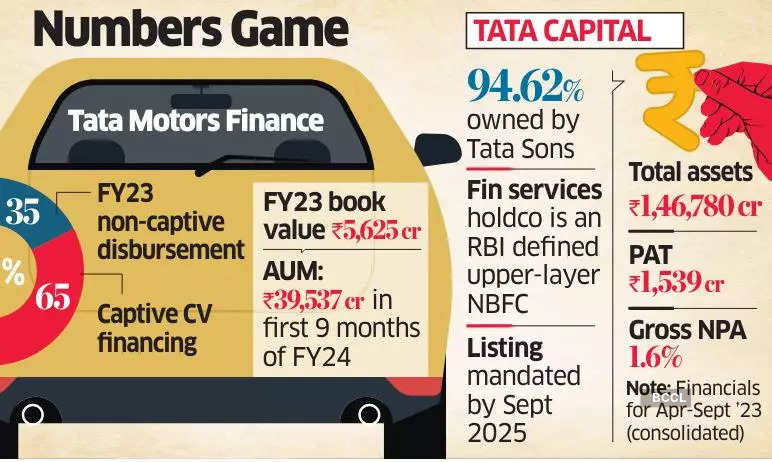

Tata Motors Finance is being valued at Rs 15,000-20,000 crore, which translates to 2.6-3.5 times of its FY23 book value of Rs 5,625 crore, said the people cited above. It is also at a significant premium to the value that Tata Motors equity analysts ascribe to it.

A formal announcement is expected in the coming days. Bank of America is advising Tata Motors.

Tata Sons and Tata Motors declined to comment. Tata Capital didn’t respond to queries.

Restructuring Thesis

From Tata Capital’s perspective, this recast is part of streamlining the financial services portfolio of the group under a single entity ahead of its planned IPO in 2024-25.

According to the Reserve Bank of India (RBI), Tata Capital Financial Services, the holding company of the financial services business, as well as Tata Sons, are treated as ‘upper layer’ non-banking finance companies (NBFCs) and are required to list by September 2025. The IPO exercise too is expected to kick off in the coming weeks.

Additionally, it will help Tata Motors deleverage its balance sheet at a time it’s rationalising its own operations by demerging the passenger and commercial vehicles businesses. Since it will own shares of Tata Capital after the merger, Tata Motors can unlock value by monetising that stock during the listing for a significant upside, said the people cited above.

Separating the finance arms will also bring down gross debt at Tata Motors, at Rs 1.25 lakh crore in FY23. About 35% of that is the net automotive debt (Rs 43,700 crore), providing clarity on the leverage. It will also reduce the drag on consolidated financials during the downcycle in commercial vehicles, typically resulting in higher provisions.

Multiple Verticals

Tata Motors Finance Holdings (TMFHL) is a wholly owned subsidiary of Tata Motors. TMFHL, in turn, has two 100% subsidiaries — Tata Motors Finance and Tata Motors Finance Business Services (TMFBSL). Tata Motors Finance is an NBFC, while TMFHL is a core investment company.

TMFBSL handles new vehicle financing while Tata Motors Finance handles dealer and vendor financing as well as used-car refinance and repurchase. Together, they are called the TMF group.

Since January 2015, Tata Motors Finance has been focusing primarily on the used-vehicle finance business of Tata Motors. It offers a range of solutions, including fuel loans, with the aim of expanding the market.

The TMF group disbursed Rs 18,334 crore in vehicle financing during FY23. In the same fiscal, approximately 17% of commercial vehicle sales in India were made by dealers with financing arrangements from Tata Motors Finance, according to the Tata Motors annual report. Revenue stood at Rs 4,927 crore in FY23, though it posted a loss of Rs 993 crore, compared with a profit of Rs 101 in FY22, due to increased provisioning for post-pandemic finance receivables.

Tata Motors Finance had a 12% market share of total commercial vehicle financing in the first nine months of FY24, as per a Tata Motors quarterly presentation, down by over half from the year earlier. However, the company expanded its non-captive disbursement mix to 35% in FY24 while 65% is still captive commercial vehicle financing.

Assets under management dropped to Rs 39,537 crore in the first nine months of FY24 as disbursals declined as Tata Motors Finance sought to improve the quality of its portfolio and lowered provisioning. However, profits improved — profit before tax rose to Rs 285 crore, against a loss of Rs 511 crore in the previous corresponding period.

According to Crisil, of the total AUM as on September 30, 2023, the share of new vehicle financing was 69%, that for used vehicles was 21% and corporate lending stood at 10%. Gross non-performing assets (NPAs) and net NPAs stood at 6.5% and 3.6% at the end of December 2023, compared with 10.9% and 7%, respectively, a year before.

In order to improve the return on assets — 1% in the third quarter of FY24 — Tata Motors Finance is aiming to improve portfolio quality through prudent sourcing and strengthening collection infrastructure, besides diversifying the loan book further to reduce risks and build back AUM, as well as digitising the business for a shorter turnaround time.

With the financial services sector gaining momentum from FY19 until the first half of FY24, Tata Sons has cumulatively invested Rs 5,000 crore in Tata Capital through rights issues and other means.

Tata Capital Financial Services and Tata Cleantech Capital were merged with Tata Capital with effect from January 1. Tata Capital Housing Finance, Tata Securities, Tata Capital Pte, Tata Capital Advisors Pte Ltd and Tata Capital Plc and other subsidiaries are housed under the Tata Capital umbrella entity.