Tata SteelBSE 0.42 % on Thursday signed a definitive agreement to sell its UK subsidiary’s speciality steel business to the Liberty House Group for 100 million pounds (Rs 839 crore), the company said in a regulatory filing on the BSE on Thursday.

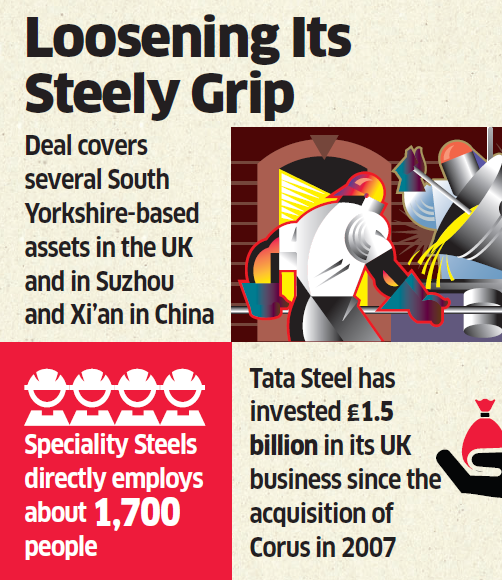

Tata Steel said the deal covers several South Yorkshire-based assets including the electric arc steelworks and bar mill at Rotherham, steel purifying facility in Stockbridge, a mill in Brinsworth as well as service centres in Bolton and Wednesbury in the UK and in Suzhou and Xi’an in China. Speciality Steels directly employs about 1,700 people, making steel for aerospace, automotive, and oil and gas businesses.

Tata and Liberty House had entered into exclusive talks in November as the steelmaker seeks to offload its money-losing assets and restructure European operations.

UK-based Liberty House is owned by Indian-origin businessman Sanjeev Gupta, whose strategy is to recycle steel instead of making it fresh from blast furnaces. The speciality business can produce 1 million tonne steel from electric arc furnaces, which can be used in the automobile and aerospace industries.