The telecom regulator on Friday recommended changes to the merger & acquisition (M&A) rules with an aim to speed up deal closures and reduce legal disputes.

The Telecom Regulatory Authority of India (Trai) has suggested that in case of a judicial intervention on the issue of one-time spectrum charge (OTSC) in M&A deals, the ”transferor” or seller entity and not the ”transferee” (read: buyer) should give a bank guarantee, equivalent to the demand raised by the Department of Telecommunications (DoT).

Mahesh Uppal, director at Com First (India) and an expert on spectrum regulatory matters, said: “Trai’s suggestion if accepted by the government, could speed up closure of M&A deals and reduce the likelihood of disputes between the company acquiring a telco and the government as the acquired spectrum would be unencumbered”.

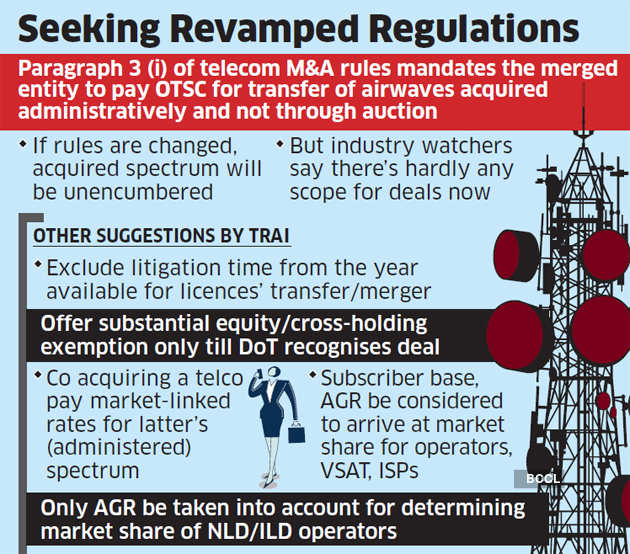

Paragraph 3 (i) of telecom M&A rules has been a major bone of contention as it mandates the merged entity to pay the government an OTSC for transfer of airwaves that were acquired administratively and not through an auction.

Trai’s recommendations though come at a time when the financially-stressed telecom industry has already shrunk from over 10 players to just three — Bharti Airtel, Reliance Jio and Vodafone Idea — after competitive pressures forced smaller telcos to exit and others to merge with each other.

Ex-VSNL chairman B K Syngal, now senior principal at Dua Consulting, said: “Trai’s suggestions come to a trifle too late when the scope for fresh M&As has drastically reduced, given that the sector is virtually staring at a private duopoly, given the uncertainty around Vodafone Idea surviving the AGR shock”.

Syngal though said the recommendations could hold “some relevance if there are takers for Vodafone Idea,” going forward, as “putting the onus on the seller to resolve OTSC dues should encourage “potential buyers to drive another round of consolidation for what it’s worth”.

EASING THE WAY

Trai also suggested that the one-year window available for transfer/merger of licences in different service areas, post-approval of the National Company Law Tribunal (NCLT), should exclude the time spent by telcos in pursuing any litigation. At present, protracted litigations have tended to delay final approvals for M&As.

Industry experts said Trai’s suggestion would also protect the rights of telcos to pursue legal remedies and ensure the one-year span doesn’t become redundant for no fault of companies on account of pendency of an issue before a court.

The sector regulator has also recommended modification of a provision in the M&A rules that offers exemption from substantial equity/cross-holding clause for a period of one year or more,” saying such exemption should be available “only for a period till transfer/merger of licence is taken on record by the DoT”.

Further, Trai has reiterated its earlier recommendation that if a transferor company holds (administered) spectrum assigned against an entry fee, the resultant entity should be liable to pay market-linked rates for the excess spectrum held by telco.

“The transferee company/resultant entity should be liable to pay the differential sum for spectrum assigned against an entry fee paid by the transferor company, from the date the DoT approves the merger,” the regulator said.

But it has suggested that while raising demand for payment of the differential sum, DoT ought to compute “the tentative demand from the date of NCLT approval”. It added that on grant of merger approval, the actual demand of differential sum be re-calculated based on the date of grant of approval.

Trai has also recommended that both subscriber base and adjusted gross revenue (AGR) be considered to arrive at market share for mobile,, VSAT and internet service providers. By contrast, it has suggested that only AGR be taken into account for determining the market share of national and international long-distance service operators.

Source: Economic Times