Tata MotorsBSE 1.15 %, India’s largest automobile company by revenue, and Volkswagen Group, Europe’s largest car maker by volume, are said to be at an advanced stage of finalising a partnership that can have a wide-ranging impact on India and other emerging markets.

The contours of the partnership, on whether it will be a joint venture or a technology tie-up, are still being worked out, said five people with knowledge of the matter. They told ET that negotiations are making progress and could culminate in an announcement at the Geneva International Motor Show in March.

Sharing vehicle architecture and technology is at the heart of the discussion, said one of the persons.

The companies are looking at sharing modular platforms for India and emerging markets, including the advanced modular platform (AMP) being developed by Tata Motors. Volkswagen may offer technical know-how on producing multiple models based on modular architecture.

The two companies are also exploring whether Volkswagen’s MQB A0 platform can be used by Tata Motors, said the people cited above.

“Both the companies are stretched financially, yet they have no way out but to invest for the future, so partnership was the only way out.”

Tata Motors has been held aloft by its Jaguar Land Rover unit with the domestic car business doing poorly. Turning it around is a key focus for chief executive officer Guenter Butschek, who is said to have a good equation with senior Volkswagen executives. Both companies declined to comment.

“To enlarge the product portfolio with tailor-made solutions, for example in India, Volkswagen Group is discussing and defining these proactively with potential partners as well as between the brands of the Group. It is, therefore, premature to make any further disclosures at the moment,” the person said. A Tata Motors spokesperson said, “As prevalent in the automotive industry, we regularly have discussions with different companies to explore future collaborations but we do not have any specific announcements at present.”

Any deal could be the first major deal under the stewardship of new Tata Sons chairman N Chandrasekaran, although talks began under predecessor Cyrus Mistry’s tenure, said some of the people cited above.

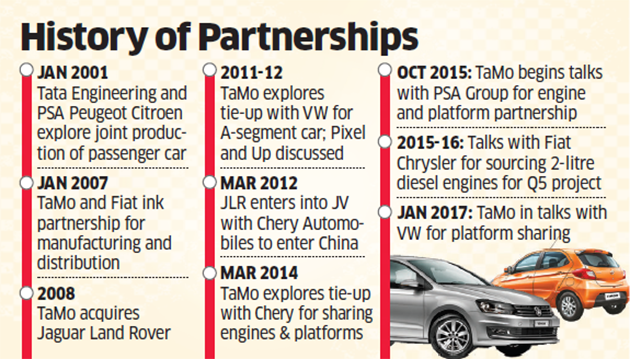

Several groups of executives from Europe have been travelling to India for meetings with due diligence having also been undertaken, said one of the people cited above. This is not the first time they have held discussions, having first explored a tie-up when Tata Motors showcased the Pixel concept at Geneva in 2011 and Volkswagen was gearing up to introduce the mini-car Up globally.

Volkswagen in India, with an ageing portfolio built around the Polo and Vento, is yet to get a major facelift. The German car maker explored the Up platform for India in 2012-13 but dropped the project due to a lack of clarity on viability. It then explored the prospects of modern modular platform MQB for India in 2014-15 but dropped the project because it was too expensive. It then decided to conserve resources, especially after the scandal over cheating diesel emission norms.

An executive associated with Tata Motors recently told ET that the company has had several investigations with potential partners in the past in order to leverage vehicle architectures and engines — for example, PSA Group and Chery from China.

Volkswagen is yet another option Tata Motors is exploring, he said. PSA Group recently concluded a partnership with Hindustan Motors in India, buying the Ambassador brand.

“While Tata Motors is consolidating from six platforms to two, each and every hundred thousand units is additional leverage and any additional economies of scale will structurally improve the cost competitiveness,” said the executive. With competition emerging from non-traditional players like Google and Apple and norms becoming stringent, the industry is increasingly witnessing tie-ups between rivals. Toyota and Suzuki recently decided to unite to explore the possibility of cooperation in areas including environment, safety and information technologies, and mutual supply of products and components. General Motors is currently in talks with PSA Group to sell the Opel brand in Europe.