Global private equity firm TPG Capital is in advanced stages of discussions to acquire a significant minority stake in Dr Agarwal’s Health Care Limited, which owns India’s largest chain of eye care hospitals Dr Agarwals Eye Hospital, said multiple people aware of the developments.

TPG is likely to acquire about 40% stake in Dr Agarwal’s Health Care, including a 32% stake held by existing investor ADV Partners and additional primary capital deployment, one of the sources said.

The deal will value Dr Agarwal’s at ₹2,200 crore, or about $300 million, the person said.

The investment will be made through the PE’s growth equity platform TPG Growth, sources said.

Spokespersons with Dr Agarwal’s and TPG declined to comment, while mails sent to ADV Partners did not elicit any response till press time on Tuesday.

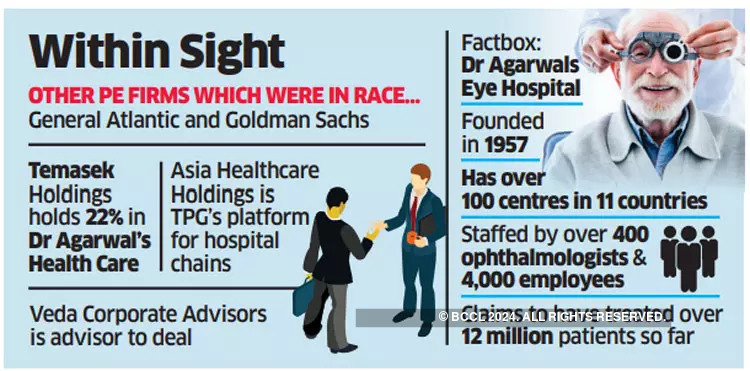

Chennai-based investment bank Veda Corporate Advisors is the advisor to the transaction, sources said. Private equity firms General Atlantic and Goldman Sachs, too, were in the race for the eye hospital chain, said one of the people cited above. Singapore state investment firm Temasek Holdings holds about 22% stake in Dr Agarwal’s Health Care. Promoter group Dr Agarwal family currently holds about 45% stake in the company.

Founded by Dr Jaiveer Agarwal in 1957, Dr Agarwals Eye Hospital is the largest network of eye care centres in the country with more than 100 centres across India and 10 other countries. Its facilities are staffed by a team of over 400 ophthalmologists and 4,000 employees. The chain is claimed to have treated over 12 million patients so far.

Dr Agarwal’s Health Care is estimated to record a revenue of ₹750 crore in the current fiscal with an Ebitda of ₹150 crore.

Marking its entry into Maharashtra, Dr Agarwals Eye Hospital last month acquired Mumbai-based Aditya Jyot Eye Hospital. The chain plans to invest ₹1,000 crore to increase its footprint pan-India to 200 hospitals, including over ₹300 crore in Maharashtra to set up 20 eye hospitals across the state in the next three years.

Hong Kong-based private equity firm ADV Partners (ADV) bought into Dr Agarwal’s in 2016, by investing around $45 million (₹305 crore) and acquiring the stake held by existing investor Evolvence India.

Life Sciences-focused private equity fund Evolvence India Life Sciences was an early investor in Dr Agarwal’s, with a ₹60-crore investment in 2012. In 2019, Dr Agarwal’s had raised ₹215 crore from the UK government-owned CDC Group in the form of structured debt.

New Delhi-based Centre for Sight, Medfort Maxivision Group, and Eye-Q Vision are the other major PE-backed players in the eyecare space. There are not-for-profit chains such as Aravind Eye Care and Sankara Nethralaya as well.

TPG Growth is an active player in the Indian healthcare sector through its healthcare platform Asia Healthcare Holdings (AHH).