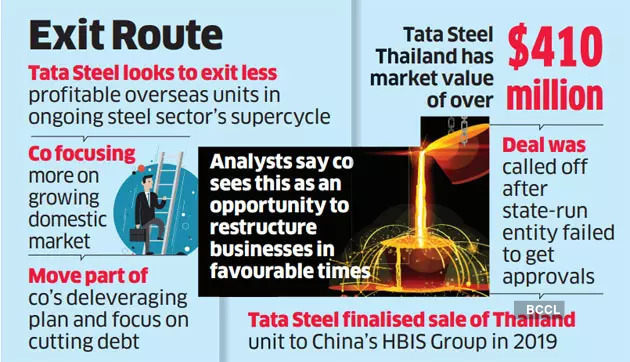

Tata Steel has revived plans to sell its Thailand business as the company looks to exit less profitable overseas units in the ongoing supercycle, said senior group officials aware of the developments. The proposed sale, coming on the heels of India’s largest steel maker’s move to offload its Singapore business, NatSteel Holdings, will aid the company cut its debt further.

Bangkok-listed Tata Steel Thailand has a market value of over 13.47 billion baht or $ 410 million.

A Tata Steel spokesperson said: “We have recently completed the transaction of NatSteel and we will continue to explore all options for Thailand.”

To be sure, Asia’s oldest maker of the primary infrastructure alloy is focused on the home market.

“There is a clear focus to invest in the domestic market which is growing well and any exposure to businesses outside India that are not offering an adequate return on capital is being carved out,” an official said. “These are cyclical sectors and post-pandemic, there is a view to cut exposure to markets not yielding the right risk to return ratio.”

Tata Steel had finalized the sale of the Thailand unit to China’s HBIS Group in 2019. The deal was called off after the state-run entity failed to secure approvals.

The decision to renew plans to sell the business comes in the wake of the sharp surge in global steel prices in the past 16 months driven by strong demand and supply cuts in China. Higher prices have boosted Tata Steel’s profitability and helped it cut borrowings. Net debt has fallen to Rs 78,163 crore as on September 30, 2021 from Rs116,328 crore on March 31, 2020. In this period, Tata Steel’s share price has climbed more than four times.

Analysts said the company has an opportunity to restructure its businesses during favourable times.

“Tata Steel is on a deleveraging drive because of the steel super cycle,” said Bhavesh Chauhan, a research analyst at IDBI Capital Markets. “The company is expanding its domestic business and looking to cut the less profitable overseas business mainly in South East Asia, especially the ones that do not have a captive iron ore.”

Tata Steel’s Indian units contributed 44% to its FY21 revenue. Overseas entities made up for 56%. The quality of profit has been stronger in its domestic operations, which contributed 90% to the company’s FY21 operating profit.

Tata Steel recently sold off Singapore’s NatSteel, its first major buyout overseas, after holding the business for 17 years. The wires business in Thailand (Siam Industrial Wires) was separated from NatSteel Singapore and was consolidated with T S Global Holdings, an indirect 100% arm of the Indian company.

In 2004-05, Tata Steel had acquired Millennium Steel in Thailand in the midst of the previous steel upcycle. In 2006-07, it took a big step towards its global ambitions when it acquired the Anglo-Dutch steel producer Corus, which was six times its size then. The subsequent meltdown in the steel cycle coupled with the high acquisition costs had resulted in Tata Steel’s debt shooting up, resulting in its shares underperforming for over a decade.

Analysts are cheering the company’s decision to offload overseas units but a sale of the European subsidiary is seen as critical.