Japan’s largest provider of city gas Tokyo Gas has joined the race to acquire a minority stake in Think Gas Distribution, Indian natural gas supplier owned by private equity fund I Squared Capital, said two people aware of the development. Founded in 1885, Tokyo Gas is the city gas provider in the Tokyo metropolitan area and surrounding Kanto region.

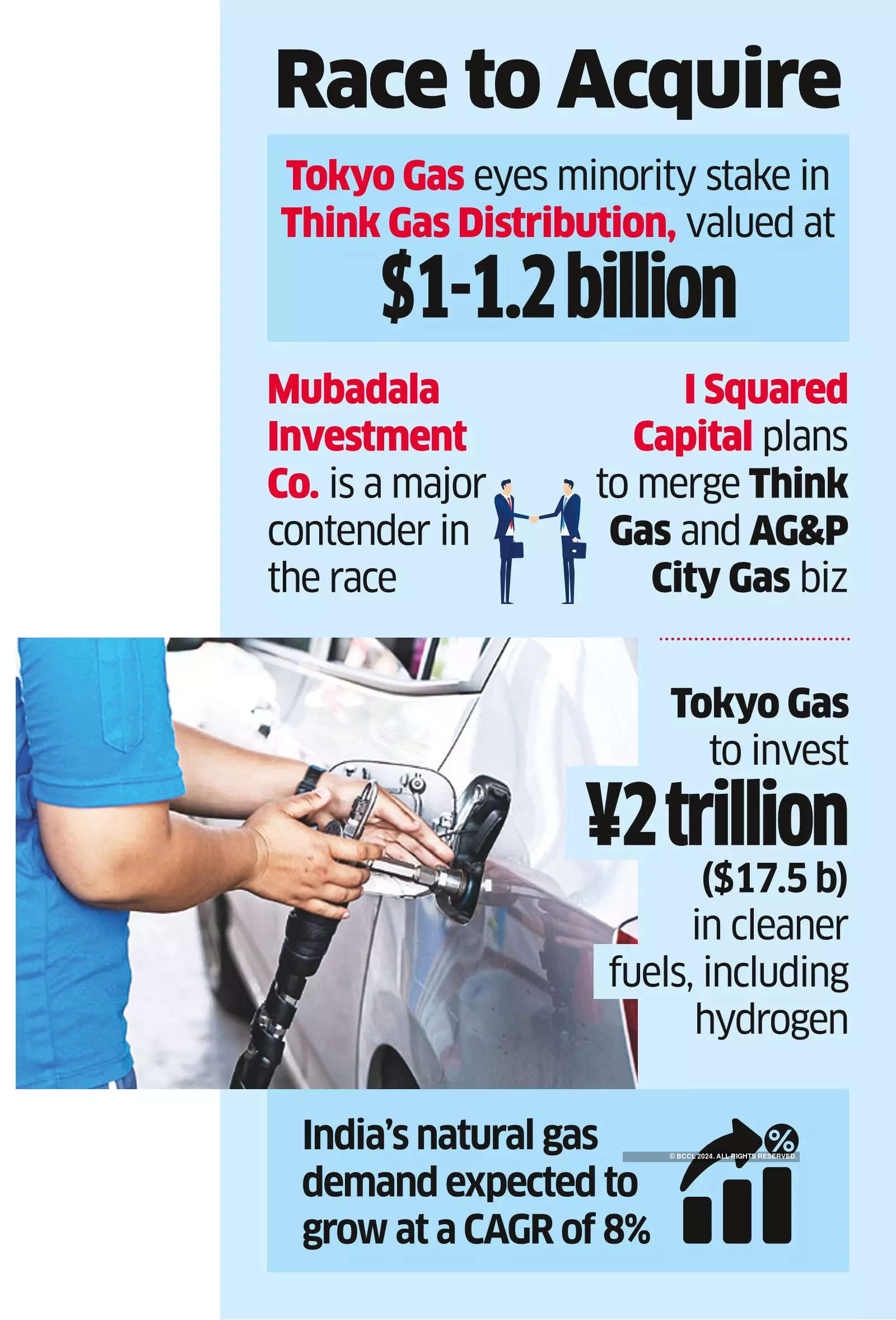

Tokyo Gas is doing due diligence at present, said sources. The potential investor will buy about 30% stake in Think Gas, valuing the company at $1-1.2 billion.

Investment bank Barclays is advising I Squared for the stake sale.

Mubadala Investment, the sovereign wealth fund of the United Arab Emirates, is the other major contender for the minority stake.

Mubadala Investment and a couple of Japanese investors, including Sumitomo, are among the contenders to acquire a 30% stake in Think Gas Distribution, ET first reported on May 12.

Established by I Squared in 2018, Think Gas operates across 13 districts in India and supplies natural gas to domestic, commercial, industrial and automotive sectors. Headquartered in Delhi NCR, Think Gas has over 80 CNG stations and serves over 30,000 customers daily, according to the company website.

As a financial institution backed platform, I Squared’s city gas distribution business is the largest in the country. Other major city gas distribution businesses include Adani Total Gas and Torrent Gas in the private sector, and PSU backed players such as Mahanagar Gas and Indraprastha Gas.

I Squared Capital operates the city gas distribution business in India through the platforms – Think Gas and AG&P Pratham.

I Squared plans to merge the Think and AG&P city gas businesses and the investor will pick up stake in the merged entity through a mix of primary and secondary investment, said sources.

Mails sent to I Squared Capital and Tokyo Gas did not elicit any response till press time.

AG&P has 12 long-term 25-year exclusive concessions in the five states of Rajasthan, Andhra Pradesh, Karnataka, Kerala and Tamil Nadu, while Think Gas has seven licenses to operate across 13 districts in India, across the states of Punjab, Madhya Pradesh, Bihar, Uttar Pradesh and Himachal Pradesh.

Tokyo Gas will spend two trillion yen ($17.5 billion) on cleaner fuels, such as hydrogen, and renewable power with the aim of doubling its profit to 200 billion yen by 2030, said a recent Reuters report.

Tokyo Gas and other utilities are stepping up overseas expansion as they face falling demand in Japan, which has an ageing population and a declining birth-rate, while the liberalisation of its energy markets has spurred competition among old-guard utilities, said the report. The $22-billion Tokyo Gas is engaged in diverse businesses spanning electricity generation, energy retailing, engineering solutions, upstream LNG, and real estate development.

India’s natural gas demand is set to grow at a CAGR of 8% and the Indian government is trying to increase access to gas to about 70% of the population by 2025.

Pipeline infrastructure is set to grow four times and CNG stations to increase three times through 2025 as expansion in new geographies picks up pace, said a recent note from the ministry of petroleum & natural gas.