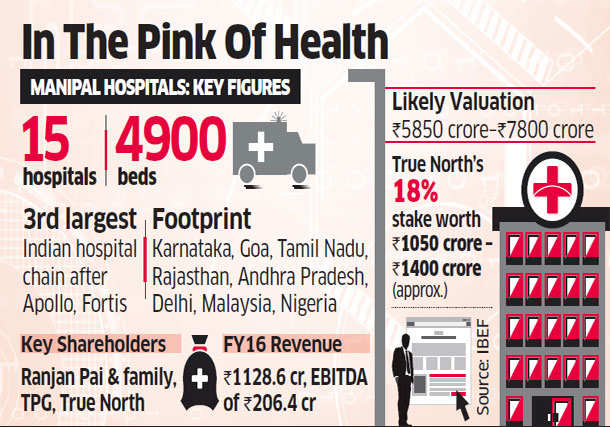

Temasek is all set to acquire an 18% stake in Manipal Health Enterprises Pvt Ltd (MHEPL) from True North, valuing India’s third-largest hospital chain at as much as $1.2 billion (Rs 7,800 crore), said people with knowledge of the matter.

The investment underscores Temasek’s bet on Indian healthcare and, according to some, may even be a precursor to a bigger push — one that could eventually see the investment company of the Singapore government stitch together a controlling stake in the company.

With a new investor coming on board, True North, formerly India Value Fund Advisors (IVFA), will fully exit its five-year invest-Temasek to Buy True North’s 18% inManipal Health for Rs 1,400 Cr. In 2012, IVFA had invested Rs 1,000 crore (then $180 million) to bankroll Manipal’s expansion in India and overseas. In 2015, bulge-bracket investor TPG invested another Rs 900 crore ($146 million) for a 23% stake. It will remain invested.

|

A formal announcement on the Temasek investment is due in the next few weeks, said the people cited above. Spearheaded by billionaire Ranjan Pai, 43, also the principal shareholder, privately held MHEPL runs the eponymous multi-speciality hospital network and is part of the Bengaluru-headquartered Manipal Education and Medical Group.

“I cannot comment on any potential secondary share sale transaction between existing and any new investor,” said Pai. “We are not selling any shares now. We may raise funds in future for acquisition purposes and then all shareholders will get diluted proportionally. But as promoters, we are not ceding control now.”

Founded in 1991, it currently has a network of 15 hospitals offering quaternary, tertiary and secondary care in five states with around 4,900 beds, catering to 2 million patients from India and overseas every year. It also owns and operates a hospital in Malaysia and manages a clinic in Nigeria. Though largely located in southern India, it has some presence in the north following the acquisition of the 280 -bed SK Soni Hospital in Jaipur in 2015 and the west, in Goa. It also plans to expand in Delhi.

The company reported revenue of Rs 1,128.6 crore, ebitda of Rs 206.4 crore and profit after tax of Rs 37.06 crore in FY 2016. Analysts peg FY17 ebitda at Rs 240-250 crore.

A BIGGER PLAY?

With two pedigreed investors in TPG and Temasek-—both of which have been bullish on healthcare-—analysts are expecting a bigger play around Manipal in future.

“At a significant premium, Pai may divest either partially or fully. But the contours of those negotiations have not been frozen yet and may eventually not fructify as well,” said a person closely associated with the group.

“TPG may also want to hike its stake. Temasek, which thus far has taken only minority stakes in hospitals, is exploring control transactions in the space. But Pai will seek a scarcity premium as there are few good assets available.”

Over the past four-five years, the one-year forward EV/ebitda multiples of listed hospital chains in Asia has increased from 10-15 (x) to 20-25 (x), according to analysts. “Indian hospital chains have followed a similar trend as Asian peers. Larger financial investors or strategic players are comfortable pricing deals at 20-22 (x) 1 year forward EV/ebitda,” said Navroz Mahudawala, founder, Candle Partners, a Mumbai-based boutique investment bank.

In India, Temasek has so far backed Medanta, Apollo HospitalsBSE -0.80 % and oncology specialists HCG. Around 4% of its global portfolio value of $242 billion is deployed in life sciences and agriculture companies. Other than Manipal, TPG has invested, through its different arms, in Motherhood, Cancer Treatment Services International and Sri Lanka’s Asiri Hospital Holdings. Both funds have consistently been in fray for quality assets like Fortis HealthcareBSE 0.82 %, CARE, and KIMS. Manipal, which had recently evaluated Fortis, may therefore possibly tie up with its marquee investors to acquire targets and consolidate the sector.

India requires 600,000 to 700,000 additional beds over the next five to six years, indicative of an investment opportunity of $25-30 billion. Given this demand for capital, the number of transactions in the healthcare space is expected to witness an increase in near future. According to a February report by IBEF, the overall Indian healthcare market is expected to treble to $280 billion by 2020 from $100 billion at a compound annual growth rate (CAGR) of 22.9%. Healthcare delivery, which includes hospitals, nursing homes, diagnostic centres and pharmaceuticals, constitutes 65% of the overall market.