Private equity group Carlyle is in formal discussions with TPG Growth to sell at least 25-30% stake in VLCC Healthcare Ltd, within a year of acquiring the wellness, beauty products and services company, said people aware of the matter.

VLCC’s nearly 78% surge in valuation in just 12 months is the key trigger for Carlyle to take some money off the table, the people said.

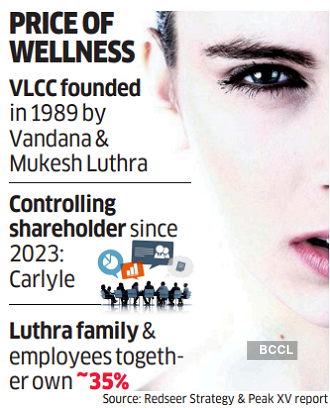

Last January, Carlyle paid Rs 2,700 crore to buy a controlling 66% stake in the three-decade-old homegrown brand that gave the buyout fund an entry into a rapidly growing market for wellness products but one that is facing disruption from younger, nimbler, direct-to-consumer (D2C) brands.

Founders of VLCC – Vandana and husband Mukesh Luthra who owned 95% of the company prior to the Carlyle deal – retained a 30% stake with the management team holding 4%.

From about Rs 4,000 crore in 2023, VLCC is now valued at Rs 7,000-Rs 7,200 crore, said the people cited above.

They added that TPG Growth is expected to put a firm offer in the next few days even as Carlyle has also tapped Gulf-based sovereign wealth funds–Abu Dhabi Investment Authority (ADIA) and Saudi Public Investment Fund (PIF) – among others as part of its ongoing fundraising initiative.

These sovereign funds have been given the option of co-investing in VLCC as well as becoming new limited partners of sponsors of a new Carlyle Asia fund that is being raised.

Canadian pension fund like Ontario Teachers’ Pension Plan (OTPP), British investment firm Permira, and Warburg Pincus, backers of Good Glamm Group, were approached too, people said.

The quantum of stake to be eventually sold and the final valuation along with affirmative rights, board representation., etc is under discussion and is expected to get finalised shortly, said the people cited above.

“The information is not true – Permira is not engaged in this transaction,” said a London-based spokesperson for Permira in response to ET’s queries.

Carlyle, TPG, ADIA declined to comment. Mails sent to PIF and Warburg Pincus did not generate a response till press time on Wednesday.

Founded in 1989, VLCC operates in the skincare, beauty and wellness segments, offering services such as weight management in addition to selling packaged products.

VLCC has a presence in 310 locations in 139 cities across 11 countries. This includes a network of 218 branded Wellness Centers & Beauty Clinics across 106 cities in India and 25 in nine other countries offering services as diverse as weight- management, laser, aesthetic dermatology and regular beauty salon services. It also runs 100 VLCC Institutes of Beauty & Nutrition across 67 cities in India, making it one of the largest professional training academy chains for skill development in beauty and nutrition. It also manufactures and sells in-house personal care products.

In the last one year, VLCC has also expanded into men’s grooming through the inorganic route, acquiring Happily Unmarried Marketing, which runs D2C men’s grooming brand Ustraa.

VLCC has undergone a senior leadership overhaul since the Carlyle takeover.

In April 2023, Vikas Gupta, former CEO of SuperStore of Nykaa, also the former chief customer and marketing officer of Flipkart and a Unilever veteran for over two decades joined as the Group CEO. Gopal Mishra, Fabindia’s former COO and CFO joined as VLCC’s CFO while Anand Wasker, formerly CEO of the primary care business of Apollo Hospitals Enterprise, joined as chief business officer. Arvind Mills erstwhile CEO J. Suresh was also inducted into the VLCC board.

In FY23, VLCC Healthcare recorded a 25% growth in revenue at Rs804 crore compared to Rs645 crore in FY22. The company, however, plunged into a net loss of Rs62 crore from a net profit of Rs18 crore in FY22.

The company is expecting to post Rs 1,200-1,300 crore revenue and Ebitda of Rs 350 crore this financial year.

The Carlyle acquisition has also fuelled aggressive marketing and promotions by VLCC while part of the infused funds has been utilised to deleverage the balance sheet. The group has repaid higher cost term loans and reduced its working capital limit utilisation, resulting in better limit buffers and liquidity position, ICRA said in a report last year.

However, unorganised smaller players remain a robust challenge for the sector. Newer global and local brands are also taking a swipe at legacy brands like VLCC while retailers like Reliance, Nykaa, Shoppers Stop, and the Tata group are aggressively pushing products and promotions, making beauty retail a playground for large corporates.

As per industry analysts, VLCC’s competition is more intense in the products division where it has to compete with FMCG giants like Unilever, Marico, and Loreal along with D2C brands while simultaneously focussing on new product developments.

India’s beauty and personal care market is projected to touch $30 billion by 2027, accounting for about 5% of the global market, according to a report by Redseer Strategy Consultants along with Peak XV.

The beauty market in India is currently under-penetrated. Online sales are also capturing a growing share of India’s BPC market, with projections indicating a $10 billion market by 2027, accounting for roughly a third of the overall market.