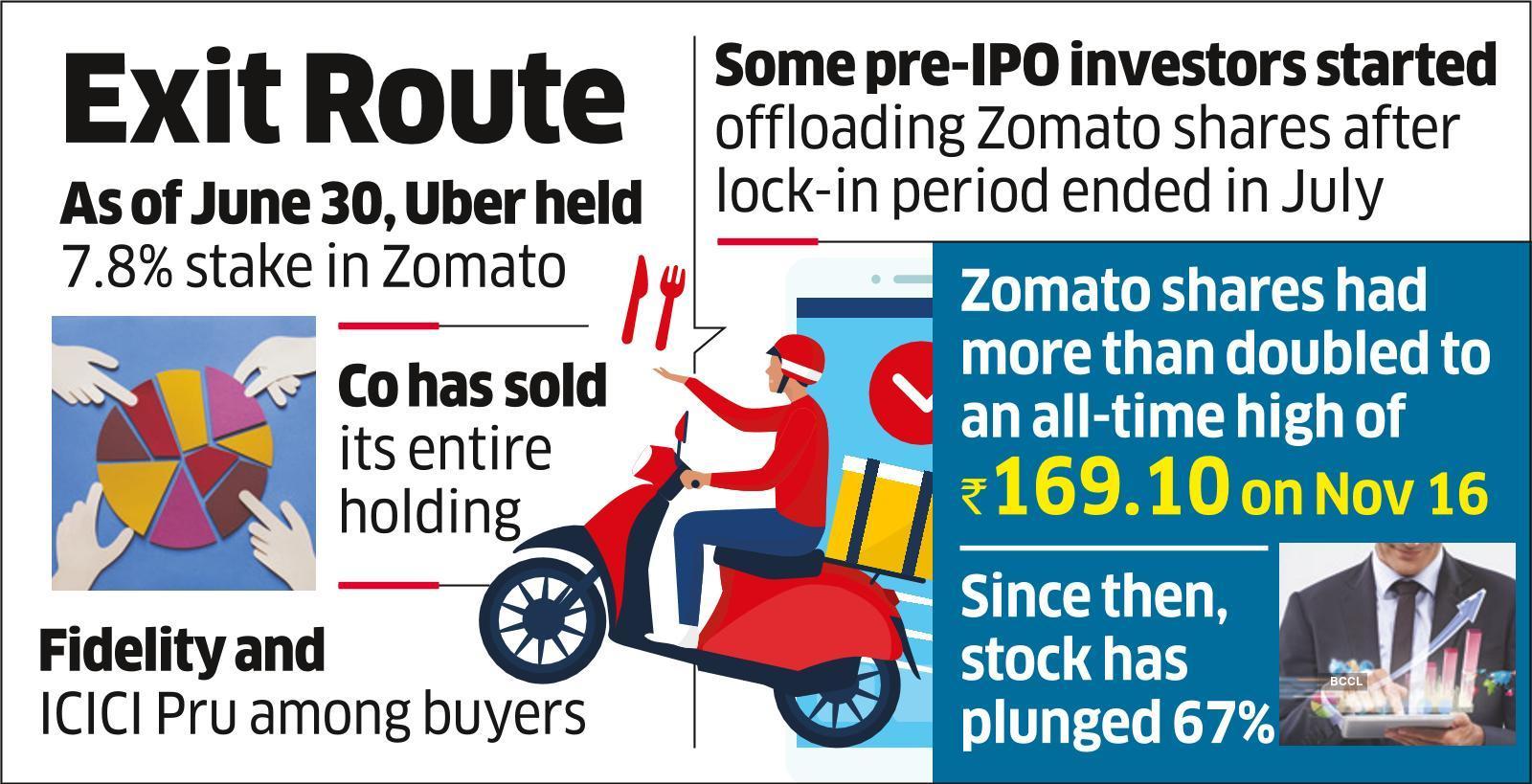

Uber Technologies exited its entire 7.8% stake in food delivery platform Zomato by selling 612 million shares through multiple block deals on Wednesday.

The American mobility service provider raised around ₹3,088 crore or $390 million at nearly 100% profit. In January 2020,

had acquired Uber Eats’ India operations in a non-cash deal, following which Uber received a 9.19% stake in the restaurant discovery platform for around $200 million.

While Fidelity Emerging Markets Fund bought 54.4 million shares, ICICI Prudential Life Insurance Company acquired 45 million shares. The names of the other buyers weren’t known.

According to stock exchange data, the deals were executed at an average ₹50.44 apiece, a 34% discount from last year’s initial public offering (IPO) price of ₹76. The sale price had been fixed at a range of ₹48-54, a 2.8-13.6% discount to Tuesday’s closing price of ₹55.55.

Zomato’s shares fell nearly 10% intraday to ₹50.25 and ended flat at ₹55.40 on Wednesday.

Co’s Q2 Losses at $2.6b

Shares of Zomato plunged to an all-time low of Rs 40.55 on July 25 after the lock-in period for pre-initial public offering shares ended. Some pre-IPO investors sold shares after the lock-in period. Moore Strategic Ventures sold 42.5 million shares at Rs 44 apiece on July 26, less than its purchase price. Moore’s investment in Zomato was Rs 191 crore and the sale value was Rs 187 crore.

Zomato had a blockbuster listing on the Indian stock exchanges in July last year and its shares more than doubled to an all-time high of Rs 169.10 on November 16. Since then, the stock has plunged 67%. Zomato’s market capitalisation stood at Rs 43,655 crore on Wednesday, compared with Rs 1.26 lakh crore in November last year. The stock’s current market cap is below its previous private valuation of $5.5 billion. Uber’s earnings report on Tuesday said it had suffered an unrealised loss of $245 million during the second quarter and $707 million in the first half of 2022 on its investment in Zomato. The ride-hailing company’s total losses for the second quarter stood at $2.6 billion, of which $1.7 billion were related to equity investments and aggregate unrealised losses associated with the revaluation of its stakes in US-based self-driving tech company Aurora, Indonesian ride-hailing firm Grab, and Zomato.

During an investor call on Tuesday, Zomato chief financial officer Akshant Goyal said the company had an internal milestone of hitting adjusted ebitda (earnings before interest, tax, depreciation, and amortisation) breakeven at a group level by the final quarter of the current financial year or latest by the second quarter of the next financial year (FY24).

In February, Zomato said it would invest $400 million in the quick commerce segment over the next two years. It revised the allocation on the call on Tuesday. It recently acquired Blinkit in an all-stock deal for Rs 4,447 crore.

Source: Economic Times