Torrent Investments has pleaded with the National Company Law Tribunal (NCLT) to direct the administrator of Anil Ambani-promoted Reliance Capital not to accept the revised offer the Hinduja group entity gave a day after the auction concluded (on December 21), said two people aware of the development.

Torrent Investments filed an interlocutory application a day before the committee of creditors and their advisors’ pre-scheduled meeting on January 3. It has petitioned that the verified lenders and the administrator, Nageswara Rao Y, will be violating the law governing the corporate insolvency process by engaging in negotiations with the “latecomer” while referring to Hinduja, said one of the persons cited above.

Today, the CoC and their advisors will review and compare the plans received for Reliance Capital, which is undergoing insolvency proceedings. Torrent did not respond to ET’s request for comments.

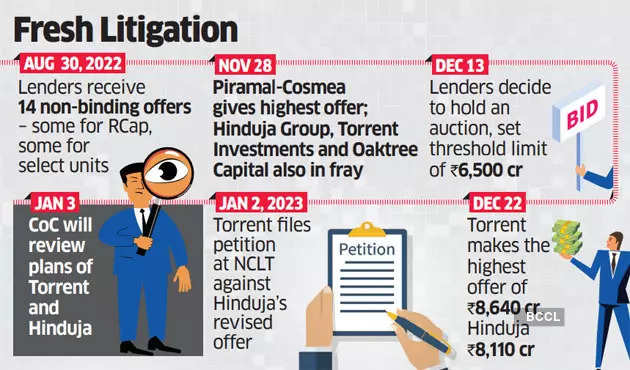

The dispute centres on a late bid given by the Hinduja group entity a day after the auction wherein Torrent was the highest bidder. At an auction on December 21, Torrent Investments offered Rs 8,640 crore on a net present value (NPV) basis as against Rs 8,110 crore offered by Hinduja entity IndusInd International Holding. The NPV is calculated after discounting the future cash flows.

The next day, the Hinduja group gave an improved offer of Rs 9,400 crore on an NPV basis. This includes Rs 8,750 crore as an upfront cash payment, higher than the Rs 3,750 crore upfront offered by Torrent.

On December 23, Torrent issued a protest letter to the administrator warning that it would seek legal remedy if lenders considered a belated offer from Hinduja.

The letter to the administrator states that the (Hinduja’s) revised offer after the auction is “in utter disregard to the sanctity of the challenge process” and “it is an attempt to illegally enhance its bid amount beyond the permissible time prescribed under the challenge process”.

Lenders held an auction process because the offers received in the first round concluded on November 28 were 60-80% lower than the liquidation value of Rs 12,500 crore-13,000 crore pegged by RBSA Advisors and Duff and Phelps.

The latest offers are also below the liquidation value, and there is no certainty on whether lenders will accept them, the people said. Hinduja’s offer is 25% while Torrent’s offer is 44% below liquidation value (at Rs 12,500 crore).

During the meeting, lenders will discuss ways to get better offers and the conditions stipulated by the bidders, if any, to conclude the deal.

Reliance Capital’s resolution is complex since it houses 20 financial services companies ranging from broking to insurance to asset reconstruction companies. Litigation among bidders could further complicate and delay the resolution process.