Tata Sons has raised its shareholding in Tata Play to 70% by acquiring Singaporean government-owned investment firm Temasek’s 10% stake in the company for about $100 million (close to Rs 835 crore), said people in the know.

The direct-to-home (DTH) firm has been valued at $1 billion, down from its previous pre-pandemic valuation target of $3 billion.

I&B Min told About New Shareholding

The DTH company is crucial for the salt-to-software conglomerate, Tata Group, as it serves as its sole consumer-facing business in the media and entertainment sector.

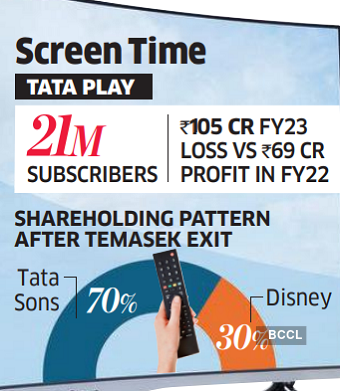

Tata Play, India’s largest DTH firm with 21 million subscribers, has intimated the Ministry of Information and Broadcasting (MIB) about the change in shareholding, according to one of the persons, who did not wish to be identified.

Under the DTH rules, licence holders are required to inform the ministry about a change in shareholding or partnership or foreign direct investment pattern.

“Tata Sons has bought out Temasek’s stake in Tata Play. The DTH company has intimated the MIB about the change in shareholding,” a senior media executive said on condition of anonymity.

Tata Sons, Temasek and Tata Play declined to comment on the development.

With Temasek’s departure, Tata Play will become a 70:30 JV between Tata and Walt Disney, which is also looking to exit the TV distribution company. Tata Sons previously held a 60% stake in the company, while Disney held a 30% stake.

Tata Sons is also believed to have held talks with Disney to buy out the latter’s stake. Disney wants to exit Tata Play since DTH is a non-core business for the US entertainment firm.

Disney inherited the 30% stake in Tata Play from the acquisition of Rupert Murdoch-promoted 21st Century Fox’s India assets, including primarily Star India.

In February, Disney agreed to merge its Star India business with Reliance Industries’ Viacom18 to create an $8.5 billion media giant.

Temasek, through its affiliate Baytree Investments Mauritius, acquired a 10% stake in Tata Play, formerly Tata Sky, in 2007.

IPO deferred

The Singapore-based investment firm has been mulling an exit from Tata Play for many years through an initial public offering (IPO). The Walt Disney Company was also aiming to reduce its ownership of the company during the IPO.

However, the proposed IPO was postponed by the company due to tough market conditions and challenges in the DTH sector.

Sebi approved Tata Play’s proposed public issue in May 2023. In November 2022, Tata Play became the first company in India to file confidential papers with the market regulator.

Source: Economic Times