Italy’s biggest utility Enel Group is competing with homegrown private power producer-distributors Greenko and Torrent Power to acquire Reliance Infrastructure’s Delhi electricity distribution business, said people aware of the matter. The Anil Ambani-led Reliance Group is looking to sell assets to pay off lenders. The unit is India’s largest in terms of consumers.

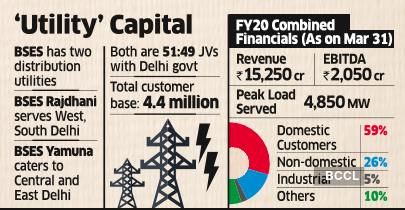

Reliance Infrastructure had hired KPMG to find buyers for the 51% stake each it holds in BSES Rajdhani Power (BRPL) and BSES Yamuna Power (BYPL). The Delhi government owns the remaining 49% in both. The three submitted bids last Friday to comply with the deadline, said people directly involved in the matter.

Reliance Group Expecting Rs 5,000 crore EV

The asset was shown to several private equity funds including Brookfield, CDPQ and I-Squared Capital, but only three submitted bids, they said. The diligence exercise will begin after the shortlist is drawn up, expected in the coming week.

Reliance Group is expecting an enterprise valuation of Rs 5,000 crore, inclusive of debt, said sources.

Reliance Group did not respond to queries. Enel and Greenko spokespersons declined to comment.

There was no response to emails sent on Saturday to Torrent Power.

LIQUIDITY PRESSURE

Ambani sold the Mumbai city power distribution business to Adani Transmission Ltd for Rs 18,800 crore in August 2018. Greenko and Torrent had also bid for that asset.

Adani has stayed away from competitive bidding this time, but some expect it join the fray later like last time.

On Friday, a London court ordered Ambani to repay within 21 days an interim $717 million owed to a Chinese banking consortium led by Industrial & Commercial Bank of China, the world’s largest bank by assets. This was for loans taken by group company Reliance Communications. Ambani had faced the prospect of a jail term last year for delaying payments to Ericsson.

Reliance Group and Tata Power supply power to about 93% of Delhi. The two BSES companies cater to 4.4 million customers in the national capital, handling peak power demand of 4.8 GW. Last July, New Delhi touched an all-time high electricity demand of 7.4 GW.

Transmission and distribution losses have shrunk drastically since power distribution in the Capital was taken over by private operators. It registers the lowest aggregate technical and commercial loss of 9.7% against a 21.4% national average.

Apart from being a marquee circle, bidders consider the high mix of residential and commercial users as a big positive. Only 5% of the user base is industrial.

REGULATORY ASSET CLAIMS

However, analysts feel a key challenge would be the near-Rs 30,000-crore regulatory asset (RA) claims that are yet to be approved by the regulator. In FY18, the Delhi Electricity Regulatory Commission (DERC) approved Rs 12,000 crore of such claims. “Although the Appellate Tribunal for Electricity has approved a part of the company’s claims, it is yet to be reflected in the tariffs, as DERC has to allow it in tariff orders,” said Nitin Bansal, analyst at India Ratings — a credit rating agency.

Regulatory assets get created when some of the expenditure is factored in by the regulator while calculating tariffs and are adjusted later. Until then, they are accounted for as RAs.

“The company also owes around Rs 16,000 crore, predominantly to state generating companies,” said a senior executive at a rival company, on condition of anonymity.

“This is the reason why the enterprise valuation will be low after adjustment. Moreover, the political allegations over alleged inflated expenses are still pending in the courts.”

THE BIDDERS

Companies such as Torrent were among the earliest private utilities to enter power distribution and currently supplies power to Ahmadabad, Surat, Agra and Bhiwandi. It has been looking at expanding its footprint.

GIC and ADIA-backed Greenko is India’s largest renewable company and is also one of the most acquisitive. Industry executive said such an acquirer could reduce BSES’s costs by switching to cleaner and cheaper fuel options.

The Centre has mandated all distribution companies to purchase at least 21% of total energy requirements from renewable sources by FY22. Additionally, the discoms will not have to bear transmission charges and losses on this renewable power.

Enel made its India debut in 2015, buying a majority stake in BLP Energy, the renewable venture of former GE India CEO Tejpreet Chopra. Enel’s renewable arm, Enel Green Power, owns and operates 172 MW of wind capacity in Gujarat and Maharashtra.

Source: Economic Times